Resources Top 5: GT1 soars on $8m lithium supply chain deal and Koba samples 7.48% yellowcake at Harrier

Our top gainer is getting deals done in the lithium space today. Pic: Getty Images.

- Massive premium sends GT1 soaring on $8m funding and partnership deal with Korean battery materials manufacturer EcoPro

- Koba rises on 7.48% U3O8 rock chips at Harrier

- Celsius secures crucial mining deal for Philippines copper project

Here are the biggest small cap resources winners in morning trade, Tuesday, August 20. Prices accurate at time of writing.

Green Technology Metals (ASX:GT1)

GT1 has secured $8m of investment at a 40% premium to the 90-day VWAP from South Korea’s EcoPro – a leading producer of nickel-rich cathode materials for EV and energy storage lithium-ion batteries.

That puts the placement at 12.5c a share and is a sign of confidence in the explorer’s plans to develop its Seymour and Root lithium operations and proposed processing and refinement facilities in Ontario, Canada.

It also gives a little hint of the green shoots battery materials players see in the EV and energy storage supply chain beyond the currently depressed lithium market.

Funding proceeds will go to supporting a DFS on the 10.1Mt at 1.03% Li2O Seymour lithium project, where extensional drilling is underway, and a PFS for the planned lithium conversion facility.

On top of the funding, binding agreements have been made for GT1 and EcoPro to negotiate agreements for both Seymour and Root that include the latter acquiring an initial 10% interest in each project, with the option to acquire a further 25% at the FID stage for Seymour and DFS for Root.

There’s also JV rights and a separate offtake agreement to acquire future concentrate from the projects.

Shares in GT1 shot up 32.8% to trade at 8.5c at time of writing.

Koba Resources (ASX:KOB)

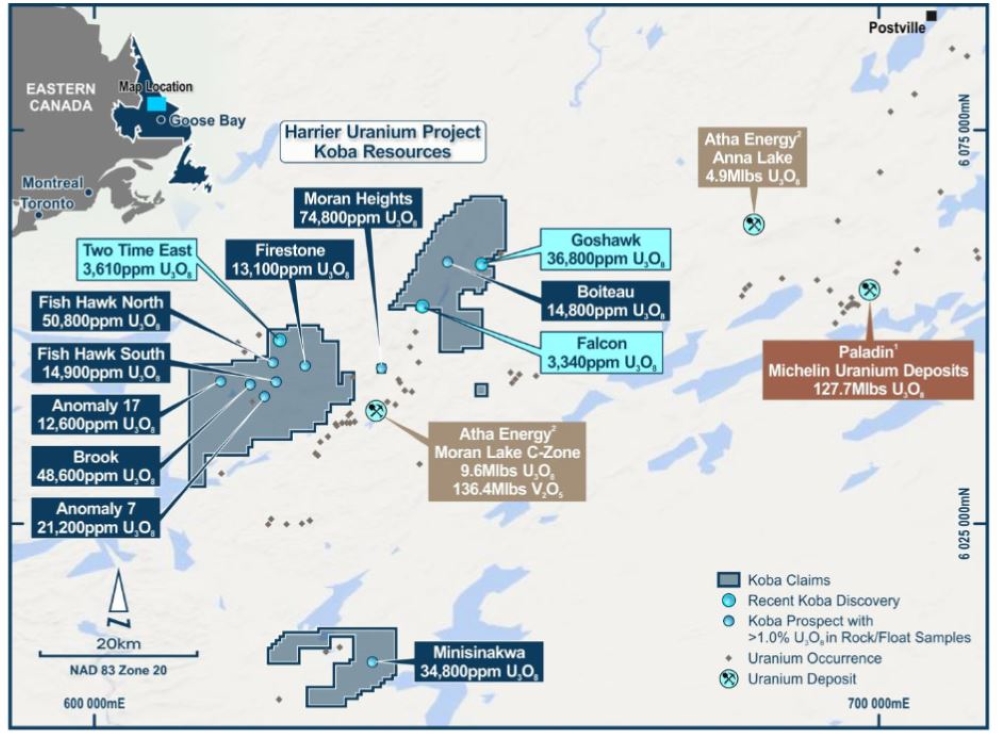

Rock chip assays from KOB’s Harrier uranium project in Eastern Canada have returned grades of up to 7.48% U3O8.

The numbers are indeed impressive, yet grades from rock chips are often just precursors to identifying what mineralisation may lie beneath the surface.

Regardless, it bodes well for future exploration and Harrier is in good company, sitting west of Paladin Energy’s (ASX:PDN) Michelin deposit in Newfoundland and Labrador, which has a proven 127.7Mlbs U3O8 resource.

Prices of yellowcake are on the rise, with a significant doubling from $47.75/lb up to $84.25/lb in the last two years due to demand for clean sources of baseload energy and a global shortfall for nuclear utilities, which paused contracting for years as low spot prices enabled them to pick up cheap material on the open market. They’re now short, with a noteworthy deficit last year of around 60Mlb.

While still in early doors exploration at Harrier, KOB says the demonstrated presence of widespread, very high-grade uranium mineralisation across its underexplored 489km2 project indicates potential to make a significant discovery.

“These values are extremely high on a global scale and provide us considerable encouragement as we continue to advance exploration at Harrier,” KOB CEO Ben Vallerine says.

“In addition to confirming the high-grade nature of our existing prospects, we are very excited to have discovered high-grade mineralisation at three new prospects including the Goshawk project, where assays up to 3.68% (36,800ppm) U3O8 have been returned from a previously unexplored area.”

Harrier is the second uranium project to go on the books for KOB this year, striking a deal to acquire the Yarramba project in South Australia in January with Havilah Resources (ASX:HAV).

KOB can earn in up to 80% of the project and has kicked off an 11,000m drill campaign to expand the contained 8.2Mt at 260ppm U3O8 for 4.6Mlb Oban deposit.

Shares in the $23.8m market-capped explorer is up 20% on the news and 50% in the last week, swapping for 15c.

Corella Resources (ASX:CR9)

CR9 is making gains today after securing Trailblazer funding from Canberra for the development of its 24.7Mt Tampu kaolin-HPA project in WA.

The ressie says the Trailblazer program, combined with potential state funding and its own $125,000 contribution allows for a fast-tracked six-month research and development program for Tampu worth over $500,000.

The resource, CR9 says, is suitable for use as high-purity alumina feedstock.

HPA is listed as one of Australia’s 31 critical minerals and together with the R&D, the explorer is looking to accelerate PFS and DFS studies to reach a final investment decision for the HPA portion of the project.

Construction of a pilot plant for the HPA is pegged to kick off early next year and CR9 says the kaolin half of the resource could also deliver a base profit margin too.

Speaking to Stockhead last month, CR9 CEO Jess Maddren said there will always be a market for kaolin.

“If you have good pharmaceutical grade kaolin, which we do, it delivers a compound annual growth rate of 5-6% averaged across all the industries kaolin is used in,” Maddren says.

“There are some very specialised uses of kaolin that you can get up to 10% CAGR, which is great, and that is going to produce our base case industrials business.”

Shares in the $5.7m market-capped junior shot up 40% on the news to 0.7c.

Celsius Resources (ASX:CLA)

(Up on no news)

CLA has obtained a mineral production sharing agreement with the Philippines government earlier this year for its flagship Maalinao-Caigutan-Biyon (MCB) copper project which gives the company a 25-year lease for exploration and development.

MCB contains a 338Mt at 0.47% copper and 0.12 g/t gold resource for a contained 1.6Mt copper and 1.3Moz of gold.

A 2021 study highlighted a post-tax NPV8 of US$464m and an IRR of 31% at an assumed copper price of US$4/lb and gold price of US$1695/oz, both below current spot prices, with gold recently cresting record highs of US$2500/oz.

It was key step for Celsius in its planned transition from explorer to developer.

“The grant of the MCB mining permit marks the progression of Celsius from being known as an exploration company to a mineral resource developer, and eventually a mine operator,” CLA director Peter Hume says.

The explorer is up 16.7% to trade at 1.4c a share.

Javelin Minerals (ASX:JAV)

(Up on yesterday’s news)

Compelling gold-copper targets were announced yesterday at JAV’s Coogee deposit, which is right next door to the world-class St Ives gold field in WA.

Run throughs of historical data from previous exploration work has cropped up numerous targets for the explorer to sink its teeth into, including a large, untested magnetic anomaly 300m from the Coogee pit.

Little to no previous drilling has been conducted and JAV reckons it’s on track to start drilling the new targets next quarter and is cashed up to do so after a raising $1.25m last month.

The $8.5m market-capped minnow has bounced 100% on trade this morning to trade at 0.2c per share.

At Stockhead we tell it like it is. While Corella Resources, Green Technology Metals, Javelin Minerals, Celsius Resources and Koba Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.