Resources Top 5: Ausgold expands to 3.04m ounces, Asra and Petratherm rise on REEs

Pic via Getty Images

- Ausgold increases its flagship Katanning gold project in WA to 3.04Moz

- Minnow Asra Minerals advances on positive ytrria-based REE test results in WA

- Petratherm hits thick REE interceptions in South Australia

Here are the biggest small cap resources winners in early trade, Monday September 4.

AUSGOLD (ASX:AUC)

WA-based goldie Ausgold has some big news stemming from its flagship Katanning gold project, 300km south of Perth.

The company has apparently been itching to get this announcement out, and here’s the gist – it’s been able to deliver a further significant increase in the resource at its burgeoning yellow metal prospect, bringing it to 3.04Moz (98Mt at 1.06g/t) – with Measured and Indicated of 2.42Moz.

This represents a 15% increase (400,000oz) in contained ounces from scoping study details released in May, a 12 % increase Measured and Indicated Resource, representing 80% of total contained ounces, and a 13% increase in overall grade

All in all, it provides the company with a strong platform to carry out and progress operations including its ongoing Definitive Feasibility Study, and it essentially supports a long-life gold operation at a project that’s now reaffirmed as the largest free-milling, open pit gold development project in WA.

The company is now looking towards the development of the project into a much larger 5Mtpa operation.

#Ausgold $AUC lifts the #resource for its #Katanning #gold project to an impressive 3.04Moz, with the updated number to go into a DFS which is now well advanced on a major new open pit #gold project south of #Perth $AUC https://t.co/VSXfgC26cu pic.twitter.com/nxeElcBIhQ

— Nicholas Read (@nicholas_read) September 4, 2023

AUC share price

ASRA MINERALS (ASX:ASR)

Gold and rare earths up-and-comer Asra (formerly Torian Resources) is cruising at +28% altitude this morning.

It’s released news that its initial Stage 1 sighter metallurgy test work is close to completion on selected drill samples from the Yttria clay hosted rare earths (REE) deposit at the company’s Mt Stirling project, near Leonora, in Western Australia.

Yttria, aka yttrium oxide, is a rare earth element that has several industrial applications, including in solar energy processes, lithium batteries, lasers and LED electronics, among others.

(Note, Yttria is also the specific name of a site at the Mt Stirling project, hence the initial capping of Yttria there, pedants.)

The company notes that its Stage 1 test work is trialing weak acid (ammonium sulphate) leaching to determine if any easily extractable REE zones are there as low-hanging fruit, before further processes and Stage 2 REE metallurgical testwork.

Asra, by the way, is also this morning boasting a current cash balance of ~$2.4 million plus an additional ~$1.23 million potential value still held in equity interests.

Asra’s Managing Director Rob Longley said:

“We are pleased the metallurgical test work for yttria is well underway which coincides with our push on the ground at Yttria, Wishbone and at Kookynie West, to map out extensions of the REE and critical minerals footprint in the Leonora district.

“We have also capitalised on the opportunity to unlock value from our shareholding in Loyal Lithium (ASX:LLI) and firm up our cash position. Asra will also benefit from an additional ~$419,500 of loan repayments, scheduled to be completed at the end of November.”

ASR share price

PETRATHERM (ASX:PTR)

Another rare earths hunter, Petratherm is up 21% on the news that step-out drilling has returned thick intercepts of high-grade REE mineralisation over a large area at the Artemis prospect in South Australia.

The drill intercepts define a high-grade blanket of REEs >1000 ppm Total Rare Earth Oxide (TREO), ranging from 10 metres to 37 metres of vertical thickness.

More specifically, the $15m market-capped company is talking discoveries that include: 37m @ 1564 ppm TREO from 15m, Inc. 3m @ 2439 ppm TREO from 21m, Inc. 6m @ 2113 ppm TREO from 27m, Inc. 6m @ 2500 ppm TREO from 36m.

The company is also reporting high-value magnet rare earth oxide (MREO) intercepts up to 521 ppm with the average MREO grade from significant drill intercepts being 225 ppm.

The Artemis prospect covers a roughly 3 km by 1.5 km area and remains open in several directions, with less than 10% of it explored.

Step-out #drilling returned thick intercepts of high-grade #REE mineralisation over a large area at Petratherm’s Artemis Prospect in SA. Intercepts include:

• 23ACCR426: 37m @ 1564 ppm TREO from 15m

• 23ACCR428: 15m @ 1046 ppm TREO from 6mhttps://t.co/UBgosNUTdU pic.twitter.com/wiOP3qIqMu

— Petratherm Limited (@petrathermltd) September 4, 2023

PTR share price

COSMOS EXPLORATION (ASX:C1X)

Lithium hunter Cosmos is also on the rise, by about 15% at time of keyboard tapping, after it found a spodumene-bearing pegmatite outcrop at the new Polaris prospect in the Corvette Far East lithium project in Quebec, Canada.

That’s in, yep, you guessed it, the region’s lithium hot spot James Bay, and zooming in, the C1X’s latest find covers an outcropping area of 40m by 20m in the south-southwest of the prospect, where the outcrop extends under low-lying cover.

Notably, the Polaris pegmatite “intrudes amphibolite host rocks within greenstone situated 20km along strike” from where a booming stock in this sector, Patriot Battery Metals, hosts the renowned CV5 lithium discovery – one of the biggest pegmatite mineral resource sites in America and the world.

Oh yeah, Cosmos also notes its find is surrounded by Rio Tinto Exploration Canada’s joint venture with Midland Exploration.

Cosmos Technical Director, Leo Horn, said:

“The discovery of spodumene at Polaris is an exciting development and this target area is stacking up to be the company’s highest priority drill target to date.

“The breakthrough strongly supports our geological idea and modelling that the Corvette Far East lithium project is highly prospective for lithium deposits along strike from Patriot’s world-class CV5 discovery.”

C1X share price

MONT ROYAL RESOURCES (ASX:MRZ)

This Canadian, Michael-O’Keefe-backed (a 7.5% shareholding) lithium-base metals explorer is also up impressively at the time of writing.

And that’s after it officially noted exploration success across two distinct areas at its Bohier and Léran projects – also in Canada’s James Bay lithium hotspot.

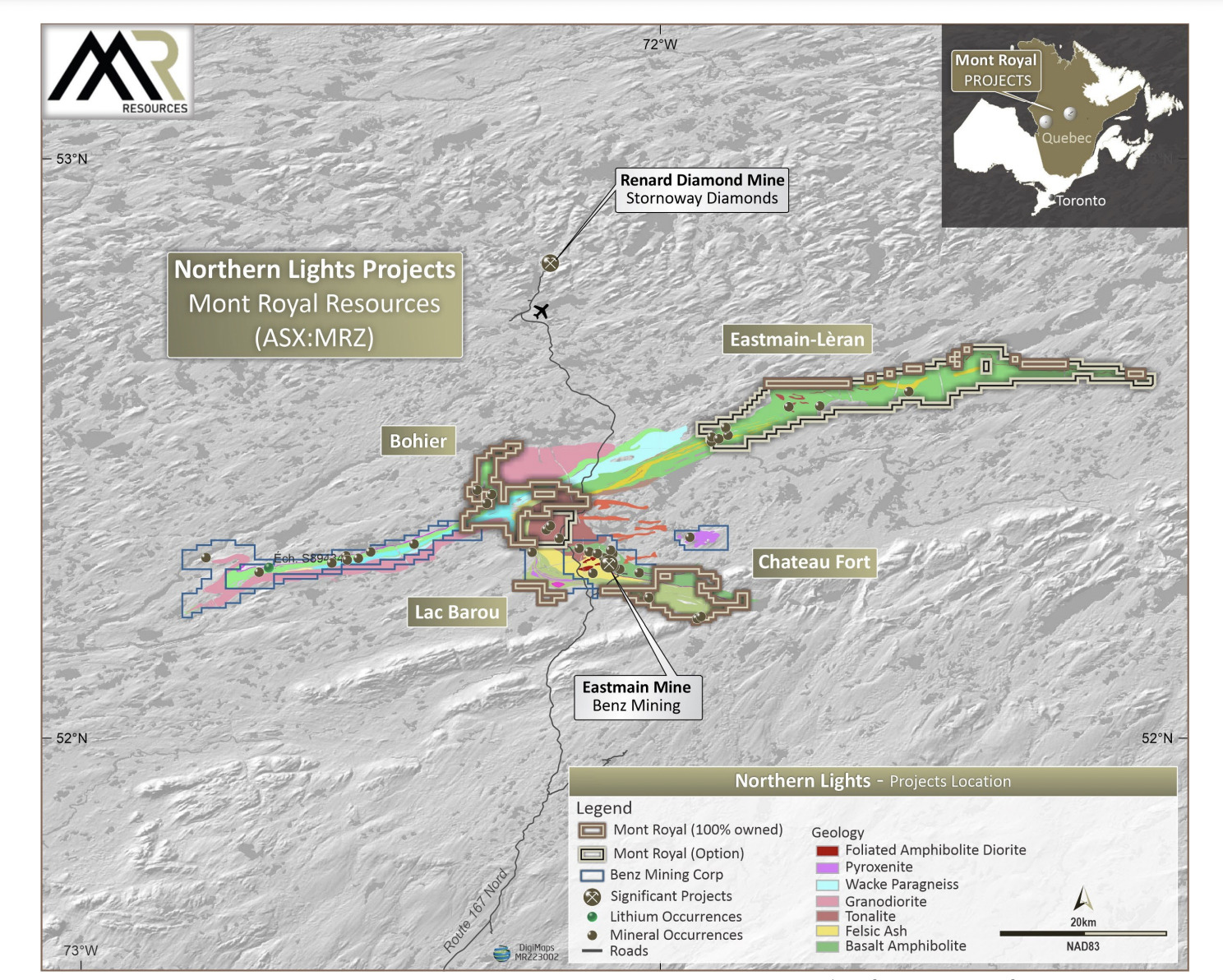

These two prospects are part of a larger encompassing tenure and operation the company has dubbed the Northern Lights Projects (see below).

The Bohier site’s outcropping spodumene-bearing pegmatites have been identified in the south-west of the property with two outcrops (30m2 and 45m2 ) 16m apart in a 500m-wide greenstone unit that extends for 15km.

$MRZ is pleased to announce highly prospective early-stage discoveries at the Bohier and the Eastmain Leran projects, with lab samples from both areas submitted to Actlabs for immediate chemical assay analysis & results expected in within the next 4 weekshttps://t.co/cefjaIpOFd pic.twitter.com/xy65LDbz4d

— Mont Royal Resources (ASX:MRZ) (@MontRoyalRes) September 4, 2023

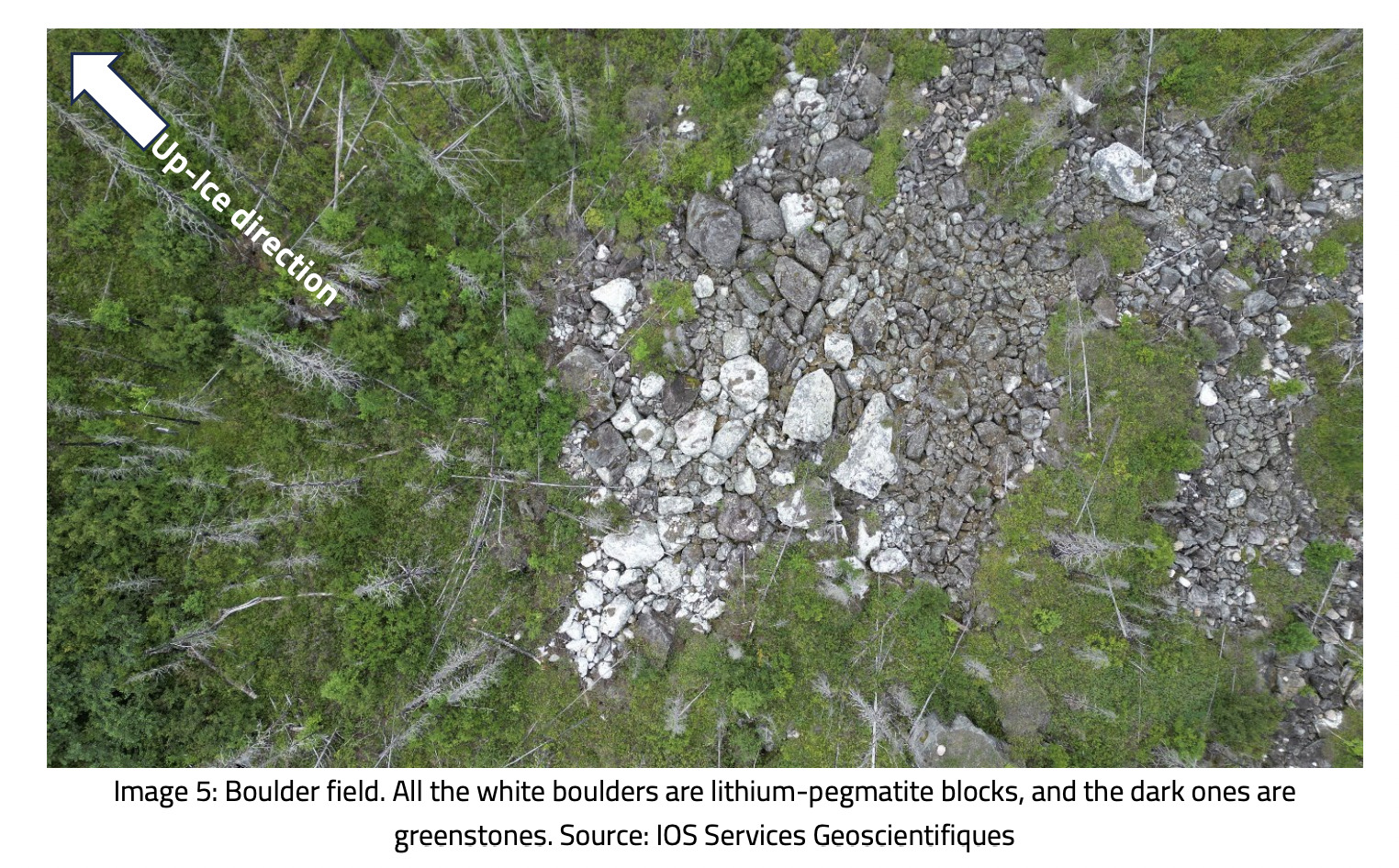

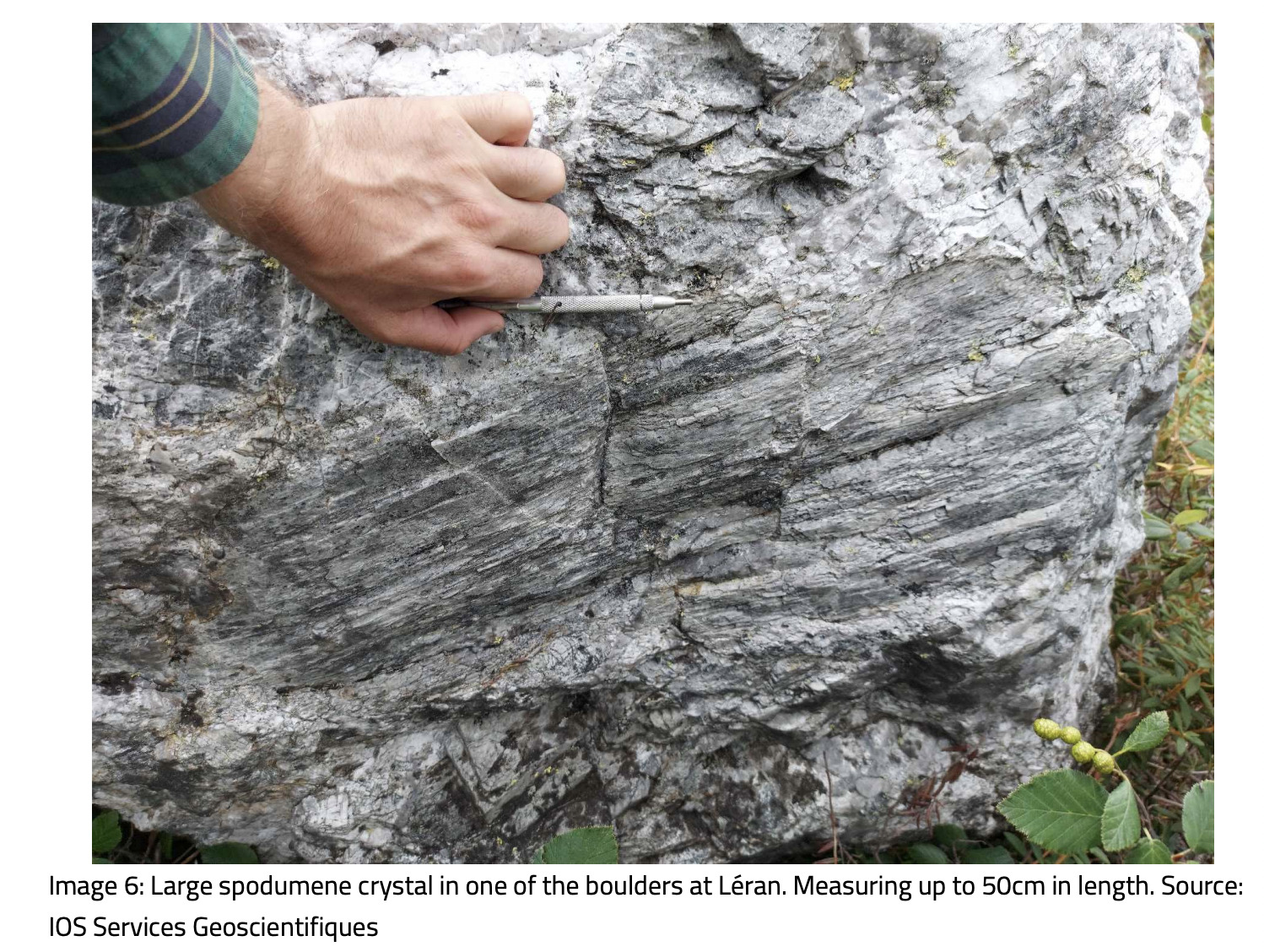

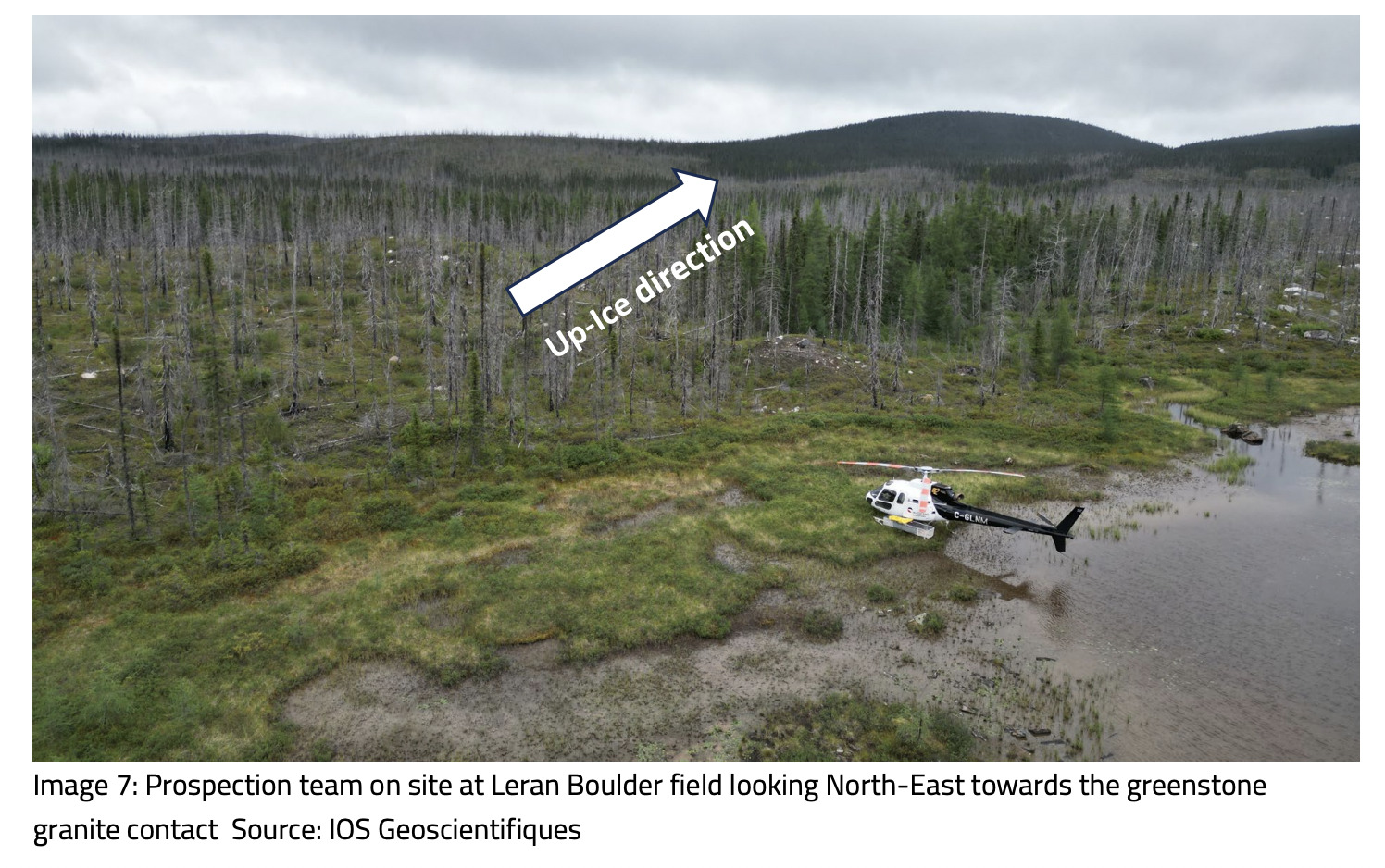

The Eastmain Léran project meanwhile has revealed a significant pegmatite boulder field “up-ice” of a known Li-pegmatite boulder found back in 2016. The boulder field is about 400m2 and contains lithium pegmatite boulders up to 4m-wide.

Here’s some bouldering porn for you, if that gets your rocks off…

And because we also like choppers, here’s another shot of one for good measure…

MRZ share price

At Stockhead we tell it like it is. While Asra Minerals is a Stockhead advertiser at the time of writing, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.