Resources Top 5: Antipa’s Citadel stake hoovered by Rio as Newmont leaves vacuum at Paterson

Pic: Getty Images.

- Paterson Province a flurry of M&A as Antipa banks $17m on sale of Citadel interest to Rio Tinto

- Labyrinth, which has made a 340% gain in the last three months, finds 7.8g/t gold intersections in Comet Vale project database

- Tesoro has valuation and work claims by minority shareholder Wanaco dismissed by a Chilean court, continues spinning the drillbit at El Zorro

Here are the biggest small cap resources winners in morning trade, Friday, September 13. Prices accurate at time of writing.

Antipa Minerals (ASX:AZY)

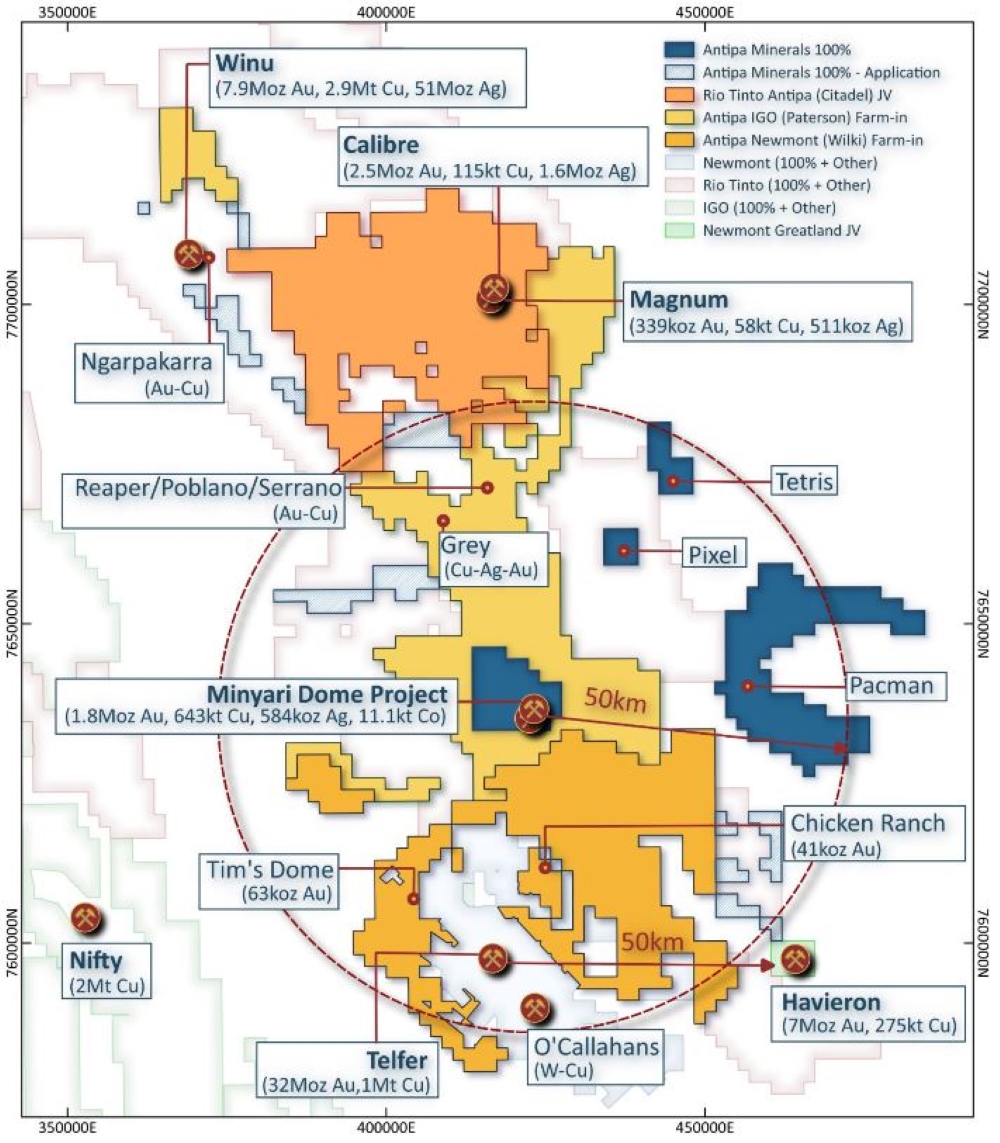

M&A Activity is heating up in WA as AZY today agreed to sell its 32% non-controlling interest in the 2.84Moz Citadel gold project JV in the Paterson Province to Rio Tinto (ASX:RIO) for $17m, cashing up the junior to accelerate exploration at its nearby Minyari Dome gold project.

Recent exploration by the junior across Citadel’s Calibre deposit increased tested shallow resource extensions and together with the nearby Magnum deposit, showed very large-scale exploration upside with just 70-80m of predominantly free-digging, post-mineralisation cover.

The results, posted late August, were seemingly impressive enough for Rio to consolidate its 68% share.

The cash injection will allow the junior to realise a range of exploration plans for Minyari Dome against a backdrop of moves and shakes in the Paterson region.

Rio has spent more than $47m over the years on exploration at Citadel to earn its current 68% interest and the transaction to full ownership is expected to be completed by November.

The Citadel buyout comes on the back of Greatland Gold’s $475m purchase of the historic Telfer gold mine and remaining 70% stake in nearby Havieron from Newmont (ASX:NEM) earlier this week.

AZY CEO Roger Mason says the sale will provide solid financial support to accelerate development at Minyari Dome, with updates to resource estimates and a revised scoping study already underway.

“Rio was the natural buyer for Citadel, and the $17m all-cash consideration fully reflects current value of our interest in the asset, positioning us to focus on unlocking the full potential at Minyari Dome,” Mason says.

AZY is up 14.3% today for a monthly gain of 57% to currently trade at 1.6c.

Labyrinth Resources (ASX:LRL)

A review of exploration databases of LRL’s recently acquired Vivien and Comet Vale gold projects in WA’s Goldfields has shown significant exploration upside at the underexplored deposits.

The junior is looking to grow Comet Vale’s 96,000oz at 4.8g/t resource and is delineating targets from historical drilling that show up a best hit of 18m at 7.8g/t gold at the newly-named Cheer prospect.

LRL has also been reviewing the Vivien database in the lead up to the company’s EGM and completion of the acquisition of the project’s owner Distilled Analytics.

Vivien Main remains underexplored despite years of production from Ramelius Resources (ASX:RMS) with substantial intersections presenting vast opportunities to target footwall and hanging wall mineralisation which has a highlight 5.4m at 12.6g/t gold intercept from 120.6m.

LRL CEO Jennifer Neild says the projects continue to impress with high-grade intercepts sitting virtually untouched near the surface.

“Opportunities like Vivien and Comet Vale are part of a growing number of projects that have had mining activities but almost no focused exploration activity,” Neild says.

LRL shares rocketed 21% on the news to trade at 2.3c a share.

Tesoro Gold (ASX:TSO)

Drilling continues at TSO’s Ternera prospect at El Zorro as it puts to bed a dispute over a cap raise and claims of work abandonment by minor shareholder Wanaco.

A Chilean court rejected attempts by Wanaco to have mining concessions transferred to it as compensation over the allegations and has ordered Wanaco to pay for legal costs.

Diamond drilling is ongoing at the high-priority targets within 1.5 km of the existing Ternera deposit, with rigs currently operating at Ternera East and Ternera.

Assay results from 10 completed holes remain outstanding and are expected back by the end of this month.

Shares in the South American gold hunter are up >15% on the news, swapping for 3c.

Mako Gold (ASX:MKG)

Rock chips sampled at the Komboro prospect, part of MKG’s flagship Napié project in Côte d’Ivoire, have returned hits of up to an eye-whopping 170g/t gold, while identifying new high-grade gold zones for potential resource growth.

Other very high-grade results including 41.92g/t, 6.27g/t, 4.63g/t, and 3.48g/t gold as part of the junior’s plans to grow Napié’s already impressive 868,000oz resource.

The samples reinforce gold mineralisation from previous shallow drilling at Komboro which returned high-grade gold intercepts of:

- 9m at 3.26g/t Au from 67m including 3m at 7.29g/t Au from 67m and 1m at 47g/t Au from 86m

- 1m at 8.45g/t Au from 74m; and

- 5m at 1.64g/t Au from 56m.

Further mapping and rock chip sampling across the Komboro prospect continues in preparation for a future drilling campaign.

Shares are up 11.1% on the news, trading for an Aussie penny.

Mithril Silver and Gold (ASX:MTH)

An investor presentation outlining MTH’s plan for Copalquin gold and silver project in Mexico (which supplies 25% of the world’s silver) has stirred the share price today.

It’s already shown a maiden resource of 2.41Mt at 4.8g/t gold, 141g/t silver for 373,000oz gold plus 10.9Moz silver (total 529,000 oz gold equivalent), demonstrating the project’s high-grade gold and silver resource potential and is drilling in and around the resource as part of its aim to double it by Q1 2025.

Assays have been received for six holes, a further three have been sent to the laboratory, two completed for logging and six more holes to be drilled in this initial 4000m program.

Shares are up almost 19% to trade at 12.5c at time of writing.

At Stockhead we tell it like it is. While Antipa Minerals, Mithril Silver and Gold and Mako Gold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.