Resources Top 5: Don’t miss the gains up in Africa – Triton guns for graphite, Arrow targets iron

Pic via Getty Images

- Triton gets the 25-year go-ahead to target even more graphite in Mozambique

- Arrow secures rights to earn a 100% interest in Simandou-style iron project in Guinea

- Zenith reveals excellent gold and silver mineralisation results at its QLD Red Mountain project

Here are the biggest small cap resources winners in early trade, Wednesday August 30.

TRITON MINERALS (ASX:TON)

Big news today for this $43 million market capped graphite explorer.

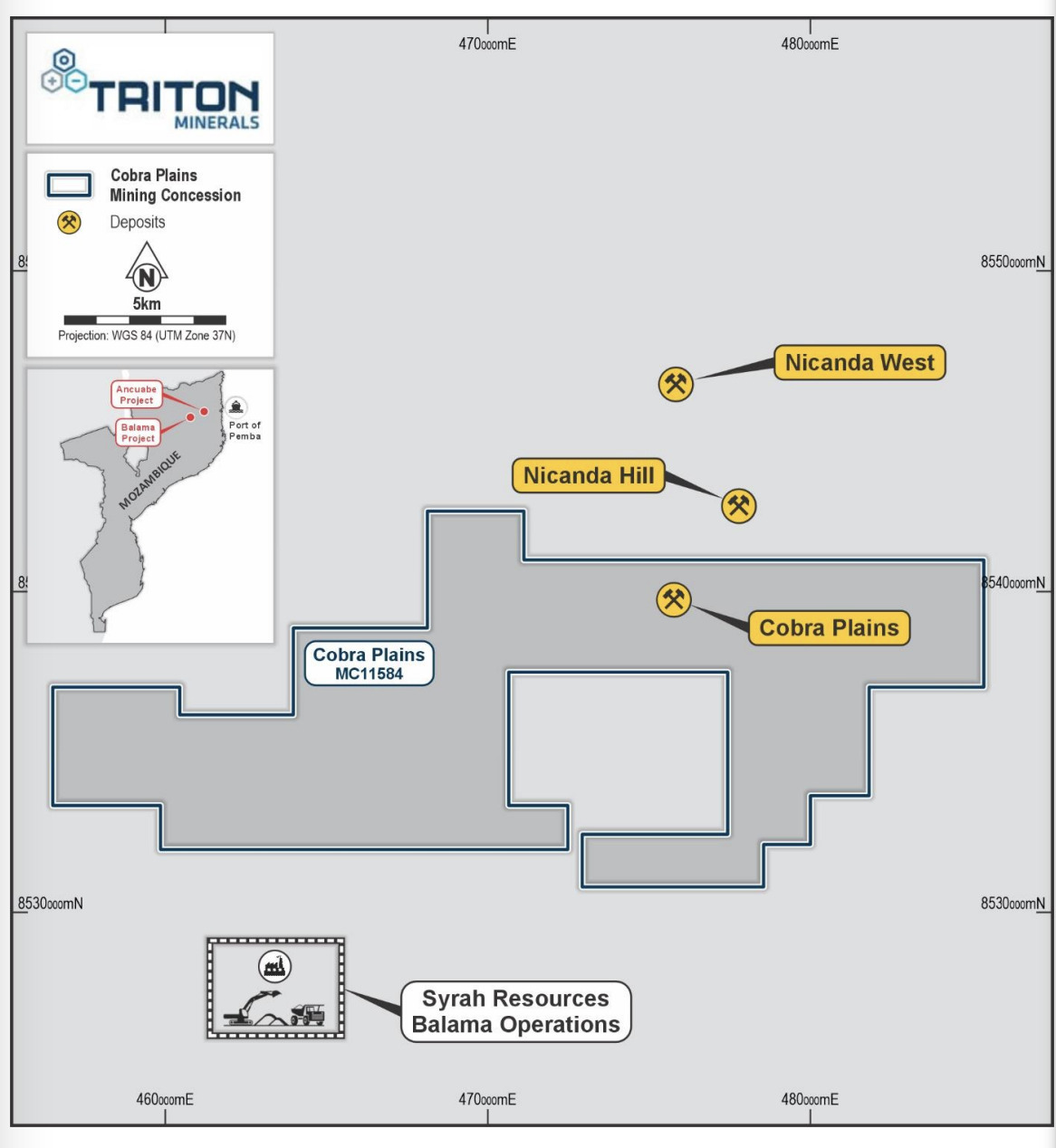

Triton Minerals has surged ahead in the ASX resources pack today after Mozambique’s Minister of Energy and Natural Resources granted the company a 25-year mining concession for the Cobra Plains graphite project in the Cabo Delgado province in northern Mozambique.

Consultations with the Mozambique government appear to have been something of a protracted process, so this will come as a big relief for the company to get things over the line. It can now get its plans cracking at Cobra Plains, as well as continuing its further funding discussions for the company’s flagship Ancuabe graphite project.

Triton’s Executive Director Andrew Frazer said:

“The grant of the Cobra Plains Mining Concession, with its large-scale 5.7 Mt contained graphite Resource, means that Triton now owns two globally significant graphite resources with a diversified mix of flake sizes which can be applied towards a range of applications from batteries to expandable graphite for building materials.”

Stockhead‘s Jess Cummins recently reported:

Triton recently announced plans to re-commit to the large-scale development at the Ancuabe project in a bid to cash in on the strong and increasing demand for graphite from both battery and industrial applications.

The move was well supported by its proposed cornerstone shareholder, Shandong Yulong, who poured a $5m conditional investment into the project.

Shandong Yulong is willing to provide Triton with additional expertise in a number of disciplines including engineering, mining technology and construction.

TON share price

ARROW MINERALS (ASX:AMD)

Like TON, AMD is up on the winners board this morning based on its African mining exploration interests – reinforcing its position in the burgeoning West African iron ore game.

Arrow Minerals this morning announced it had secured rights to earn a 100% interest in the Simandou North Iron Project in Guinea through a staged earn-in.

The project covers the northern extension of the Simandou Range, which is considered the home of the largest undeveloped high-grade iron ore deposit in the world, a Rio Tinto (ASX:RIO) and Chinese backed monster expected to hit a FID this year.

AMD has executed a binding term sheet to acquire the remaining 39.5% interest in private Singaporean registered company Amalgamated Minerals Pte. Ltd, which holds majority interest in the project.

#ArrowMinerals (ASX: $AMD) is pleased to announce it has executed a binding term sheet to acquire the remaining 39.5% interest in Amalgamated Minerals, which holds the majority interest in the #Simandou North Iron Project in #Guinea, #WestAfrica.

View: https://t.co/bBeeL94P3N pic.twitter.com/Rcvl1TbQba

— Arrow Minerals (@ArrowMinerals) August 29, 2023

The explorer holds a 33.3% interest in the project and is in the process of earning in to increase this interest to a 60.5% controlling interest and says the latest agreement provides a mechanism by which AMD can advance to a 100% interest.

Arrow says it’s in the process of developing an “infrastructural corridor” including shared use rail and port infrastructure to support development in the iron-rich area.

Arrow Managing Director Hugh Bresser described the commercial agreement with the Amalgamated shareholders as “a major step forward”, adding that it: “enables us to advance our exploration activities and development plans with security and confidence”.

ZENITH MINERALS (ASX:ZNC)

Base, industrial and precious metals hunter Zenith Minerals is pumping so far today, courtesy of… yesterday’s news.

And that, in case you probably missed it, regarded assay results from its deep diamond drill program at its 100% owned Red Mountain gold-mining project, about 390km northwest of Brisbane in central Queensland.

The results come from a May-July campaign this year and ZNC is labelling discovered intersections as “significant widths of gold and silver mineralisation”.

For analytical mining-stats tragics, that reverse translates to this, ripped straight from the Zenith ASX announcement horse’s mouth:

118m at 0.54 g/t Au + 11.9 g/t Ag from 225m in ZRMDD052, including 12m at 1.36 g/t Au + 4.93 g/t Ag from 288m and 9m at 1.24 g/t Au + 6.30 g/t Ag from 323m o 11m at 0.45 g/t Au + 4.54 g/t Ag from 183m, and 11m at 1.16 g/t Au + 1.08 g/t Ag from 224m in hole ZRMDD051.

Zenith also notes it’s currently targeting its Intrusion Related Gold Breccia Pipe (IRG) discovery down to 400m below surface.

Executive Chair David Ledger said: “We are excited by these gold and silver intersections that now demonstrate not only the excellent continuity of mineralisation at Red Mountain within 400m from surface, but also a significant increase in mineralised widths at depth, as predicted by our modelling.”

Oh, and there was also this divestment news from Monday, which might also be playing into the ZNC share price rise:

QMines (QML) agrees to acquire a high-grade copper-zinc project from @ZenithMinerals for $4.5 million

Both parties see the arrangement as a win-win, with Zenith today announcing its divestment of Develin Creek as Zenith pivots to #lithium exploration.https://t.co/FsuisO1mFC

— Zenith Minerals (@ZenithMinerals) August 29, 2023

As the post above notes, Zenith Minerals is also very much into lithium and it’s one of the companies lithum giant Sociedad Quimica y Minera de Chile (SQM) might be interested in sniffing around for a buy.

For context on that, here’s what our Jess wrote the other day in a broader piece on possible prospects of SQM interest:

Split Rocks lithium project is in WA’s Forrestania greenstone belt, an emerging lithium district host to SQM-Wesfarmer’s Mt Holland/Early Grey lithium deposit containing 189Mt at 1.5% Li20.

The company recently defined 30 new lithium targets in addition to the >3km long by 2km wide Cielo lithium target reported earlier this year.

These new targets lie outside the Rio prospect, where drilling returned 26m at 1.2% Li20.

ZNC MD Michael Clifford says the explorer is “very keen” to see these targets being tested to unlock the full potential of this exciting project area.

ZNC share price

FIREBIRD METALS (ASX:FRB)

Unlike the very vocal lithium, manganese is a battery-metal quiet achiever, though it also plays into the irrepressible electric vehicle narrative, and Firebird Metals is here for it.

When we say “here”, we mean Western Australia and specifically the company’s flagship Oakover project about 85km east of Newman.

The company this morning announced the successful completion of its updated scoping study to produce manganese concentrate at Oakover.

This followed an 80% increase in the Oakover indicated mineral resource estimate, which now stands at 105.8 Mt at 10.1% Mn.

Firebird notes that, combined with an Inferred MRE of 70.9Mt, the total Oakover Resource is 176.7Mt at 9.9% Mn (all using a 7% Mn cut-off).

Firebird has now made the decision to progress with a full-scale productin that will see, annually, ~4Mt processed and ~1.2Mt kt of 30-32% Mn concentrate produced.

Firebird Managing Director Peter Allen — known by some as Mr Manganese — said he believes everything is in place for the Oakover project to become a “significant manganese operation”, adding that the board’s latest decisions “have nearly doubled the life-of-mine at Oakover from 10 years to 18 years” with NPV growing from $329m to $741.3m NPV and IRR increasing from 47% to 73.1%.

FRB share price

LCL RESOURCES (ASX:LCL)

The nickel hunter previously known as Los Cerros is up again on some fresh news this morning regarding an acquisition in Papua New Guinea.

LCL has executed a binding tenement sales agreement with Papuan Minerals Limited, an unlisted public PNG exploration company, to acquire 100% ownership of two exploration licences – EL 2391 and EL 2560.

The company notes that, when combined with its existing exploration licences, as well as other applications and agreement to acquire EL 2566 from Munga River Ltd, these new Papuan grabs will give LCL “control of a significant region prospective for nickel mineralisation”.

LCL acquired the final piece of the Ni Camp around our Veri Veri Project. Note the proximity of Iyewe, Doriri & Veri Veri. Likely to be priority sub-area for us, as is Wedei, possibly the largest, most coherent Ni surface anomaly in PNG. See ASX release. https://t.co/TiSSc7yRLo pic.twitter.com/FIWH8KOEcJ

— LCL Resources (@LclResources) August 30, 2023

As reported by Stockhead’s Reuben Adams last month,

LCL has uncovered a 200m wide corridor of high-grade nickel sulphides – include nickel-rich boulders up to 1m in diameter — at the Veri Veri project in PNG.

Multiple surface samples return over 10% nickel sulphides – that’s high grade — including a trench of 3m @ 2.11%Ni and 0.23g/t Au.

Veri Veri is a distinctive hydrothermal nickel sulphide-gold system. It could also be very big, LCL says.

Regarding these new acquisitions, LCL’s Managing Director Jason Stirbinskis said:

“We now hold the dominant position across the ultramafic lithologies in the south of PNG. These units are highly prospective for nickel mineralisation as evidenced by our Veri Veri nickel sulphide project, the established Iyewe and Doriri targets and large nickel stream sediment anomalies at Wedei and Safia.

“We also note the potential for nickel laterites, particularly in the northern region, near the advanced Wowo Gap Nickel Project, north-east of our boundary3.”

LCL share price

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.