Resources Top 5: Buxton makes a high-grade nickel Dogleg; while lithium heads GRE and WC8 are spinning

Pic via Getty Images

- Buxton Resources is a ressie star on the ASX today thanks to a WA nickel sulphide find

- GreenTech has the drills spinning at its Osborne JV project in the Pilbara

- Also out that way, hot stock Wildcat just keeps digging up more beaut lithium results

Here are the biggest resources winners in early trade, Monday November 6.

Buxton Resources (ASX:BUX)

Buxton has a diverse minerals exploration portfolio, and is on the hunt for nickel, copper, gold, iron and graphite across various Aussie tenements. Today’s news, though, is all about nickel sulphides – of the high-grade variety.

The small (but well formed) explorer revealed this morning that assay results returned from the first diamond drill hole at its Dogleg Ni-Cu-Co prospect at its (JV with IGO (ASX:IGO)) West Kimberley project in WA have confirmed the following:

High-grade nickel sulphides with 13.85m (true width 13.24 m) at 4.35% Ni, 0.34% Cu, 0.15% Co from 177.34m, including 5.86m (true width 5.60m) at 7.47% Ni, 0.31% Cu, 0.25% Co from 179.08m.

If you’re not a mining stats nut, then just take on board the words “high” and “grade”, along with “nickel sulphides” and then consider whether you believe in the long-term future of the electric vehicle market narrative into which this resource (once it’s converted to nickel sulphate) plays heavily.

High-Grade #Nickel Sulphides @ #Dogleg #Ni–#Cu–#Co Prospect at West Kimberley JV with $IGO

🔗: https://t.co/Qt1d85suiA$BUX

See highlights 📽️ pic.twitter.com/y512byz3C0

— Buxton Resources Ltd (@BuxtonResources) November 5, 2023

The company also notes that a downhole electromagnetic (DHEM) survey completed on hole 23WKDD004 shows “strong in-hole response”, which is always nice. And that apparently provides a good basis for potential follow-up drilling.

Assay results are expected on the second hole (23WKDD004) in 3-7 weeks’ time.

Buxton Resources CEO Marty Moloney said:

“The Buxton and IGO technical teams are extremely excited to report high grade nickel and cobalt mineralisation in sulphides from the first diamond hole at the Dogleg Prospect within our West Kimberley Project JV.

“This result, along with previous exploration success at the Merlin Prospect, validates our view that the West Kimberley Project has the potential to host Nova-Bollinger style nickel sulphide deposits.”

BUX share price

GreenTech Metals (ASX:GRE)

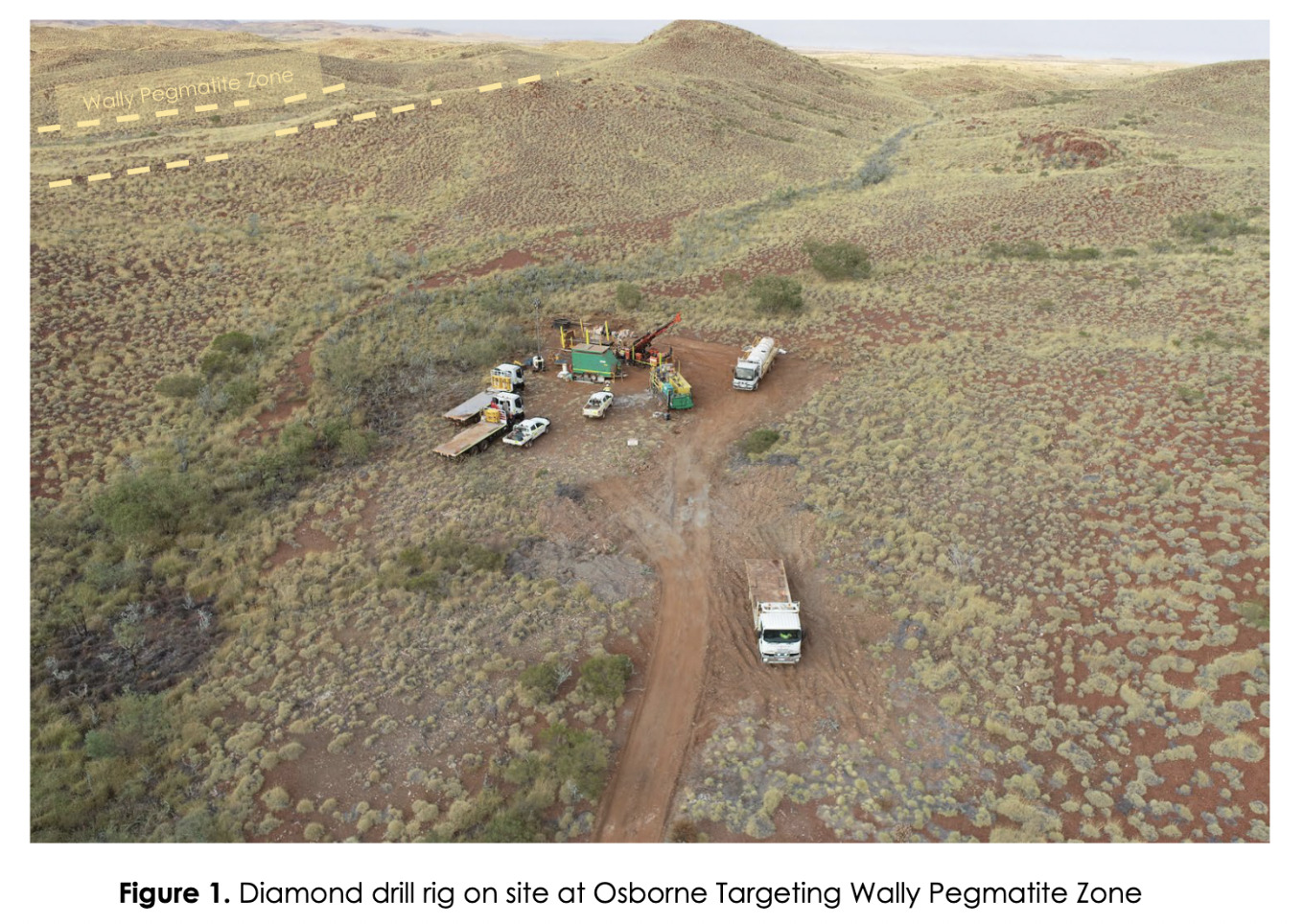

Azure neighbour GreenTech Metals, also on the hunt for battery-metal white gold, has news out today regarding the Osborne lithium project in the Pilbara.

It’s got the diamond drills spinning at the highly promising JV (51% GRE: 49% Artemis Resources (ASX:ARV) tenement, in which it says its campaign will provide for up to 1500m drilling to “test stratigraphy and structure to aid in planning of future detailed drilling”.

The drilling is specifically targeting north-dipping stacked LCT pegmatites in the project’s “Southern Zone”.

⛏️ Diamond Drilling Commences at Osborne JV West Pilbara #Lithium Project

Programme provides for up to 1500m drilling to test stratigraphy and structure to aid in planning of future detailed drillinghttps://t.co/ffMx9XFOd9 $GRE $GRE.ax $ARV #exploration #ASX pic.twitter.com/9ooaBwIOfr

— GreenTech Metals (@GreenTechMetals) November 5, 2023

Analysis has previously confirmed spodumene-bearing pegmatite at the Kobe and Osborne prospects, and a heritage survey report is expected in about 4-6 weeks that the company says will allow for further detailed drilling.

Results from latest rock chip samples at the Northern LCT pegmatite (Kobe prospect) at Ruth Well and Osborne have returned excellent lithium grades of up to 1.82% Li2O along the 7.5km long trend.

You can read a bit more about GreenTech’s other latest significant news regarding Kobe here.

This is all magnified by the fact nearby Azure Minerals is the subject of a $1.6b takeover bid from SQM, itself facing competition from the big-spending Hancock Prospecting and Mineral Resources (ASX:MIN). It shows what can happen if you do cotton on to that magical Pilbara lithium find.

“In light of the recent $1.6B takeover offer for Azure, the West Pilbara is continuing to cement its position as one of the premier global jurisdictions for hard rock lithium exploration,” the company’s executive director Thomas Reddicliffe noted.

“GreenTech is moving quickly with its exploration programs as it continues to reveal the true potential of its significant tenure in the region.”

For more on GRE’s drill-spinning news from today, read our special report > here

GRE share price

Wildcat Resources (ASX:WC8)

Speaking of Pilbara lithium finds … super-stonking-hot lithium-hunter Wildcat is only up about 3855% YTD. So does it really need the extra 15% or so it’s added on over the past 24 hours? Of course it does.

The hits just keep on coming for WC8. It’s up on the news its Pilbara-based Tabba Tabba lithium project near Port Hedland has delivered more exceptional results.

New assay results from the Leia pegmatite in the project’s Central Cluster have revealed Wildcat has hit 180m at 1.1% Li2O from 206m, adding further gravitas and proof that the company has a Tier-1 deposit under its boots.

We’ve hit 𝟭𝟴𝟬𝗺 @ 𝟭.𝟭% 𝗟𝗶𝟮𝗢 at Leia Pegmatite in latest results from our Tabba Tabba #Lithium Project, WA, confirming it as a Tier-1 lithium deposit. Aggressive drilling continues, focusing on Leia, Chewy, and Boba. Further results pending.

📄https://t.co/bsnYzDGM0M #WC8 pic.twitter.com/Pu0exADM0k— Wildcat Resources (ASX:WC8) (@WildcatRes_WC8) November 5, 2023

The Leia pegmatite is now over 1.65km long, up to 180m wide, has been intersected to more than 350m vertical depth, and remains open laterally and at depth.

The company notes that results are now pending for 34 holes from Leia with Wildcat completing roughly eight of those holes per week.

As noted above in the GreenTech section, after the recent Liontown Albemarle/Rinehart tussle, and after SQM’s major move for Azure Minerals, the ASX lithium M&A scene is still frothy, still front and centre. And Aussie mining titan Mineral Resources (ASX:MIN) last week came in hot for WC8.

So all that ought to tell you something about how highly prized WA’s lithium land is perceived.

The Chris Ellison-led mining giant has confirmed it’s now bought up almost a fifth of WC8, increasing its stake in the company to 19.85%.

Per The Australian last week:

“Mr Ellison is also speculated to be a shareholder in Azure Minerals under 5 per cent, and some had suspected he may have been looking to amass more shares in the takeover target of which Mrs Rinehart recently raided, with the billionaire gaining about 18 per cent.

“Wildcat’s market value has soared on the back of promising drilling results of its Tabba Tabba lithium project near Port Hedland in Western Australia.”

Ellison and Co. now hold over 12% of Azure along with nearly 20% of Wildcat. Will the outback predator be the latest lithium junior to turn prey?

WC8 share price

TG Metals (ASX:TG6)

The “Tethered Goat” is on the loose again, surging up the bourse to the tune of 30-odd% at the time of writing.

This lithium, nickel and gold exploration junior was October’s clear ressie stocks winner, rising 251% for the month. In fact, it’s now up a stonking 500% YTD as we type/read/sit here/drink third coffee of the morning.

A couple of weeks ago, the company announced an interception of high-grade lithium at its Lake Johnston Li-Ni-Au project in the Lake Johnston Greenstone Belt of WA.

TG Metals, on the radar of renowned expert Joe “Mr Lithium” Lowry, noted that initial drilling of the 4.5km by 1.7km Burmeister lithium soil anomaly within the project has found a spodumene-bearing pegmatite with grades up to 2.28% Li2O.

#TGMetals featured @StockheadAU

“Tethered Goat” as Joe “Mr Lithium” Lowry recently dubbed #TG6 – is continuing the good vibes from its recent find with an investor presentation drilling further into the details for shareholders & other interested partieshttps://t.co/wctHDdGSGA— TG Metals Limited (@TGMetals) November 1, 2023

As noted in one of our recent special reports:

The stock listed on the ASX May last year with assets prospective for nickel, lithium, and gold in the Goldfields-Esperance region of WA.

It had amassed the largest land package ever held by one exploration company within the Lake Johnston Greenstone Belt, saying the region has been “historically overlooked and underexplored”.

Five of the six holes completed, which were drilled to depths of between 120m and 132m, intersected multiple-stacked pegmatites with all pegmatite intervals hosting lithium mineralisation averaging 1.46% Li2O in spodumene.

Down-hole widths ranging from 9m to 12m and the better intercepts are 9m at 1.35% Li2O from a down-hole depth of 30m and 9m at 1.62% Li2O from 87m.

TG6 share price

North Stawell Minerals (ASX:NSM)

Junior goldie North Stawell Minerals has had a great past week (up 66%), and past 30 days (+76%), in fact.

It’s most recent Quarterly Activities and Cashflow reports were positive. Some highlights:

• One hole was returned from the Caledonia prospect [in the prolific Stawell region of western Victoria] with: 1.3m at 2.29g/t Au from 63.1m (NSD051)

• Corporate activity focused on M&A strategy and on-going funding options.

• Review of Wildwood, Forsaken and Caledonia targets sets some clear priorities for on-going exploration.

The team at North Stawell Minerals is pleased to present their September Quarterly Activities Report.

View the highlights here: https://t.co/FlXm5xJE8b pic.twitter.com/AplEfUoMSP

— North Stawell Minerals Limited (ASX:NSM) (@NorthStawell) October 31, 2023

North Stawell Minerals Chief Executive Officer Russell Krause said recently:

“NSM has used the winter months to review and revise exploration plans on several fronts, to best deliver progress identifying and delineating Stawell-like gold mineralisation from the northern continuation of the rocks that host this impressive multi million-ounce gold deposit.

“The corporate team has focused on opportunities to expand NSMs project pipeline and to secure on-going funding to get the work done.”

NSM share price

Greentech Metals and TG Metals are Stockhead advertisers at the time of writing but did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.