Resources Top 5: Bastion passes Cometa copper project to Hot Chili; AUZ targets Brazilian REEs

Pic via Getty Images

- Australian Mines targets more niobium and REEs in Brazil

- Bastion Minerals divests its Cometa copper project in Chile to… Hot Chili

- Carnavale has high-grade results this week at its Kookynie gold project in WA

Here are some of the biggest resources winners in early trade, Wednesday February 21.

Australian Mines (ASX:AUZ)

Battery metals and rare earths company AUZ is on the up today, to the tune of 29%. But jeez, look at its YTD performance, too: +120%.

Australian Mines has announced it’s identified a second exploration target prospective for niobium and REEs at the Jequie Rare Earth Project, which is in the state of Bahia in Brazil.

Highlights, per the company announcement:

• The target comprises an airborne radiometric thorium anomaly of roughly 12km in length and with a width of up to 2.5km.

• Identified soils and clays are within close proximity to outcropping leucogranites, which have potential to either host primary REEs in hard rock or be the source of secondary REE oxides within weathered saprolite, soils and clays.

• What else? An AUZ expert got on the tools – specifically using a portable scintillometer – and noted positive readings for the presence of potential REE-bearing minerals in the outcrop.

AUZ’s CEO Andrew Nesbitt had this to say:

“Really happy to have identified a second target prospective for Rare Earths. The target has the geological setting to potentially host significant Rare Earth Element mineralisation, and we are looking forward to the next phase of exploration.”

Meanwhile, “Flynn” over at GBA Capital digs what the company has been doing lately…

https://twitter.com/Flynn_ASX/status/1760097412813873378

AUZ share price

Bastion Minerals (ASX:BMO)

Bastion is an early-stage exploration minnow focused on copper, gold, and green metals. It’s scored a few wins for its share price of late, and has more news pushing the needle in the right direction today, too.

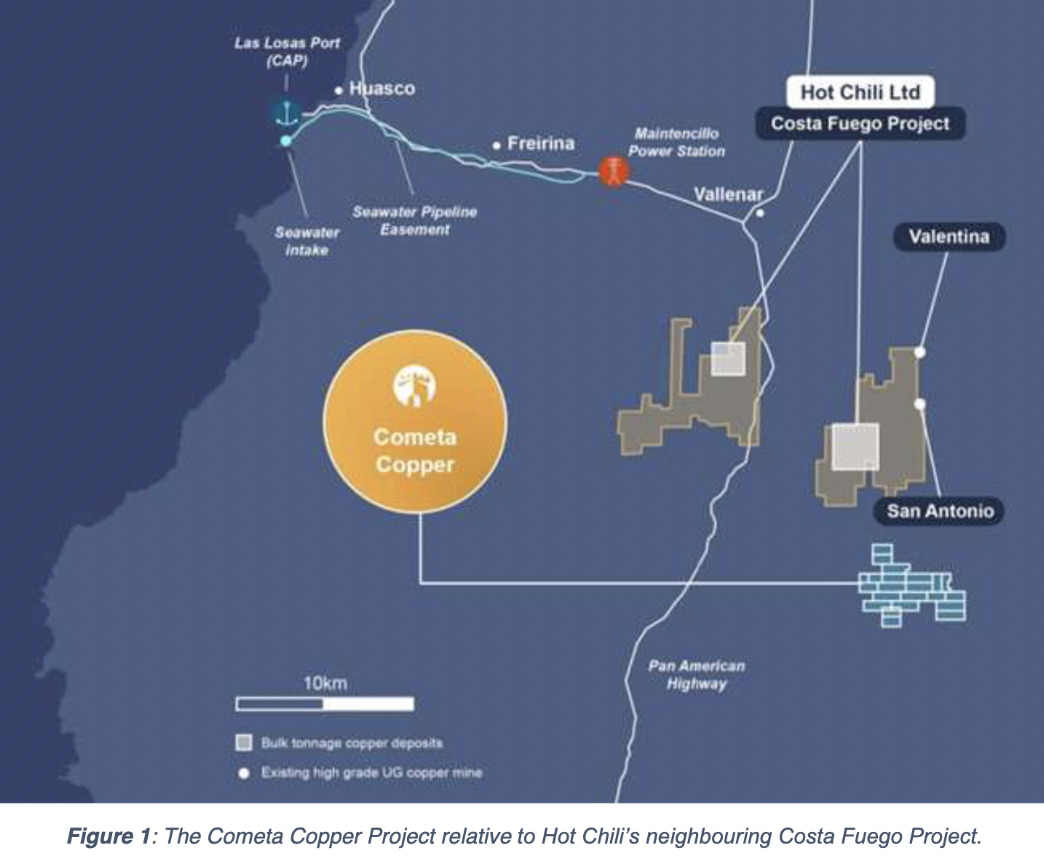

The $4.05m capper is up on divestment news – specifically the divestment of its Cometa copper project in Chile to Hot Chili (ASX:HCH)

Hot Chili has now completed its period of due diligence on the project and has officially entered into an option agreement to acquire Cometa for up to US$3.3 million, with BMO already receiving a first payment of US$100k.

What does this mean for BMO, then? A beaut bank account, basically. But more to the point, it will enable the company to place more focus on its Canadian lithium project, as well as its Swedish REE project and a lithium/REE project in WA.

All these projects are highly prospective and more funding poured in their direction is the strategic way to go for BMO right now.

Commenting on the agreement, Bastion Minerals executive chairman Ross Landles said:

“The Bastion Board is delighted to progress with the Option Agreement for the divestment of the Cometa Copper asset to our neighbours in Chile. Hot Chili Ltd has a strong track record of consolidating tenure around its Costa Fuego Project.

“With the first payment now banked, the Company will continue to concentrate its focus on our lithium and REE assets based in Canada, and Australia, Sweden respectively.”

BMO recently reported strong, high-grade results at its Gyttorp land holding in Southern Sweden – a project located on the southern end of a belt of iron and REE-enriched skarns, more than 100km long, known locally as the “REE-line”, with Bastnäs type REE mineralisation. More on that > here.

BMO share price

Carnavale Resources (ASX:CAV)

Up about 25% at time of second breakfast hangry-ness, junior goldie Caranvale is possibly trading on its good news from a coupla days ago.

Namely, “further outstanding results” from CAV’s December drilling campaign at the McTavish East prospect within the Kookynie gold project, which is about 60km south of Leonora in Western Australia.

Those results, from RC and diamond drilling were from infills and high-grade plunging zones and include:

3m at 58.54g/t Au from 97m in MERC102 (inc. 2m at 84.5g/t*)

7m at 23.18g/t Au from 46m in MERC098 (inc. 3m at 51.18g/t*)

4.6m at 24.92g/t Au from 112.07m in MEPC008 (inc. 0.2m at 26.4g/t and 1.25m at 69.28g/t*)

10m at 11.03g/t Au from 88m in MERC105 (inc. 2m at 42.15g/t*)

And more besides.

CEO Humphrey Hale is: “delighted with the results of the drilling, which has confirmed the continuity of the bonanza grades at McTavish East.”

“This gives the company confidence to commission a maiden resource estimate and economic studies to evaluate potential mining scenarios,” he added.

CAV share price

Rincon Resources (ASX:RCR)

This Western Australian gold and base metals exploration company also released its latest news of import two days ago.

On the hunt for copper and gold in the West Arunta across three exploration licences comprising the Pokali target, Rincon notes it’s now expanding its footprint.

A new tenement application is in the works, which will expand Rincon’s presence in the West Arunta region to more than 260 km2 of ground.

The exploration licence application sits next to existing tenements and includes the historic ‘Mantati’ copper-lead-zinc occurrence associated with the highly prospective Central Australian Suture. To be clear, not the application itself – that’s paperwork in an office somewhere. Probably.

Mantati has reportedly never been drill tested and was originally identified by BHP Limited via a surface sampling program which returned anomalous gold and silver results up to 7.3g/t Ag3. That’s apparently consistent with some of the high-grade silver results returned at Rincon’s Pokali IOCG/REE prospect.

Our West Arunta footprint continues to expand! ⛏️ This is exciting news ahead of our diamond and RC drilling programs which are scheduled to commence end of February. 🙌

Read more: https://t.co/VvOwXbSt7W#drilling #copper #gold #REE #WestArunta #ASX #RCR pic.twitter.com/Kyv6rYXn7l

— Rincon Resources (@RinconResources) February 18, 2024

RCR share price

BMG Resources (ASX:BMG)

(Up on no news)

Small goldie (and REE explorer) BMG is also well up today, but on no fresh news of note.

A quick flick of the time machine dial, then, takes us back to Feb 8, when it revealed it’s acquired an option over a niobium-REE project in WA.

It’s a large, strategic landholding prospective for niobium and other rare earths elements in, like Rincon above, the emerging world-class West Arunta region.

The binding option agreement gives the company the right to acquire a 90% interest in three exploration licences (one granted and two in application).

Nearology? Check.

The tenements under option will be known as the Dragon Niobium-REE project and will include ground that abuts the tenure for the West Arunta project of WA1 Resources (ASX:WA1) – home to the renowned Luni Niobium-REE discovery.

BMG share price

At Stockhead we tell it like it is. While AUZ is a Stockhead advertiser at the time of writing, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.