MIDNIGHT PEGGING: Use it or lose it

Pic: LordHenriVoton/E+ via Getty Images

Midnight Pegging places the microscope on everything exploration – from fresh discoveries to ye olde land claims, nearology to Warden’s Court decisions and so awfully much more.

If you are a firm believer in the doctrine ‘Use It or Lose It’ maybe you should consult a sex therapist. In mining though, and specifically mining in WA, Use It or Lose It means something else entirely, and is far less psychosomatic.

In fact if you don’t use it, you really can lose it. Your tenement.

When you peg or purchase a prospecting, exploration or mining lease in WA, attached is a minimum amount of dosh the government requires you to spend to ensure you’re actually trying to make a discovery.

Often companies will head out to do little drilling or sampling programs, maybe some rehabilitation or environmental surveys just to keep their holdings, in the parlance, “in good standing”.

More exciting is how this is policed.

Miners are self-reporting and the Mines Department has nowhere near the cattle to go out and inspect the 55% of the State now covered by mining tenements.

So they rely on, we kid you not, JEALOUS NEIGHBOURS, to help them out.

Here’s how it works. Miners, explorers, prospectors, informal real estate agents and the like send the DMIRS Form 5 reports on their expenditure.

Don’t believe what you’re reading? Plaint it.

Or more technically, put in an application for forfeiture.

The best part is if you take your plaint to the warden’s court and the mining warden agrees the expenditure statements are bollocks, they can recommend to the Mines Minister they be taken off your target.

Miners can also apply for an exemption if, for some legitimate reason, you admit you didn’t spend the money, or convert to a retention licence if you’ve got something like, say, lignite, which you’ll never be able to mine but keep holding on in sheer hope that one day the world will just give up and let itself burn.

More Midnight Pegging: Twiggy’s Fortescue heads to Yinnetharra in search of lithium

And what if the plainter wins?

The best part of the Jealous Neighbour principle is that if the plainter can convince the Warden they’re right, they get first dibs. Snitches, we guess, don’t get stitches.

(See s96 of the WA Mining Act.)

But it normally doesn’t get that far. These cases typically take years to run through the system.

Often plainters target tenements set to be packaged for sale. Referred to by more skeptical commentators as “greenmailing”, these plaints can hold up a sale process until the applicant nabs a settlement to drop ’em and ride into the sunset.

For instances, plaints allegedly played a role in holding up the sale of the Central Norseman Gold Mine for well over a year.

A long-running campaign only spread to core mining leases after plans to sell all or part of the mine were made public in August 2017.

Eventually the mine’s half-sale to Pantoro (ASX:PNR) — now full owner after its merger this year with the vendor, the Maloney family’s Tulla Resources — was completed after those plaints were settled.

For more uncommon in this day and age is a plaint that gets all the way to a decision.

The Specifics

Imagine our luck when one of these very rare cases popped up in the Warden’s Court in Kalgoorlie in front of Genevieve Cleary, whose judgment on September 14 could have implications for an ASX-listed explorer.

It pertains to experienced prospector Wayne Van Blitterswyk, who by coincidence cut a deal with Focus Minerals (ASX:FML) several years ago over forfeiture applications at its Laverton Gold Project.

His latest long-running Jealous Neighbour mission came against an obscure company known as Wingstar Investments.

Privately owned Wingstar holds the Avalon and Cawse nickel laterite projects once held by Russian giant Norilsk before a collapsing market sent it running scared from WA’s fickle pickle of a nickel scene.

Wingstar is owned by Robert Gardner, the chairman of ASX-listed tiddler Dragon Mountain Gold (ASX:DMG), which has ‘earned in’ to a 25% share in the non-nickel-and-cobalt rights at Cawse and Avalon.

Only Van Blitterswyk reckoned he traversed 10 mining leases across Cawse and Avalon, located a little bit east of Kalgoorlie, over 2017 and 2018 and couldn’t identify actual exploration work going on.

Much of the case hinged on whether a $2.585 million heap leach plant purchased in July 2017 and a couple bulldozers used for rehab and environmental works could be applied across the entire project group.

The big dozer

The process of gathering the evidence was all complicated by the fact many of the invoices purporting to show expenditure on the Cawse and Avalon tenements were irretrievable.

This happened after Gardner said he had his home burgled and computer stolen on September 30, 2019, at which point his tenements had been subject to applications for forfeiture for over a year.

Warden Cleary was unconvinced work was going on daily.

“… I am of the view that any assurances Mr Gardner made that the work had been done, the work had been done on the particular tenements or that the work had been properly accounted for, can be given little weight. Neither can his assurances that activity was ongoing on the tenements daily during the relevant tenement years,” she said in her decision.

That left questions about equipment bought for the purposes of rehab and restarting nickel mining and processing operations at Cawse, and whether they could be applied across the tenement group, as well as Mining Rehabilitation Fund payments.

Indeed, did this small operation actually intend to mine on its tenements or simply prepare them for sale.

And when it came to the dozers, Gardner’s evidence showed neither claimed in an expenditure item that totalled $554,180 was actually on the tenements in the relevant year subject to the forfeiture application, Van Blitterswyk claimed.

He claimed Gardner was more likely to have bought the bulldozers to undertake commercial logging on his property in NSW. Gardner said the dozers were in New South Wales for mechanical repairs.

Then came the question of “the big dozer” which actually did work on the tenements, a D11N Van Blitterswyk and lawyer Carmel McKenzie posited had already been on the tenements before the new dozers were paid for.

“I am satisfied that given the alternate use and length of time it has taken Wingstar to have the one bulldozer brought to WA, the reasons given by Mr Gardner as to the delay are not reasonable,” Warden Cleary said.

“That adds weight to a submission that the bulldozers were not purchased in connection with mining on the relevant tenements.”

The outcome of all this (and more, check the whole winding thing for yourself here) is the Warden declared the ‘non-compliance is of sufficient gravity to justify forfeiture on each of the tenement(s) the subject of this application, and I so recommend’.

The recommendation will head to Mines Minister Bill Johnston.

As for Dragon Mountain Gold, we made attempts to contact them and Robert Gardner on Friday, all to no avail.

The $3.5 million microcap once made a killing selling the Lixian gold project in China to Zijin for $175 million. Its succeeding decade has been far less eventful.

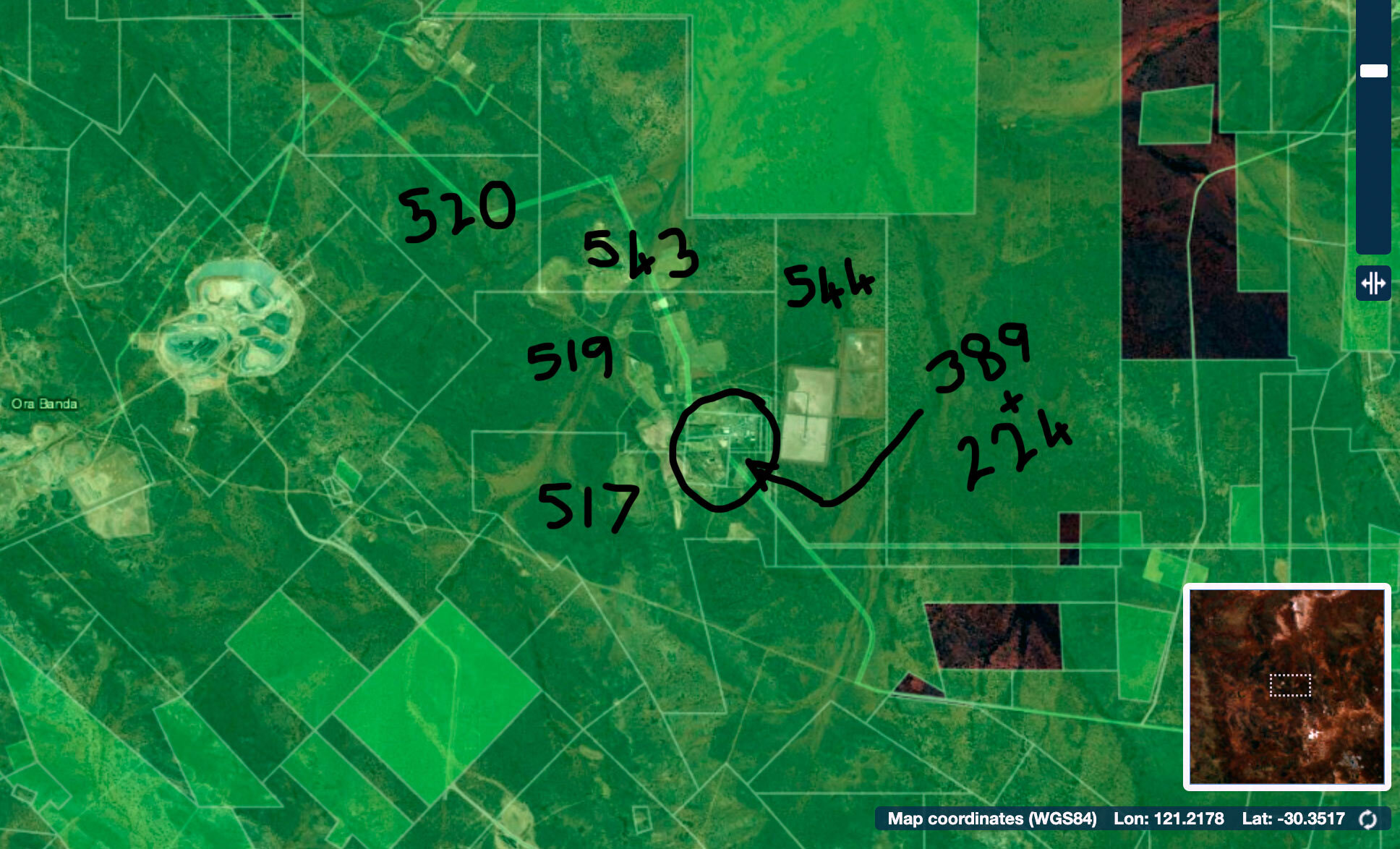

According to ASX filings, DMG ran a 3,055m RC program consisting of 29 holes at the Avalon project, 35km east of Kal, in late 2021, announcing in January last year it had satisfied its earn-in requirements for an initial 25% stake in the non-nickel-and-cobalt rights at Cawse and Avalon. The target is to eventually increase that to 80%.

It should be noted not all of the leases in the projects were subject to applications for forfeiture, though DMG acknowledged the Van Blitterswyk claims in a relisting prospectus last June.

The company subsequently acquired 23 separate prospecting licences near Cawse deemed prospective for gold in November last year, while chairman Gardner voluntarily dropped his remuneration from $350,000 to $50,000 per year to improve its working capital outlook.

Dragon Mountain Gold (ASX:DMG) share price today

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.