Resources Top 5: High grade gold discoveries and another ‘landmark’ junior lithium deal

Pic: Bec Parsons, The Image Bank/ Via Getty Images

- Askari inks agreement with $US1bn Chinese company to develop AS2’s lithium assets

- Strickland hits additional shallow, high grade gold at new Wanamaker discovery

- $165,000 WA government grant will go toward drilling Bryah’s big copper-gold targets

Here are the biggest small cap resources winners in early trade, Thursday October 20.

ASKARI MINERALS (ASX:AS2)

The junior explorer has inked an agreement with $US1bn Chinese company Zhejiang Kanglongda to develop AS2’s lithium assets in WA and the NT.

While Zhejiang Kanglongda mainly makes and sells protective gloves, it recently moved to 51% ownership of a local Chinese lithium chemicals producer called Jiangxi Tiancheng.

Today’s announcement was light on terms, but AS2 says the partnership will create a pathway for the rapid development of its Australian lithium assets, in which case Zhejiang Kanglongda will be given a preferred offtake position.

The Chinese company will also assist AS2 with lithium chemical downstream processing techniques and opportunities “as well as provide access to capital for future development”.

“The lithium partnership agreement with Zhejiang Kanglongda signifies a landmark agreement for the Company and validates the potential of our lithium projects within the Northern Territory and the Eastern Pilbara region,” AS2 exec director Gino D’Anna says.

“Our aggressive exploration mandate has enabled us to delineate areas of high-priority and we are rapidly planning the re-commencement of field activities at our lithium exploration projects, including the recently acquired Myrnas Hill lithium project.”

AS2 is also investigating commercialisation strategies for its copper and gold projects within Australia, including a spin-out, so it can focus on lithium.

The $20m market cap stock is up 100% in 2022.

STRICKLAND METALS (ASX:STK)

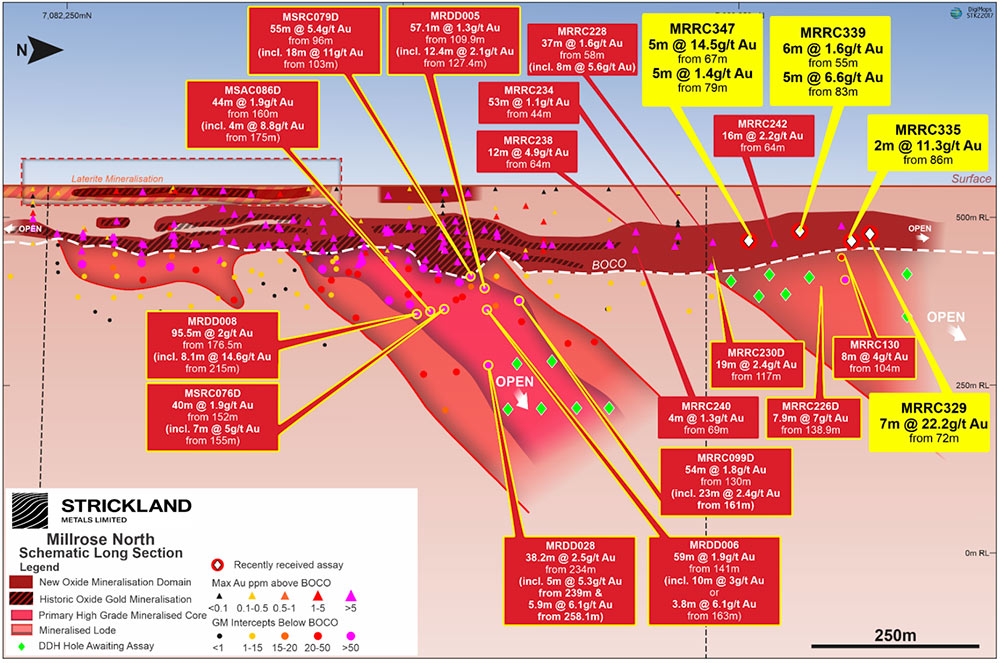

The explorer hits more shallow, high grade gold at the new Wanamaker discovery, part of the Millrose project in WA.

New oxide gold results include 5m @ 14.5g/t from 67m and 5m @ 6.6g/t Au from 83m, in two separate holes.

The first of these is ~200m away from the hit of 7m at 22.2g/t announced earlier this week.

Wanamaker is shaping up as a very exciting high-grade discovery 250m north of the historic 346,000oz Millrose resource, STK CEO Andrew Bray says.

The oxide mineralisation footprint now successfully links Millrose and Wanamaker, for an overall strike length of 3.2km “with further extensions to the north expected from future drilling”.

“The results from MRRC347 (5m @ 14.5g/t Au from 67m) and MRRC339 (5m @ 6.6g/t Au from 83m) further contribute to the incredibly exciting story continuing to unfold at Wanamaker,” Bray says.

“A number of additional assays are pending from Wanamaker, targeting both oxide and primary mineralisation.

“Two further step out holes to the north of MRRC329, designed to test for extensions to the bonanza gold mineralisation, have been drilled with results expected in the coming weeks.

“Additionally, seven diamond tails have been completed which were designed to test for plunge extensions to the previously intersected fresh rock mineralisation.”

The results from the Wanamaker drilling will feed into an updated mineral resource, which STK plans to release to the market in Q1 2023.

R3D RESOURCES (ASX:R3D)

The small copper play has appointed current board member and major investor Jihad Malaeb as chairman, who will also provide a $500,000 unsecured loan to the Company “on attractive terms”.

Subject to shareholder approval, that $500,000 will become convertible into shares at $0.15c – over an 85% premium to yesterday’s close.

It’s also a good deal for Malaeb, who will be paid $50,000 per annum as chairman, and an additional $110,000 per annum for “additional management and advisory services”.

R3D says Malaeb is an experienced entrepreneur across several industries including hospitality, construction, and mining.

The company recently increased resources by x4 at its Tartana project in QLD to 11,265t of contained copper – enough to underpin “several years of copper sulphate production”, it said.

The company is targeting first production in December 2022.

R3D aims to produce 6,000 to 7,000tpa of copper sulphate from Tartana, alongside a low-grade zinc furnace slag/matte from its Zeehan project in Tasmania.

These two projects have the potential to generate a cash flow to underpin the R3D’s extensive exploration activities in the Chillagoe region of QLD, it says.

The $10m market cap stock is down 38% year-to-date.

BRYAH RESOURCES (ASX:BYH)

A $165,000 WA government grant will go toward drilling some big copper-gold targets at Aquarius, part of the Bryah Basin project in central WA.

The 2,500m RC program is hunting for volcanogenic massive sulphide (VMS) deposits, like Sandfire’s (ASX:SFR) nearby DeGrussa company maker, and the historical Horseshoe Lights mine.

VMS deposits are rich in base and precious metals like copper, zinc, lead, gold, and silver.

Because these deposits tend to ‘cluster’ together, VMS camps can often be mined for a very, very long time.

The exploration targets which are the focus of this EIS grant target the same stratigraphic position as the Horseshoe Lights deposit, BYH says.

“Our geological team have again successfully submitted an excellent EIS proposal which reflects our increased understanding of the Bryah Basin and potential targets,” CEO Ashley Jones says.

“Receiving further support from the WA Government through the EIS co-funded drilling program is a major benefit for Bryah shareholders and further validates Bryah’s exploration strategy.

“The grant covers up to 50% of the drilling costs. We are excited to keep expanding our targets in the Bryah basin and executing drilling to find the next discovery in the region.”

TOMBADOR IRON (ASX:TI1)

(Up on no news)

It appears the high-grade Brazilian iron ore producer is having some good conversations at the South-West Connect ASX Showcase in WA, where it is due to present this arvo.

In September, TI1 declared a maiden full year profit of $3.5m on revenues of $32.6m, which came amidst “the extremely volatile environment that gripped the iron ore market with huge price fluctuations, persistent decade-high dry bulk freight rates, an energy crisis, market disruption in Europe and global inflationary pressures”.

It rewarded investors with a 28c divvy.

“We are delighted to reward our shareholders with a maiden dividend which signals our belief that Tombador’s operations underpin a long-term and financially robust mining business, subject only to iron ore market price conditions,” CEO Gabriel Oliva says.

“We have ramped up to already deliver the 1.2mtpa production rates outlined in the PFS during the FY 2022 year and, subject to prevailing market conditions we plan to deliver more product to European steel mills and into the Brazilian steel industry in the year ahead in FY 2023.”

The company’s balance sheet currently holds net assets of $35.0m, including $29.4m in cash and $9.8m in inventory valued at cost.

The $71m market cap stock is down 10% year-to-date.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.