Resources Top 5: Cooper Metals bolts up bourse again on Brumby Ridge copper news

The Influencer From Snowy River didn't look all that. (Pic via Getty)

- That’s the way it’s gonna be, little darling. Cooper’s riding on the (Brumby Ridge) horses, yeah yeah…

- Australian Pacific Coal rides high, too – on a huge, US$60m funding deal

- Meanwhile DMG, RTG and LDR are also having a beaut day

Here are the biggest resources winners in early trade, Thursday November 30.

Cooper Metals (ASX:CPM)

Copper and gold hunter Cooper has some super duper news today, confirming a high-grade copper discovery at its Brumby Ridge copper-gold prospect at the Mt Isa East project in northwest Queensland.

It’s talking 71m at 2.8% copper including 24m at 5.4% copper. “Bonanza copper grades” right there.

Says the company: “This new result builds on the initial RC drill hole 23MERC024, which intercepted 50m at 1.32% Cu and 0.05g/t Au from 80m including 2m @ 6.1% Cu & 0.23g/t Au.”

Not granular enough for you? Here’s a pic from CPM’s ASX release today…

Earlier this month Cooper indicated that further info on its results would be coming in December, but its team clearly got straight back on the horse to get the info out into the wild as swiftly as possible.

CPM investors seem to be lapping up the early news – this thing’s bolted up the bourse with an 70%+ gain at the time of writing.

It sounds like there’s more to come, too, with assay results pending for four drill holes at Cooper’s Raven Cu-Au prospect – also at Mt Isa East.

Plus, a downhole electromagnetic survey is in progress at both prospects, with results expected in December.

Cooper Metals MD Ian Warland said the find “could be the start of a significant discovery at Brumby Ridge for Cooper Metals.

“Of the five drill holes to date, three have hit significant mineralisation and finished in mineralisation.

“This whole Prospect area is well located, just down the road from Mt Isa township and will continue to be our main focus going in to 2024.”

CPM share price

Australian Pacific Coal (ASX:AQC)

This $79m capped coal-mining company had a good start to its day, moving up 25% on the back of news regarding a US$60m funding package offer for its Dartbrook coal mine in the Hunter Valley, NSW.

AQC and its JV partner Tetra Resources have essentially agreed terms on a credit committee-approved offer for a three-year USD $60 million debt facility from Vitol Asia Pte Ltd, which is a leading global energy and commodities company.

“Funds will cover all remaining restart capex through to first coal and the acquisition of additional mining systems during ramp-up,” notes AQC. Dartbrook coal marketing rights will be assigned to Vitol under a Coal Supply and Marketing Agreement between the parties.

Australian Pacific Coal’s interim CEO, Ayten Saridas, said:

“For the past 12-months, AQC has been focused on de-risking the Dartbrook project and obtaining a debt funding package that gives Dartbrook the best chance of succeeding and delivers the best outcome for shareholders and stakeholders.

“The Dartbrook Mine is a Tier 1 asset and this transaction is testament to the quality of the resource.”

AQC share price

Dragon Mountain Gold (ASX:DMG)

(Up on not much news)

This tiny, formerly China-focused goldie held a meeting the other day. Is that why its share price is suddenly up 50% today? Because there’s not much else floating about to indicate the rise.

It was the company’s AGM, and the DMG notes that “all resolutions were decided by poll… and passed by shareholders”.

This isn’t, on the surface, very exciting stuff (or is it?) but those resolutions included:

• Adopting a renumeration report.

• Electing Dimitri Bacopanos – a name that makes us feel like another breakfast.

• And the change of the company name… to Everflow Resources.

In November last year, DMG acquired a tenement package of prospecting licences covering 40km2 located within the Cawse envelope northwest of Kalgoorlie.

At that time company geologist Tim Leonard, said: “The company considers that these tenements may be highly prospective for gold that are within the Gordon’s Project on the granite ultramafic boundary alongside our existing Cawse interests south of Ora Banda Road.”

Dragon Mountain has also been trying to earn into some tenements around the Bulong nickel and gold field owned by its chairman’s private company Wingstar Investments. Some of those have been recommended for forfeiture by Warden Genevieve Cleary in the WA Warden’s Court on minimum expenditure grounds, a decision for Mines Minister Bill Johnston to deliberate on.

DMG share price

RTG Mining (ASX:RTG)

(Up on no news)

This small-ish mining and exploration company, which is also listed on the Toronto Stock Exchange, has gold and copper things going on in the Philippines and in Central Asia.

We’re not seeing much, or anything at all, behind its double digits gainage today, so let’s revert back to October 9, when we last mentioned it in any detail, and when the company last had some news of real note to share with the ASX.

At that time it released an update on field work showing encouraging gold and copper mineralisation along 6.5km of skarns and new structures within its 90% owned Chanach project in the Kyrgyz Republic in far-flung Central Asia.

Assay highlights from its high-grade trench sampling included: 2m at 4.05g/t Au and 1.56% Cu from Cut 1; 1m at 1.10g/t Au and 0.76% Cu from Cut 1; 7m at 2.94g/t Au (including 4m at 4.87g/t Au) and 1.12% Cu from Cut 2; 5m at 5.53g/t Au from Cut 5.

The company’s main focus, however, remains its Mabilo gold project in the Philippines. It continues to advance work there, with “budget discussions with project partners progressing well”.

RTG share price

Lode Resources (ASX:LDR)

(Up on no fresh news)

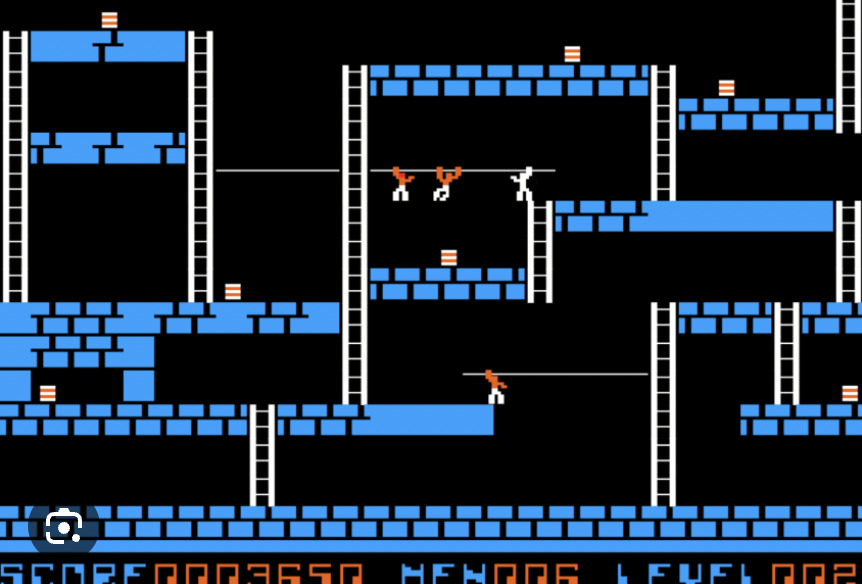

Did you ever play the old video game Lode Runner? It has very little to do with this gold/copper/silver explorer (although the little white character there is frenetically hunting for gold, so maybe it has everything to do with it). It was great – spent countless hours on it as a nipper and I’d really like to play it again as soon as I’ve put this article to bed.

Lode Resources, a $12m market capper on the search for precious metals in the New England Fold Belt of NSW, is up on nothing completely fresh that we’re seeing at the time of writing.

Here, however, was its most recent news of note, from a bit over a week ago, regarding its Webbs Consol silver project.

Lode Resources has commenced drilling on a significant exploration target at its Webbs Consol Silver Project. The Webbs Consol North Prospect anomaly footprint is the largest surface occurrence at Webbs Consol as outlined by surface sampling. #LDR #Silver #Zinc #Lead #WebbsConsol pic.twitter.com/xaIYsatb2t

— Lode Resources Ltd (@LodeResources) November 22, 2023

With $3.7m cash in its coffers as of September 30, Lode says it remains fully funded for upcoming drilling programs and further exploration work.

Its MD, Ted Leschke, said: “We are excited about the just-commenced drilling programme at Webbs Consol North given the large size of the surface anomaly. This prospect is defined by an intense and large geochemical anomaly making a high priority drill target.”

LDR share price

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.