Resources Top 5: Antimony drilling and lithium conversion breakthrough send ASX small caps crazy

Pic: Getty Images.

- Larvotto shoots on RC drilling to expand Clarks Gully antimony deposit

- MTM makes game-changing lithium conversion breakthrough

- Dundas shoots 145% on gold hit

Here are the biggest small cap resources winners in morning trade, Wednesday, August 21. Prices accurate at time of writing.

Larvotto Resources (ASX:LRV)

LRV has been on a tear since last week on the back of China deciding to restrict exports of highly sought-after antimony – of which it currently dominates production.

A 5250m RC drilling program is about to kick off at the Clarks Gully deposit at the explorer’s Hillgrove gold-antimony project in NSW to increase confidence in the current 266,000t antimony (Sb) and 2g/t gold (10.6g/t AuEq) resource.

READ MORE: Larvotto flies on antimony as China bans yet another critical mineral

LRV MD Ron Heeks, a 35-year veteran of the mining game, says the export restrictions came as a bit of a surprise.

“We’d been hearing it was all but in place anyway, but for them [Chinese government] to come out so strongly it’s had a significant effect on those of us with large amounts of antimony credits at our projects.”

LRV is progressing with the expansion of its Hillgrove gold and antimony resource, with studies currently pegging a development capex of $72m and an NPV8 of $157m.

Yet at spot prices of both Au and Sb, the NPV8 would sit at a jaw-dropping $383m and an IRR of 114%.

Shares in the junior are up 17% today and a whopping 130% since this time last week, swapping for 31c.

Dundas Minerals (ASX:DUN)

A highlight 1m at 9.5g/t gold assay has returned from drilling at DUS’ Windanya gold project, intercepted almost 150m below surface and has spurred the explorer to drill deeper.

DUS has an option to acquire 85% of two gold projects – the 24,000oz Windanya and 23,000oz Baden Powell deposits (yep, named after the founder of the Scouts movement) from Horizon Minerals (ASX:HRZ).

Two deep drill holes down to 300m will test for primary gold mineralisation west of 24WDRC015 in the northern portion of the Aquarius prospect and are scheduled to start spinning in September.

Shares have shot up a massive 145% on the news to trade at 5.9c per share at time of writing.

MTM Critical Metals (ASX:MTM)

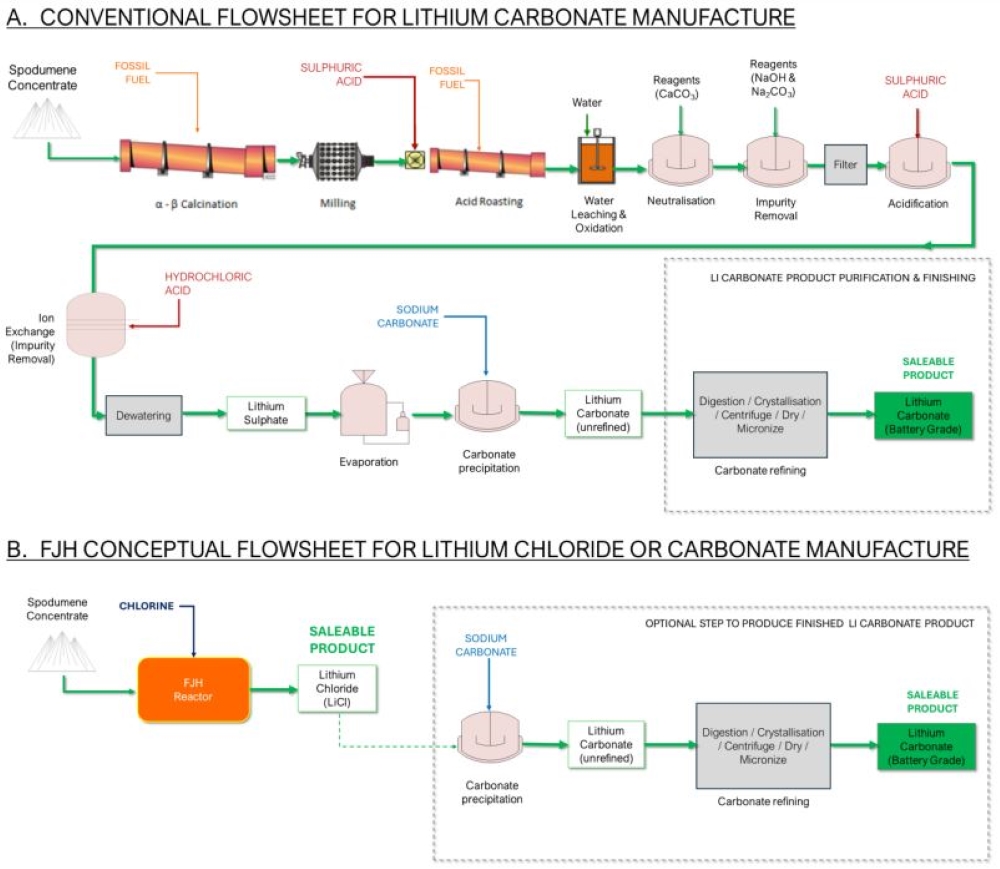

A flash joule heating (FJH) tech breakthrough by MTM has converted 6% spodumene concentrate directly into lithium chloride in a single, acid-free unit operation.

What does that mean? Well, it has the potential to revolutionise lithium refining by radically simplifying the processing of spodumene – the primary source of lithium batteries.

Substantial reductions in opex, capex and emissions would be realised, MTM says, through the elimination of many stages of conventional processing.

MTM CEO Michael Walshe says preliminary results are highly encouraging and is excited about the commercial opportunities.

“This breakthrough validates the disruptive potential of our FJH technology. The ability to convert spodumene – a highly refractory mineral – directly to lithium chloride in a single step, without the use of acids, is a game-changer for the industry,” Walshe says.

“By eliminating two major fossil fuel-dependent kiln processes and removing the need for significant acids and chemical reagents, we are fundamentally disrupting the status quo in lithium production.”

Shares have jumped 35% for the $13.5m market-capped junior to trade at 5c at time of writing.

Antilles Gold (ASX:AAU)

Infill drilling at AAU’s Cuban operation (that’s right, an ASX junior in Cuba) has revealed multiple 20m intercepts with 1.2-1.7% copper at its Nueva Sabana gold-copper deposit at the El Pilar gold project – a 50:50 JV with the Cuban government.

Best hits for shallow gold mineralisation showed 2m @ 25.26g/t gold from 38.5m, including 1m @ 45.39g/t; and 25m @ 1.76% copper from 52m, including 4m @ 5.56%.

Interestingly, its second gold project in Cuba – La Demajagua – has high concentrates of hot commodity antimony, and a preliminary feasibility study is due out in the September quarter this year.

Shares in the minnow jumped >28% today to trade at 0.5c.

Silver Mines (ASX:SVL)

SVL says despite the NSW courts upholding the appeal by Bingman Catchment Landcare against the company that challenged an administrative process against the impacts of a power line for its Bowdens project, it’s progressing a new development application.

Bowdens is a 396Moz silver equivalent deposit with exploration upside and SVL is proposing the development of an open cut mine feeding a new 2Mtpa plant that will produce 66Moz silver, 130,000t zinc and 95,000t of lead across a 16.5-year mine life.

SVL says from its initial Bowdens development application to the NSW government, it received no objections from any government agencies and received resounding public support, with 79% of all organisation and general public submissions in favour of development.

Bowdens is expected to create >320 direct jobs during construction and >220 ongoing jobs during operation.

Investors seem to be positive on the latest news, with shares jumping >10.5% in early trade to 9.4c after falling almost 50% on on August 19.

At Stockhead we tell it like it is. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.