Resources Top 5: Andromeda a star on ultra-high purity HPA breakthrough

Andromeda is a star ASX performer after achieving a high purity alumina testwork breakthrough. Pic: Getty Images

- A testwork breakthrough by Andromeda Metals has resulted in the production of 4N HPA

- RareX is extending a search for critical mineral gallium at the Khaleesi rare earth project

- Taruga Minerals has exercised an option to acquire the Thowagee tenement in WA

Your standout small cap resources stocks for Thursday, May 1, 2025

Andromeda Metals (ASX:ADN)

A star performer on the ASX has been Andromeda Metals after pulling off a testwork breakthrough by producing ultra-high purity 4N high purity alumina (HPA) of 99.9985% using its own low-cost process and kaolin from the Great White Project in South Australia.

ADN hit a new 12-month high of 2.8c, double the previous closing price on volume of more than 265m. The daily high for the $48m company was four times the closing price of 0.7c on April 10.

Analysis of the produced HPA confirmed it has a purity of 99.9985%, well above the 99.99% purity required to be considered 4N HPA for use in lithium-ion batteries as a battery separator as well as the production of synthetic sapphire glass and LEDs.

Results from the laboratory-scale testwork have been confirmed by top labs in the US and CSIRO and have validated the company’s novel process flow sheet developed over seven years of investigation, research and metallurgical testing.

What sets them apart is the process – no high-pressure acid, no extreme heat and no expensive aluminium metal.

What’s more, it’s cleaner, cheaper and slashes carbon emissions by more than two-thirds, according to ADN.

The ability to produce 4N HPA from kaolin is expected to provide significant cost advantages over the current dominant method of producing the critical mineral through synthesizing aluminium alkoxide from high-cost aluminium metal.

The cost advantage also comes as demand for HPA is expected to outstrip global supply by 45% by 2028.

“Whilst Andromeda’s primary focus remains the development of the Great White Project, the production of HPA is a high-value and complementary opportunity,” acting chief executive officer Sarah Clarke said.

“This latest test work validates our novel flowsheet, showing our Great White CRM product from the Great White Project can be used to produce HPA at an impressive 99.9985% purity.”

She said this demonstrated the potential to expand the company’s product portfolio in the future to include a value-added critical mineral while underpinning its confidence in progressing HPA production to the next stage of development.

“The premise of producing HPA – a high-value, in-demand product – at lower cost and reduced carbon intensity compared to established processes should be highly attractive to any manufacturers using HPA in their products,” Clarke added.

The Great White Project is backed by 15.1Mt in high-grade ore reserves, enough to fuel a 28-year mine life.

A 2023 bankable feasibility study estimated capex at $194m for a three-stage development that could supply up to 330,000 wet metric tonnes of product per annum, generating an NPV and IRR of $763m and 43% respectively.

Andromeda Metals (ASX:ADN) is now heading into a scoping study and will start working with customers to fine-tune the product for everything from semiconductors to batteries. It will also investigate government funding opportunities.

After seven years of R&D, this could put it in the box seat as global HPA (high purity alumina) demand heats up, it said.

RareX (ASX:REE)

RareX has been heading north since revealing high-grade gallium in historical drill core from its Cummins Range project in WA’s Kimberley and then pointing out that another critical mineral scandium is also present.

Shares have reached 3c, a lift of 15.4% on the previous close and have risen from 0.8c at the close on March 24.

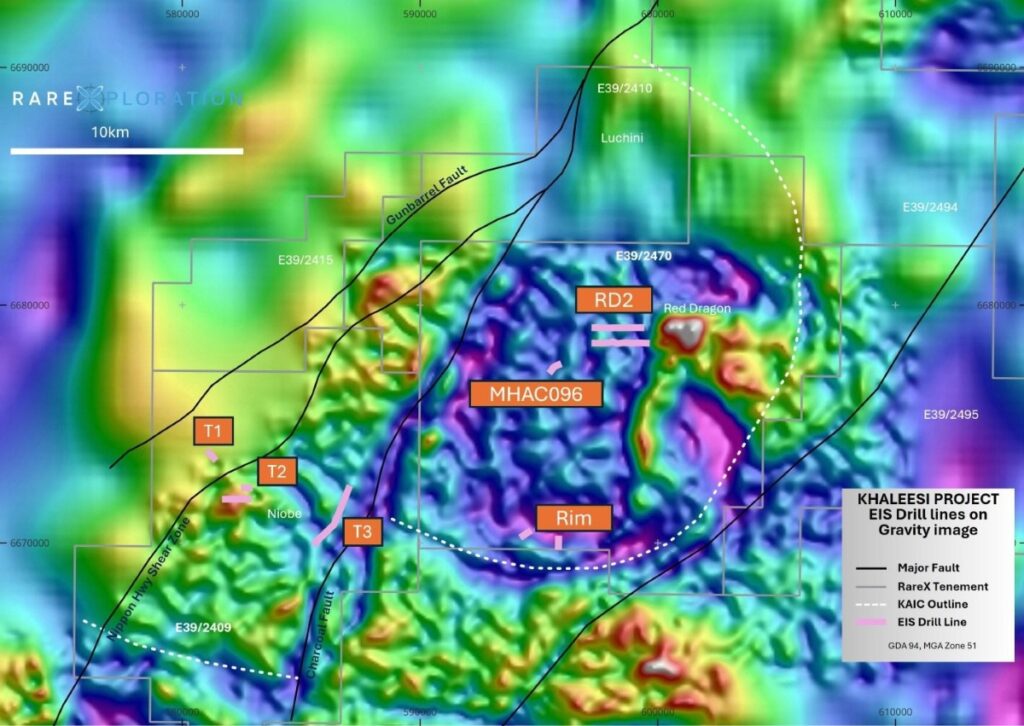

The latest fillip comes after REE extended its search for gallium at the Khaleesi rare earths project in WA’s Albany-Fraser Belt, supported by the award of a grant in Round 31 of WA’s Exploration Incentive Scheme co-funded drilling program to cover up to 50% of drill costs.

REE already identified extensive gallium mineralisation at the project, including aircore intersections up to 86g/t gallium and rock chips up to 81g/t, and now plans to RC drill test multiple targets.

The EIS program entitles the company to receive up to 50% of direct drilling costs, capped at $160,000, and up to 50% of mobilisation costs, capped at $15,000, for a total refund of up to $175,000.

REE plans to complete between 300m and 1300m of RC drilling at the project, with an average hole depth of 100m, across six targets.

“This support from the Western Australian government is a strong endorsement of the project’s prospectivity and the quality of our technical approach,” REE MD James Durrant said.

“The grant will allow us to accelerate exploration across multiple high-priority targets, including the highly prospective Niobe prospect, where the exploration team has identified a potential very large gallium mineralised system.

“Niobe has the potential for many tonnes of contained metal within the extensive moderately mineralised regolith and basement granitic rocks over 5km x 3km.

“With this funding, we are well positioned to unlock the district-scale potential of the Khaleesi Alkaline Intrusion Complex and advance our strategy to deliver critical minerals for the future.”

Gallium is a key mineral with demand growing due to Chinese export restrictions and its vital use in semiconductors, robotics, LEDs and a range of defence applications.

And being on the Aussie critical minerals list, it’s a no-brainer that exploring the gallium potential at Khaleesi has attracted EIS funding from the WA government.

Taruga Minerals (ASX:TAR)

Strengthening its WA footprint, Taruga Minerals has exercised an option to acquire 100% of the Thowagee tenement in the northern Gascoyne of WA and is trading 11.11% higher at 1c.

Thowagee complements its existing application portfolio, now spanning 416.5km2 of contiguous ground and a dominant landholding with lead, zinc, copper, silver and gold potential.

It includes two historical mining sites – Thowagee Mine and Thowagee Bore – with high-grade polymetallic mineralisation occurring in outcropping veins and gossans.

TAR’s initial reconnaissance and rock chip sampling has proven positive, confirming the general mineralisation trends and high-grade polymetallic nature of mineralisation in the area.

Results including heavy mineralised altered country rock samples next to the historical quartz vein focus notably showed potential hefty scale to add to the mineralised system.

TAR intends to revive the mine, which has gone underexplored since 1956, when 15.2t of lead and 5878g of silver were extracted in a concentrate produced on site, along with hints of gold, copper and zinc.

Field exploration at the project kicked off this month, with work focusing on exploiting the potential riches below high-grade base and precious metals mineralisation in outcrops.

Constellation Resources (ASX:CR1)

After releasing a quarterly report and launching a non-renounceable entitlement offer to raise up to $2.36 million before costs, Constellation Resources has been 7.7% higher to 14c.

Under the entitlement offer, eligible shareholders are entitled to purchase one new fully paid ordinary share for every four fully paid ordinary shares held at the record date, at 15c per share.

The offer opened on April 28, 2025, and is scheduled to close at 5.00pm (AWST) on May 19, 2025.

In addition to their entitlement, eligible shareholders with a registered address in Australia, New Zealand, Germany or the United Kingdom may apply for additional new shares.

In its quarterly, CR1 outlined progress on projects in Western Australia while it continues to evaluate new opportunities in the resources sector.

The flagship Ularring copper-gold project is in a region that host several major deposits that are intrusion related, such as the Boddington copper-gold mine and Caravel Minerals’ Caravel copper-molybdenum-silver-gold project

A dipole-dipole induced polarisation (DDIP) survey defined a high-quality chargeable anomaly which with its relative location to previous drill intersections and relationship within a circular magnetic low, presents as a high-grade intrusion related copper-gold target.

Modelled chargeability responses are significantly higher in magnitude when compared to the responses modelled over historic sulphide-copper gold drill intersections located up dip.

This may represent increased sulphide development and higher grade Cu-Au mineralisation.

A two-hole diamond drilling program is underway initially testing the northern end of the anomaly where the highest and shallowest modelled chargeability peak responses were identified.

At CR1’s natural hydrogen projects a staged, regional soil gas program is expected to start this quarter at Edmund-Collier once all approvals are obtained.

Sampling will be optimised from the outcomes from the CSIRO Kick-Start Program Research Agreement.

A second technical services agreement with the CSIRO has commenced to assist in progressing thermal maturity assessments and fluid inclusion analysis. Results from the study will determine if the shale units have generated hydrogen and if true, could indicate a major basin-wide kitchen, one of the key elements needed to help establish a viable hydrogen system.

NewPeak Metals (ASX:NPM)

(Up on no news)

A quarterly report for NewPeak Metals issued last month outlined progress at vanadium and gold projects in Australia, Argentina and Canada as well as a rejuvenated executive team.

Although there has been no news, shares have been 33% higher to 1.2c.

During the quarter, NPM appointed Mark Purcell as its CEO to lead the execution of an updated strategy.

Former CEO David Mason is undertaking a 3-month transition period as executive director to ensure a smooth and successful transition.

Following this he will remain on the board as a non-executive director, while Purcell will be appointed managing director.

NewPeak has since engaged Alistair Grahame, an exploration geologist with 27 years’ experience including 12 years based in Argentina.

As project manager for Exeter Resources’ Cerro Moro project he refreshed the exploration strategy through integration of databases, re-interpretation and new mapping and geochemical studies.

The drill program he designed and managed discovered the high-grade mineralisation that subsequently led to the development of the Cerro Moro mine.

Grahame was also involved in redefining exploration strategies for Woolgar (Queensland) and Caspiche (Chile).

In February 2025, NewPeak executed a share purchase agreement with AusVan Battery Metals Pty Ltd to purchase that company for $5 million worth of NewPeak shares.

AusVan holds six granted exploration permits and one exploration permit application covering the Allaru vanadium project in northwest Queensland, which has an inferred JORC resource of 710 million tonnes of vanadium mineral resource.

NewPeak will initially focus on expanding the shallow, oxidised Allaru North project which has a typical depth of 12 m and vanadium grade ranging from 0.19 to 0.68 V2O5, averaging 0.45 V2O5.

In conjunction with the transaction, NewPeak plans to undertake a rights issue to raise $2m to $3m at 1.65c per share.

The company also holds interests in gold projects in Argentina, the Treuer Range uranium-vanadium project in Australia’s Northern Territory and the George River uranium, REE and scandium project in Canada.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions. While Andromeda Metals, RareX and Taruga Minerals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.