Resources Top 5: Gold hits, helium sales and mine approvals win the morning

Approvals and gold hits have sent small cap ressies up today. Pic: Getty Images.

- Ordell hits shallow high-grade gold at Barimaia

- Western Gold shovel ready for Gold Duke after mining approval

- Blue Star balloons on rubber-stamping a 50% farm-out of Galactica/Pegasus helium project

Here are the biggest small cap resources winners in morning trade, Monday, November 4. Prices accurate at time of writing.

Ordell Minerals (ASX:ORD)

ORD is being heavily traded today and up a whopping 68% after revealing a 29m intercept containing 2.52g/t gold from Phase 2 RC drilling of the McNabs East prospect at Barimaia near Mount Magnet in WA.

That was the best hit, yet gold was also shown across multiple drill holes that have now defined an extensive >1000m open strike at shallow, typically <80m depths.

McNabs East makes up part of a 2.5km-long strike that was defined by Genesis Minerals (ASX:GMD). ORD bought GMD’s 80.2% interest in Barimaia back in May prior to its $6m July ASX IPO.

ORD is headed by Michael Fowler, the former MD of Genesis, so there’s a good bet the company is pretty familiar with its flagship gold project that counts several gold deposits and processing plants nearby.

Baramaia is adjacent to Ramelius Resources’ (ASX:RMS) Mt Magnet, 70km from Spartan Resources’ (ASX:SPR) Dalgaranga and 80km from Westgold Resources’ (ASX:WGX) Tuckabianna mill. Ordell sees geological similarities to Ramelius’s 1.2Moz Eridanus discovery.

“We have now completed over 5000m since we listed on the ASX in July, with the results from this drilling showing clear potential for shallow open pits at Barimaia,” Fowler says.

A diamond drilling program is planned for this month to confirm the orientation of the high grade hit.

ORD is planning further extensional and infill drilling in the coming months.

Western Gold Resources (ASX:WGR)

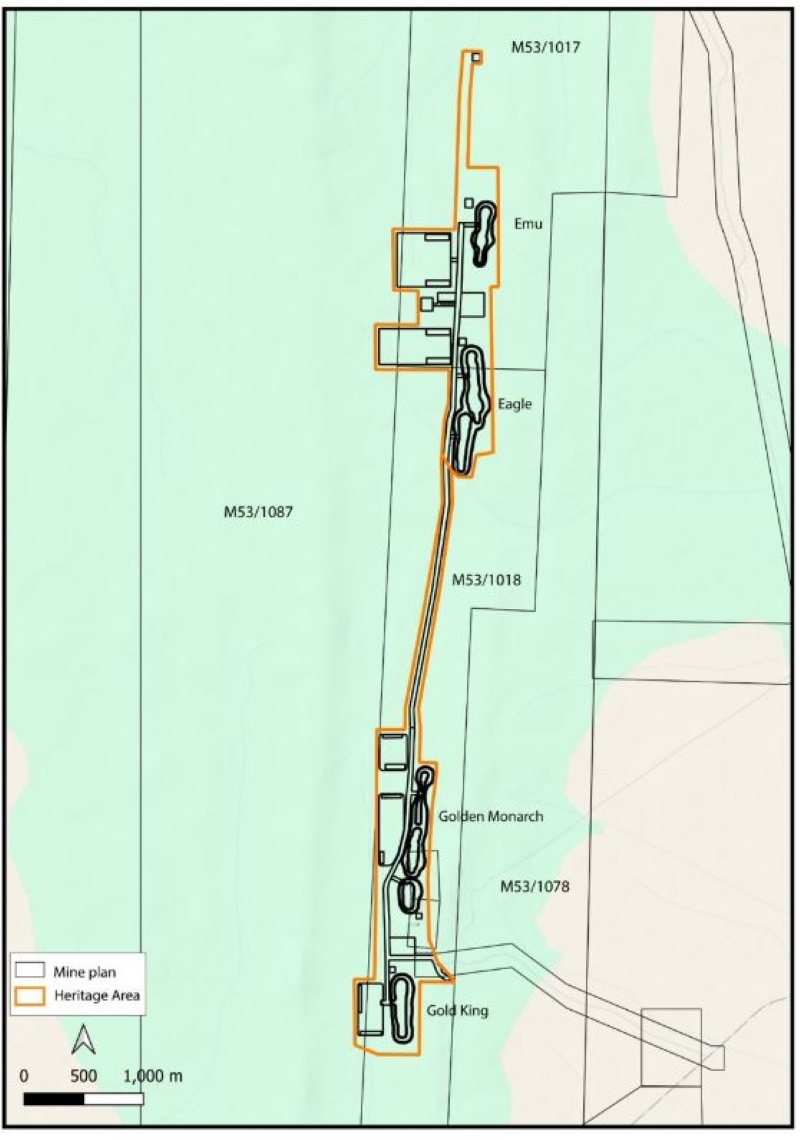

WGR is on a tear today, up >30% after WA’s mines department DEMIRS granted final mining approvals for the Gold King deposit, part of its Gold Duke project in WA’s north-east Goldfields.

That means all four deposits at the project – the Eagle, Emu, Golden Monarch and now Gold King pits – are shovel-ready for first-stage production that will focus on a contained 178,000oz of gold, 51% of Gold Duke’s total resource.

A recent study highlighted a production target of 447,000t at 2.55g/t for 34,000oz as part of the first stage that will generate a cash surplus of ~$38.1m at $3500/oz gold– a figure set to significantly rise as that’s well below the current $4150/oz Aussie gold price.

The reason for mining just a portion of the asset? WGR says it’s to minimise upfront capex (which it projects to be just $6-7.2m over a 12-month mine life) and will utilise operational cashflow to self-fund mining and feed into nearby processing facilities.

Goldies are increasingly using nifty JV models, contractor equity agreements and third-party processing deals for small gold deposits lately, especially with bullion prices punching through all-time highs.

READ MORE: Driller and dealers: The bold contractor you’ve barely heard of growing WA’s exploration scene

The near-term miner says it’s in a strong position to advance into production, is investing in treatment options and is in discussions with multiple nearby plants.

It’s also going to update Gold King’s MRE and use its projected cash surplus to continue exploration and development across its tenure.

Blue Star Helium (ASX:BNL)

BNL has signed off on the farm out of its 50% interest in the Galactica/Pegasus project in Colorado, USA, to Helium One Global for US$1.5 million, plus US$2.7m free carry.

Helium demand is set to increase from 6Bcf annually to 8.5Bcf by 2030, production of the finite gas is becoming ever-more lucrative.

As part of the free carry deal, London-listed Helium One will also fund drilling of six development wells on top of the already producing State 16 well for gas gathering into the Galactica helium production facility.

The move comes on the back of drilling permits being rubber-stamped by the Colorado Energy and Carbon Management Commission via an Oil and Gas Development Plan.

The wells are being funded to a cap of US$450,000 each and drilling is expected to kick off during this quarter, aiming for first helium production from Galactica/Pegasus from H1 2025.

Altech Batteries (ASX:ATC)

(Up on no news)

Run by all-things-lithium boffin Iggy Tan, who also sits on the board of Lithium Universe (ASX:LU7), ATC shares have jumped a sizeable 21.7% in early trade today without any disclosure to the market.

Last we heard, ATC – which is driving the development of its lithium-ion Silumina anodes battery material tech – made a breakthrough 55% surge in in energy capacity.

The proprietary technology involves the blending of alumina-coated silicon particles (10%) with battery-grade graphite to create a composite graphite/silicon anode for the lithium-ion battery electrode.

The company says the tech has the potential to be a game-changer for the EV market after demonstrating that silicon particles can be modified to resolve capacity fading issues back in October and is racing to get it into the market.

At the same time, ATC is planning the construction of its 120MWh CERENERGY solid state sodium chloride battery plant in Germany, another game-changing energy solution that uses regular old table salt, reducing battery costs by up to 50%.

Tan’s ATC recently raised $6.47m and signed a strategic offtake LOI for 30MWh of energy storage a year with Zweckverband Industriepark Schwarze Pumpe from the plant which is pegged to start production from mid-2027.

Yandal Resources (ASX:YRL)

(Up on Friday’s news)

YRL’s share price is up over 340% in the past month, including another 20% today as follow-up drilling kicks off at the emerging Siona gold discovery looking to confirm and test the extent of mineralisation.

A 12-hole, 2500m RC drill program will test current intercepts of 78m at 1.2g/t from 96m to end of hole at one of its best hits to-date at the project’s New England Granite prospect.

With $3.8m cash on hand to further exploration YRL says it’s in a strong position to grow Siona.

The timing of this discovery is exciting given the current gold price setting.

“Significantly, this result validates the revised targeting modelling developed following the completion of the Exploration Incentive Scheme (“EIS”) diamond drilling earlier this year, which implies that there could be several similar structural settings comparable to Siona present across the broader New England Granite area,” YRL MD Chris Oorschot said.

At Stockhead we tell it like it is. While Altech Batteries, Lithium Universe and Blue Star Helium are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.