Resources Top … 6: Andromeda’s Great White hunt, more Andover nearology and Pantera gets (lithium) briny

Pic via Getty Images

- Andromeda Metals is up today on good news regarding its South Australian halloysite kaolin Great White Project.

- Pantera Minerals is making a strong move into the US lithium brine market.

- Raiden Resources is still surging based on yesterday’s pegmatites discovery news in the Pilbara.

- Errawarra is meanwhile up after an aerial recon op completes over its Andover West nickel project.

Here are the biggest small cap resources winners in early trade, Thursday August 24.

ANDROMEDA METALS (ASX:ADN)

Andromeda Metals, explorer for niche commodity halloysite kaolin, used in premium ceramic and tech industries, is up today on news of an updated Definitive Feasability Study for its Great White Project (GWP).

What’s that you ask? It’s a halloysite kaolin-hunting project (of course) located at Streaky Bay, near the community of Poochera on the Eyre Peninsula in South Australia.

Highlights of the study: the Great White Project Net Present Value (NPV) has increased by 65% to $1,010 million, and average annual earnings before interest tax depreciation and amortisation (EBITDA) increases by 59% to $130 million.

“The 2023 DFS represents the outcome of a rigorous commercial and business strategy review for commercialising our construction ready project, to meet rising market demand,” said Bob Katsiouleris, CEO and Managing Director of Andromeda.

“As we move to finalising debt funding, the 2023 DFS will underpin our funding strategy for the remaining capital required to move towards anticipated construction and into production.”

“Andromeda Metals aims to be the largest supplier of halloysite kaolin to the global premium ceramic and technology industries,” reads the company’s X/Twitter profile.

Ceramics? Think tiles and porcelain tableware. Okay, think toilets, too, which is where $90 million capped ADN is hoping to get its shares out of.

ADN share price

PANTERA MINERALS (ASX:PFE)

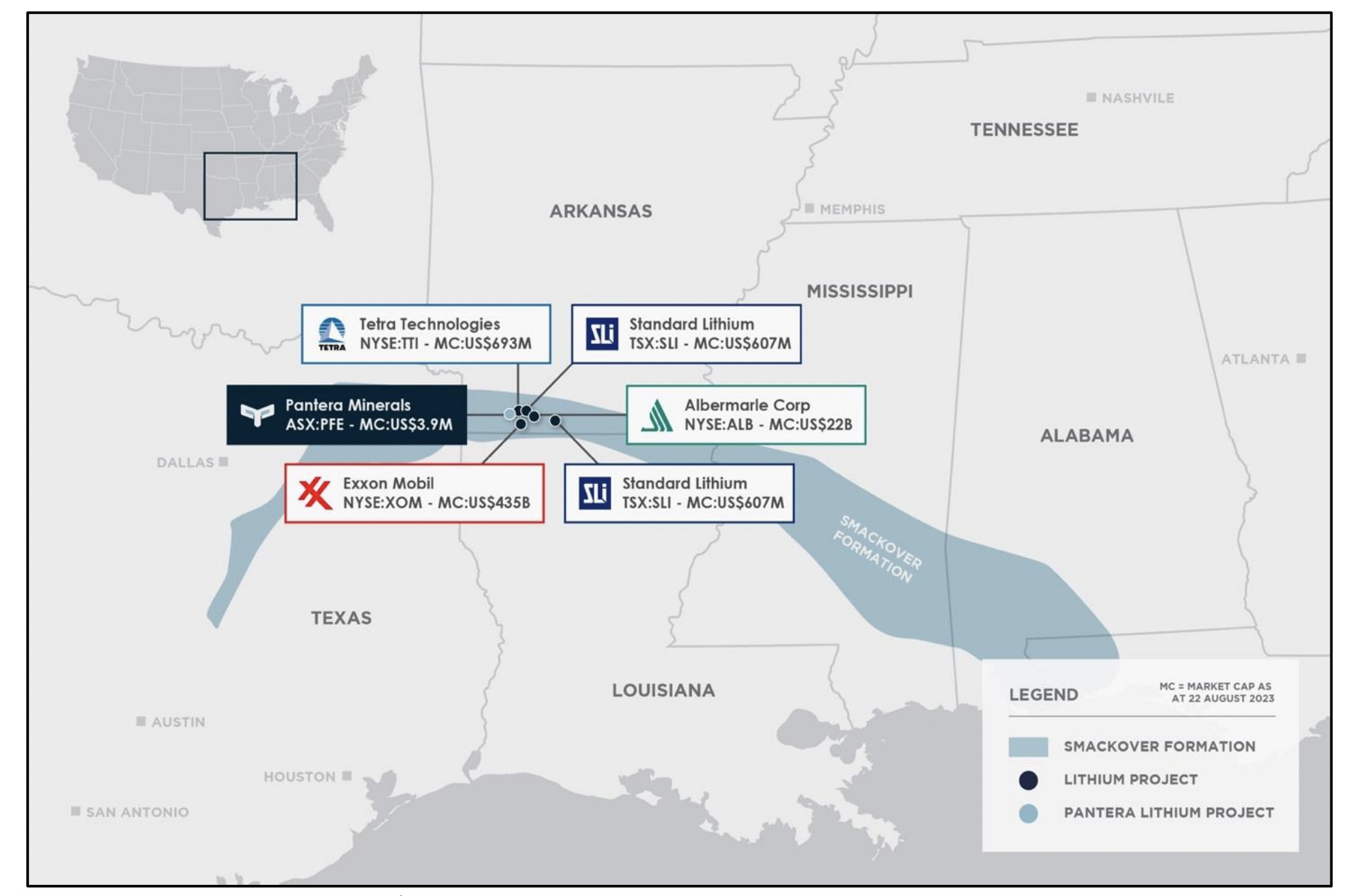

Pantera Minerals, a Perth-HQed $8.2m market-capper exploration company, has springboarded into the burgeoning American brine-sourced lithium market.

It’s landed itself smack, bang in the thick of the lithium-rich Arkansas “Smackover Formation”, USA, with an investment into Daytona Lithium Pty Ltd.

Specifically, Pantera has entered into a $2 million convertible note facility with Daytona for a 35% interest in the Superbird Project, a known high-grade lithium brine formation in the Smackover.

Daytona, despite its name, is a private Aussie company making inroads into the American market, managing US land acquisition programs and going hard on acreage, controlling some 5,325 privately leased acres abutting Exxon’s Arkansas lithium brine project.

$PFE has entered into the fast-emerging US #lithium #brine market, with a key investment in Daytona Lithium Pty Ltd.#ASX release ➡️ https://t.co/8XQcJqiMdr$PFE.ax #ASXNews #SmackoverFormation #Arkansas 🇺🇸 pic.twitter.com/62aj6ZriVI

— Pantera Minerals (@PanteraMinerals) August 24, 2023

Huge player Exxon is making a huge play for lithium in general. As are Standard Lithium (NYSE:SLI) and Albemarle Corporation (NYSE:ALB) in adjacent projects.

Stockhead‘s Cameron Drummond wrote the other day:

Rubber-stamping Smackover as a Tier 1 lithium brine district was ExxonMobil’s recent entrance into the region, marked by a +US$100m acquisition of 120,000 acres of private leases from lease-holder Galvanic Energy.

This, coupled with an agreement with Tetra Technologies to develop more than 6,100 lithium-rich acres in Arkansas, marks one of the first forays by an oil and gas major into the sector.

Exxon’s landholding is estimated to have 4Mt of LCE at an average of 325 parts per million (ppm) lithium – enough to power ~50 million EVs.

It also plans to build a 75,000-100,000mt production plant nearby, which at current levels equates to ~15% of the world’s lithium production.

“The Smackover Formation… is already home to a large-scale commercial bromine brine processing industry and 100 years of oil and gas operations, is now experiencing a land rush,” notes Pantera.

PFE share price

ERRAWARRA RESOURCES (ASX:ERW)

Errawarra and its Andover West nickel project is one of a handful of mining companies banking on the lithium “nearology” narrative based around Azure Minerals (ASX:AZS)’s recent “monster” lithium hit.

And that’s because ERW’s operation in WA’s Pilbara region is a near neighbour of Azure’s Andover project.

Today, the company has news regarding the completion of aerial reconnaissance of the Andover West project, as well as the collection of follow-up rock-chip samples.

“This work focused mainly on the cluster of samples which had been previously collected in the north-western area of the tenement and occurring within the projected prospective SW trend from Azure Minerals Ltd and Raiden Resources Ltd,” noted Errawarra.

Aerial reconnaissance was completed to assist in the identification of the pegmatite outcrop.

“Errawarra is strategically located within a highly prospective lithium pegmatite zone, the company notes, adding that it will “continue to methodically explore its 100km2 tenement for lithium bearing pegmatites”.

ERW share price

RAIDEN RESOURCES (ASX:RDN)

(Climbing on yesterday’s news)

Lithium hunter Raiden Resources can’t keep out of the news just lately, for good reasons.

Its share price is up another 37% today, adding to yesterday’s 58% bump.

On Wednesday the company announced it found swarms of outcropping and interpreted pegmatites of up to 30m width at surface at its Andover South project in the Pilbara, WA.

Big because the company’s Andover South project happens to be adjacent to one of the market’s larger current ‘it’ lithium stocks, Azure Minerals (ASX:AZS), which has been enjoying a monster hit or two of late.

@LtdRaiden (#ASX: $RDN) is pleased to announce that the current #mapping and rock #sampling program across the Andover South Project areas, has defined significant outcropping #pegmatites up to 30 metres in width.

Read the full release here: https://t.co/0hU6F2clUn pic.twitter.com/3cn0JCowWc

— Raiden Resources Ltd (@LtdRaiden) August 23, 2023

Raiden has completed its latest fact-finding mission, confirming the go-ahead to acquire an 80% interest in five more lithium tenements – nearby the privately held Welcome Exploration project and adjoining Azure’s Pilbara lithium discovery.

For more details, have a read of our latest special report on Raiden.

RDN share price

ANAX METALS (ASX:ANX)

(Climbing on yesterday’s news)

ANX has made an “update” to yesterday’s announcement that the company (Anax Metals) has discovered extensive pegmatites at its Whim Maar and Loudens Patch prospects – located in the Pilbara in WA.

Looking at the update next to yesterday’s announcement, however, is like playing a really, really difficult version of Sesame Street’s “One of these is not like the other” segment. Let us know if you can figure it out.

In any case, the context is still this:

Anax’s Whim Maar lithium operation is an 80-20 joint venture with Develop Global (ASX:DVP), with ANX owning and operating 80% of the pie.

Loudens Patch, meanwhile, is 100% Anax owned and adjacent to the east of the Whim Creek Pit – see below. The Whim Creek operation is the company’s flagship copper-zinc project.

@anax_metals ASX Announcement 📣

EXTENSIVE #PEGMATITES AT WHIM MAAR AND LOUDENS PATCH TO BE ASSESSED FOR #LITHIUM FERTILITY

See highlights 🎥 👇

Full ASX Announcement : https://t.co/Aqn7th79Xa$ANX #ASX #Pilbara #exploration pic.twitter.com/tjfHInu3I0

— Anax Metals (@anax_metals) August 22, 2023

Geoff Laing, Managing Director of Anax, said the following:

“Pegmatite swarms at Whim Maar and Loudens Patch are far more extensive than were initially identified by historical mapping or recent reconnaissance sampling.

“Anax’s mapping and sampling programme has defined new pegmatite swarms, which have been sampled for geochemical and mineralogical analysis.

“This work provides further encouragement of potential lithium fertility based on field observations. “

Soil sampling work continues, which will define the extent of lithium geochemical anomalies and may help to identify pegmatites obscured beneath recent alluvial cover.”

ANX share price

METAL BANK (ASX:MBK)

(Up on no fresh daily news)

Diversified minerals hunter Metal Bank has various exploration projects throughout Australia but right now, it’s going hard for copper in Jordan in the Middle East.

The company revently revealed its field team has begun initial reconnaissance exploration activities underway across the Malaqa and Wadi Araba project areas.

It also noted it has a “first-mover advantage in this historically prolific copper mining region” and has planned a busy exploration pipeline over the coming months.

“We have moved quickly to get our feet on the ground in Jordan and we are very excited to have this initial phase of exploration work underway.” – $MBK Executive Chair Ines Scotland

📷Wadi Feinan Region Geology Map$MBK.ax #copper #ASX pic.twitter.com/CWubYU7OFc

— Metal Bank Limited (ASX:MBK) (@MBKMinerals) August 15, 2023

Commenting on the start of exploration activities in Jordan, Executive Chair Ines Scotland said: “We have moved quickly to get our feet on the ground in Jordan and we are very excited to have this initial phase of exploration work underway.

“The area we are working on is well known for historic copper mining and more recent work in the 1960s and 1970s. We believe that with modern exploration the region has the potential to host economic copper projects.”

Recently our ‘Garimpeiro’ (independent minerals prospector) columnist Barry FitzGerald wrote about Metal Bank’s Jordan movements in depth, which you can read here after quickly scrolling down from his unnervingly steely gaze into your soul.

A teaser to that article…

“It is coming up to two years since Garimpeiro mentioned that Inés Scotland was planning a Middle East adventure for her small market cap Metal Bank (ASX:MBK) and that on the basis of her past success in Saudi Arabia, it was one to put on the watchlist,” wrote Barry.

“The focus this time is on the historic copper riches in neighbouring Jordan which once upon a time was the major source of the red metal for the Roman Empire. But in the modern era precious little copper exploration has taken place.

“Scotland is out to change that after securing exclusive rights to explore for copper in the historical copper areas from Jordan’s Ministry for Energy and Mineral Resources. It is coup for the ASX-listed junior as prime copper exploration ground is increasingly tough to come by.”

We encourage you to read the rest.

MBK share price

At Stockhead we tell it like it is. While Raiden Resources and Pantera Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.