Resources Top 5: Firetail heats up on Canadian copper, zinc ‘n’ silver project gain

Pic via Getty Images

- Firetail Resources double bags intraday gains as it moves into Newfoundland, rich in copper, zinc and silver mineralisation

- Adavale Resources has news regarding a uranium target at the Marree Embayment Project in South Australia

- Meanwhile Dreadnought Resources, Brazilian Rare Earths and European Lithium are all in the fast-gains lane, too

Here are some of the biggest resources winners in early trade, Thursday June 6.

Firetail Resources (ASX:FTL)

Battery metals hunter Firetail is spreading its wings into a copper-zinc-silver project in Newfoundland, Canada and is soaring more than 115% on the news at the time of writing.

The company has announced it’s set to acquire up to 80% of the York Harbour project via a staged earn-in agreement.

York Harbour is a Cyprus-style volcanogenic massive sulphide (VMS) exploration project, and it’s situated 180km west-south-west of FireFly Metals’ (ASX:FFM) Green Bay copper project, which currently hosts a high-grade copper resource of 39.2Mt at 2.1% for 811,000t CuEq.

Historical underground production at the site – waaaay back between 1898 and 1913 – resulted in 100,000 tonnes mined at 3-12% copper, 7% zinc and 1-3oz/t silver.

Shallow exploration to less than 300m has only ever been completed in the area, with exploration so far limited to the old York Harbour mine and the Number 4 Pond target. Multiple intercepts of note have included: 29.0m at 5.25% Cu, 9g/t Ag from 147m; and 3.24m at 9.54% Cu, 3.5% Zn, 10g/t Ag from 167.8m.

#ASXNews$FTL.AX has executed a Binding Option Agreement for the acquisition of up to 80% of York Harbour #Copper–#Zinc–#Silver Project in Newfoundland, Canada, via a staged earn-in.

York Harbour is a Cyprus-style #VMS exploration project.https://t.co/0qHhefxkub#FTL #ASX pic.twitter.com/dbLcZR0gA7

— Firetail Resources (@FiretailRes) June 6, 2024

In addition and connected to the acquisition, Firetail is planning to raise approximately $1.57m (before costs) by way of a placement to strategic investors together with a non-renounceable entitlement issue to existing eligible shareholders.

Firetail’s non-exec director Simon Lawson said:

“The [York Harbour] project is an advanced high-grade copper-focussed opportunity for Firetail to get involved in at just the right time.

“The previous history of copper mining at the project and a number of existing significant copper-zinc-silver drill hits makes this a “walk-up” project of excellent exploration potential.”

Read more > here

Adavale Resources (ASX:ADD)

Adavale has also been climbing today after announcing that exploration at its Marree Embayment Project (MEP) has identified a significant new area for uranium deposition that will be a priority drill target for the company.

The company has revealed it’s delivered positive results from its initial exploration program in the Mundowdna area, now part of the MEP. The findings reveal a promising new uranium deposit zone, marked by several surface features and anomalies.

Adavale says the discovery will be a key drilling target as it expands its focus on uranium exploration in South Australia and the data collected will guide future exploration efforts in the region.

ADD’s executive director David Riekie said:

“The positive outcomes generated by our maiden, multi-technique exploration program indicates a uranium-rich paleo drainage system.

“What is most exciting is that collectively this data has now identified a significant basement structure at depth that appears to be a large trap site for the ancient uraniferous groundwaters washing/shedding from the adjacent Flinders Ranges.

“This area of the Marree Embayment will be a priority uranium exploration focus. Most pleasing is this basement structure does not appear to have been previously recognised or drilled.”

#ASXNews$ADD.AX returned positive results for the maiden Mundowdna exploration program on EL6821 & EL6957, at the Marree Embayment Project. #ADD‘s results identified a #uranium deposition area that will be a priority drill target.https://t.co/bCYofZBsik#ASX pic.twitter.com/smirilVvz2

— Adavale Resources Limited (@AdavaleL) June 6, 2024

Brazilian Rare Earths (ASX:BRE)

BRE does what it says on the tin. It’s hunting for rare earths. In Brazil.

It’s up a goodly amount today on the discovery of “ultra-high” grade REE-Nb-Sc-U at its Sulista project, located ~80km southwest of its Monte Alto project.

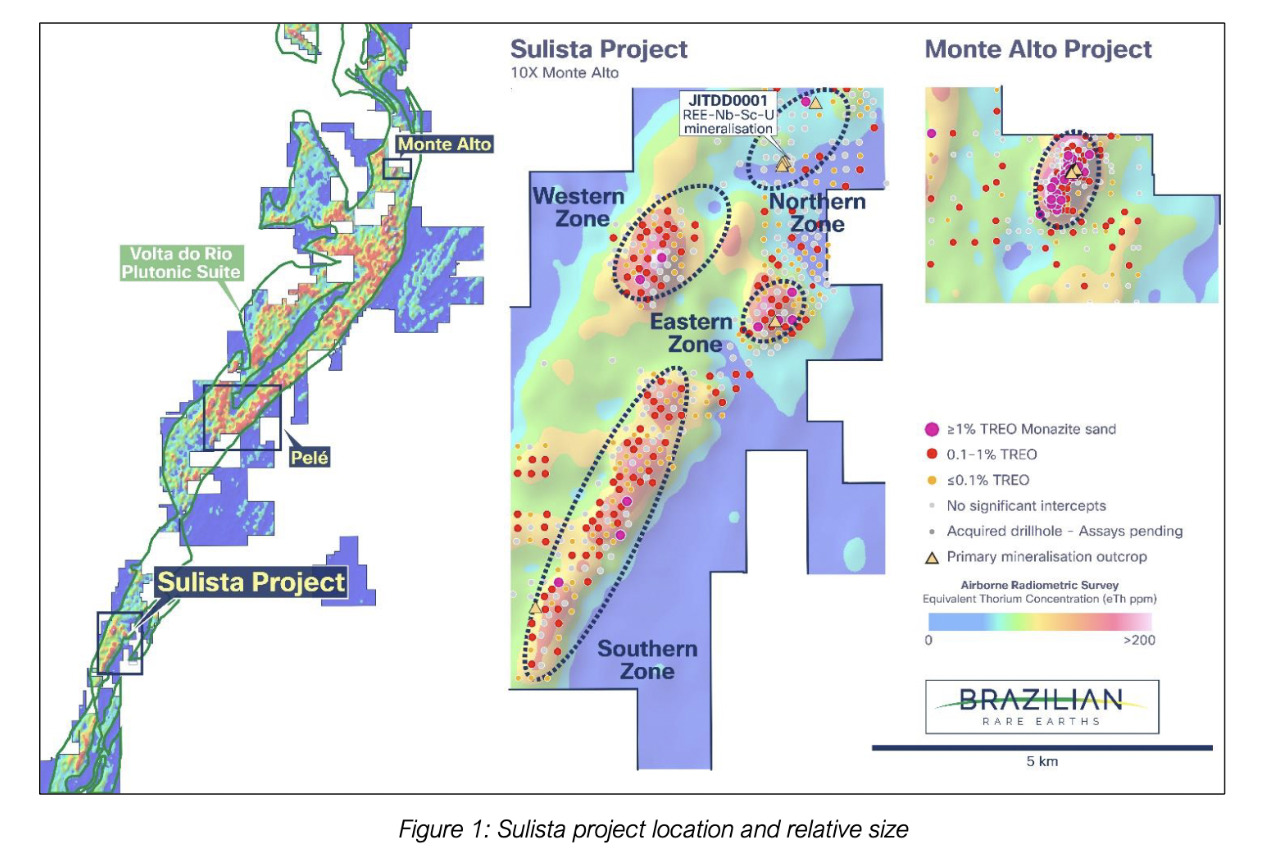

Sulista is a “district-scale exploration” operation with a total tenement package over 10x the size of the Monte Alto project and a total exploration area of ~10km by ~5km.

The rare earth grades discovered measure up to 22.4% TREO.

BRE is talking “exceptional” REE-Nb-Sc-U grades of up to 39,770 ppm NdPr, 1,579ppm DyTb, 4,821ppm niobium, 241ppm scandium and 2,422ppm uranium.

For some context, we defer to the company’s MD and CEO, Bernardo da Veiga:

“This new discovery of ultra-high grade REE-Nb-Sc hard rock mineralisation at the Sulista project confirms that we have an exceptional province scale exploration opportunity,” he said, adding:

“The Sulista discovery is located nearly 80km southwest of Monte Alto, near the southern end of the mineralised Volta do Rio Plutonic Suite trendline that runs down the extensive 180km spine of BRE’s rare earth province.”

Here’s a map.

European Lithium (ASX:EUR)

European Lithium is double digits to the good today after announcing that car maker BMW is committing to the explorer and developer’s Wolfsberg lithium project located in Carinthia, 270 km south of Vienna, Austria.

BMW has transferred funds of US$15 million to ECM Lithium AT GmbH, a wholly owned subsidiary of Critical Metals Corp (Nasdaq: CRML) in relation to the offtake of battery grade lithium hydroxide (LiOH) from the Wolfsberg project, which is to be offset against LiOH delivered to BMW.

EUR’s high-profile chairman Tony Sage digs it:

“This is a huge milestone for the Wolfsberg project,” he enthused, “which now paves the way for the next financing steps.”

BMW Commits to Wolfsberg Lithium Projec

️ https://t.co/khgsqUdOei@TonySage7237 $EUR.ax #Lithium pic.twitter.com/qBES4SI3Zg

— European Lithium (@EuropeanLithium) June 5, 2024

At Stockhead we tell it like it is. While Firetail Resources is a Stockhead advertiser at the time of writing, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.