Resources Top 5: Bonanza gold and an emerging rare earths player

Photo by Michael Loccisano/Getty Images for TNT

- Predictive uncovers more bonanza grade gold results — like 17m at 31.9 g/t — from deeper drilling at ‘Bankan’ project

- RareX increases rare earths resources at ‘Cummins Range’ project by 47%

- Aurumin (gold), Coppermoly (copper, gold), Corazon (nickel, copper, cobalt) up on no news

Here are the biggest small cap resources movers in early trade, Monday July 19.

PREDICTIVE DISCOVERY (ASX:PDI)

Predictive has uncovered more bonanza grade gold results — like 17m at 31.9 g/t — from deeper drilling at its ‘Bankan’ project in Guinea.

In April last year, the long-time West African prospect generator rocketed from 0.5c to 7c per share – a 900 per cent gain – on a new gold discovery.

The $170m market cap stock has since increased those gains to an eye-watering ~2200%.

Until now, NE Bankan has been shaping up as a large gold deposit with excellent geometry for a large-scale open pit mine, managing director Paul Roberts said. That’s changed.

“These new results have added a whole new dimension to the project as it now appears that the core of the deposit contains consistently higher grades in a zone which is expanding at depth,” he said.

AURUMIN (ASX:AUN)

(Up on no news)

Last week, the recently listed explorer kicked off drilling at the ‘Mt Dimer’ gold project in WA.

Mt Dimer is a historical high-grade production centre, having produced +125,000 ounces of gold from open pit and underground at an average grade of 6.4 g/t gold.

Drilling will build on the previous successful Aurumin drilling program at existing deposits (Lighting, Golden Slipper and LO3) and at a bunch of new targets.

The company expects this drilling program to take ~three weeks to complete, with assays to be received and interpreted five weeks later.

The $11.3 million market cap stock – which surged +85% on its first two days on the bourse in December — is currently up just 10% on its listing price of 20c per share.

COPPERMOLY (ASX:COY)

(Up on no news)

This sleepy copper play – whose exploration programs have been stymied by COVID — is sitting on about $4m cash.

Its flagship ‘Mt Nakru’ project in PNG has a substantial 309,000 tonne copper, 300,000oz gold and 2.1moz silver resource.

A planned exploration drilling program to increase the size of the resource is expected to kick off once COVID travel restrictions between Australia and PNG ease.

RAREX (ASX:REE)

The rare earths explorer has increased resources at ‘Cummins Range’ in WA by 47% to 18.8 million tonnes grading 1.15% total rare earths oxides (TREO) (inc. 0.23% high value magnet rare earths NdPr) and 0.14% niobium.

The maiden indicated (higher confidence) resource is 11.1Mt at 1.3% TREO (inc. 0.27% NdPr) + 0.17% Nb2O5.

This resource is expected to get bigger, with the deposit open in multiple directions.

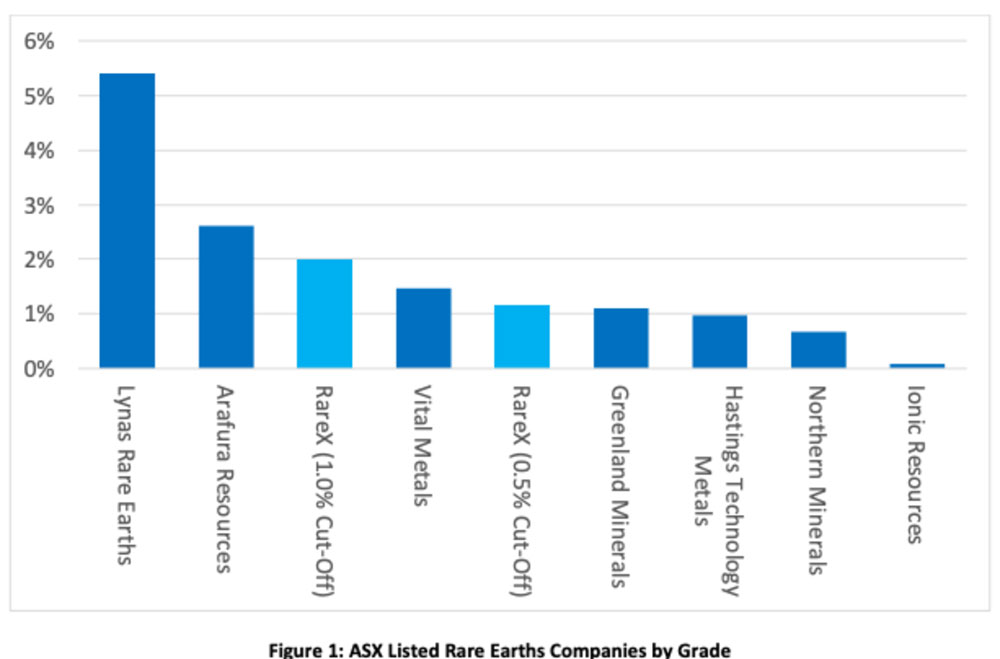

The grade is also up there with the best of them, the company says:

“The resource has increased in grade and scale, and now clearly sits at the forefront of rare earth development projects on the ASX,” REE managing director Jeremy Robinson says.

“Apart from the overall 47% increase in tonnage, we have also posted a sizeable increase in high grade tonnes and a very significant maiden Indicated Resource of 11.1Mt which will be available for conversion to ore reserves as part of upcoming economic studies.

“Importantly, we believe that there is enormous scope to grow the resource further, both in overall size and grade.”

RareX has already resumed exploration at Cummins Range targeting more high-grade rare earths both along strike and at depth.

CORAZON MINING (ASX:CZN)

(Up on no news)

In mid-June, the explorer kicked off drilling at the ‘Mt Gilmore’ copper cobalt gold project in NSW.

The first-ever drill holes into the 20km-long Mt Gilmore copper trend would include the high priority ‘Gordonbrook Hill’ mineralised porphyry intrusion, uncovered by the company in 2020.

Results will be released when available, the company says.

Activities are also underway to enable the restart of drilling at the flagship Lynn Lake nickel sulphide project in Canada “as soon as practicable”.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.