IGO is on the hunt for the new Nova. Which Fraser Range explorer holds the next nickel elephant?

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Sirius Resources was just months from bleeding its cash reserves dry in July 2012 when it made the fateful Nova nickel and copper discovery.

Three years later the company was sold to IGO (ASX: IGO) for $1.8 billion, earning shareholders the equivalent of $225 for every $1 they held at the time of the discovery.

Located in a remote and largely unexplored district hundreds of kilometres east of Kalgoorlie-Boulder, the find drew a parade of junior explorers to the region in the hunt for a company maker.

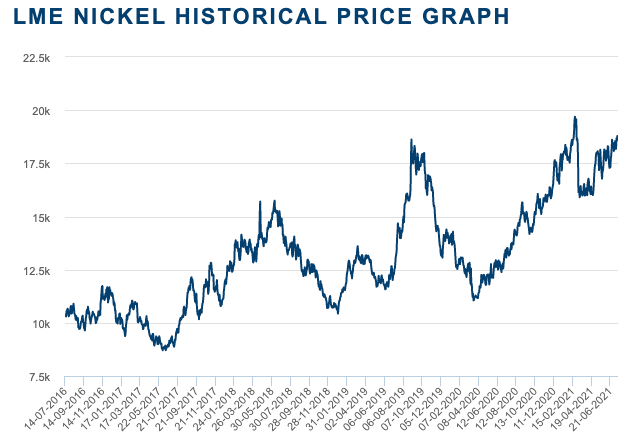

What they found in the years after was roughly zilch, nil and nada, as the mining downturn and weakness in the nickel price thinned out the field seeking the “next Nova”. By the time nickel hit its ebb in 2016 some had so little in the bank they could barely afford their listing fees.

Fast forward to 2021 and IGO is so desperate to find another major nickel-copper orebody on the Fraser Range it is pumping around $40 million a year into exploration in the region – much of it on ground held by juniors.

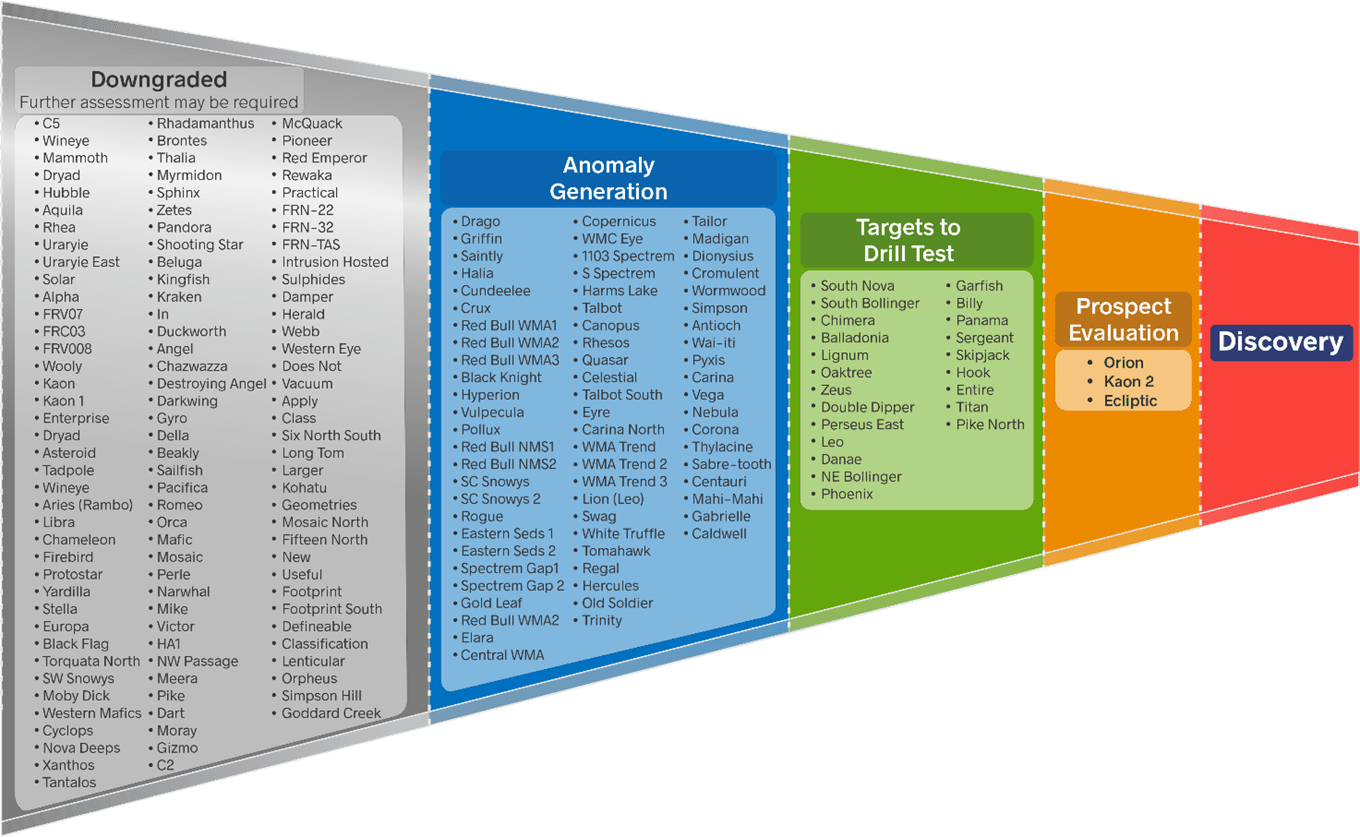

Want to see just how extensive its search is? Check out this barely readable table of every target IGO is looking at outside the Nova mine.

This week brought a jolt of excitement for starry-eyed small-cap investors as two interesting developments briefly electrified the market.

Firstly, Matsa Resources (ASX: MAT) announced IGO had hit 410m of blebby and semi-massive sulphide mineralisation at its Symons Hill prospect 6km south of Nova, on ground the junior gold miner has held since before Sirius drilled the Nova discovery hole.

Then Boadicea Resources (ASX: BOA) said IGO had drilled an 809m long diamond hole homing in on its Orion target on Boadicea’s ground.

Results are pending, with positive indicators for nickel mineralisation suggesting more drilling will follow.

Matsa and Boadicea share price today:

What is Nova and why is another one so hard to find?

Nova-Bollinger, which produces around 30,000t of nickel, 12,000t of copper and 900t of cobalt a year, is not like other Australian nickel deposits.

In fact, geologists say it bears more similarities to large Canadian nickel sulphide systems like Voisey’s Bay.

Komatite hosted deposits like those found in Kambalda are lower tonnage and higher grade, and tend to have clear pathfinders at surface.

The Nova mineralisation meanwhile is hosted in a magmatic sulphide intrusion called a chonolith. Nickel sulphide deposits in these settings are usually large and flat but difficult to map in magnetics and hidden under deep cover.

That makes exploring for them very expensive, one of the reasons so many juniors are reliant on IGO’s cash balance and exploration expertise to seek out their Fraser Range riches.

Surprisingly in the case of the Matsa drill hole, the blebby and semi-massive sulphides were hit without an associated electromagnetic conductor.

“We actually sought out the deal with IGO a) because of their expertise and b) because of their budget,” Matsa executive chairman Paul Poli told Stockhead.

“I would expect this hole would have cost them close to a quarter of a million dollars.

“For a junior company to have contemplated 4 or 5 holes in a greenfields area without an EM anomaly would been a very courageous thing to approve in my eyes anyway.”

Geological similarities to Nova

Having held the ground at Symons Hill for over a decade, Matsa executed a $7 million farm-in last year that will see IGO earn a 70% interest in Symons Hill by spending a minimum $3.5m on exploration.

Matsa will also receive $3.5m in staged cash payments and is free carried to a decision to mine should IGO find an economic deposit on its ground.

The deal enables Matsa to cash-in in the short term on its Fraser Range package (though it owns more ground to Nova’s west on a 100% basis) and focus on its ~700,000oz gold portfolio near Laverton in the northern Goldfields.

“What Matsa did is we did a tenement-wide site-powered EM moving loop survey and we did develop some anomalies through that survey and we did do one hole, but Matsa didn’t really have that appetite for these deep holes that were required,” Poli said.

“So we thought it was more prudent to get a large company involved and it took us a while to get IGO on board and whilst we tried to negotiate a deal, we did very little.

“As part of their first year minimum spend requirement they did this hole, which we think is a fantastic result.

“We believe its similar (in style to Nova) so what we are now waiting for is the assays to determine if this is nickel bearing or not, but pyrite with chalcopyrite and pentlandite is exactly what Nova is.

“So really what we now need to do is wait for the assays and that will tell us if it’s nickel bearing and where it’s nickel bearing. I would expect, and IGO have already suggested to us, that this will require further drilling.”

Even if nickel sulphides are not identified in the assays, it doesn’t mean they might not be found in the area around where IGO completed the 863m diamond drill hole.

“What they drilled here it was a magnetic inversion and it is my understanding these magnetic inversions can be very interesting in the Fraser Range,” Poli said.

“One of the issues is that some nickel orebodies may not be very wide at the top, and if the nickel orebody has folded, this single hole might have missed the orebody, if there is in fact an orebody there.

“It would always be nice to have nickel in your first hole, we shouldn’t be surprised if it isn’t, but do expect nickel in subsequent holes.

“I don’t think anyone suspected such a huge sulphide intersection without an anomalous result from an EM survey, it’s quite unique.”

What is the size of the prize?

Nickel is hard to find, and a shortage of class I nickel suited for the batteries that go in electric vehicles could cause problems down the line as that market explodes.

When Nova was under construction five years ago nickel was trading around half of the US$18,689/t it is now fetching.

While supply increases from Chinese backed producers in Indonesia, or substitution of more expensive nickel chemistries out of lithium batteries could put downward pressure on prices, there is a broad belief that nickel sulphate will face supply constraints in the not too distant future.

For products like Nova and future Fraser Range discoveries, that could mean upward pressure on prices or what BNEF believes will be a price split between nickel destined for its traditional market in stainless steel refining and the tighter battery supply chain.

IGO sold out of its gold interest in the Tropicana gold mine this year to focus on battery metals like nickel, copper, cobalt and lithium through Nova and a new stake in the Greenbushes lithium mine and Talison Lithium processing plant in Kwinana.

If it makes a new major nickel discovery now the timing may be perfect. If a junior were to make that find either by itself or with IGO’s support, the impact for its share price could be astronomic.

IGO share price today:

Who else is out on the Range?

While IGO is now the dominant corporate force in the Fraser Range, rich lister Mark Creasy’s Creasy Group remains a major player.

Space geek Creasy actually identified the nickel-copper potential there in 1979 while searching for debris from the NASA Skylab satellite that crash landed near Esperance, more than a decade before he sold the Bronzewing gold mine to Joe Gutnick to become the world’s richest prospector.

He pegged most of the available ground in the region, eventually being a 30% holder of the tenement when Sirius made the Nova find.

His private company has the only major nickel resource in the region outside Nova at Silver Knight, which in 2018 was revealed in a mineralisation report to hold 4.2Mt at 0.8% nickel, 0.6% copper and 0.04% cobalt, including a higher grade 200,000/t grading 3% nickel, 1.9% copper and 0.17% cobalt.

In the listed players there are two broad camps – those who have IGO on the task of making a discovery and those going it alone.

Of the latter, Legend Mining (ASX: LEG) is furthest along the path at its 3088km2 Rockford project to the north of Nova.

Also backed by Creasy, Legend and its boss Mark Wilson maintained their conviction in the Fraser even as the price of nickel entered the doldrums a few years ago.

In December 2019 the company rerated on the discovery of massive nickel-copper sulphides at its Mawson prospect. While it has a JV with IGO as well, Mawson is located on ground Legend shares 70-30 with Creasy.

Legend hit 14.9m at 1.07%Ni, 0.75%Cu, 0.06%Co from 114m in its discovery hole and has been drilling away since. Its share price rose from 4 cents before the hit to as high as 19c in April 2020 before settling back to its current level of 9.5c.

Galileo Mining (ASX: GAL) raised $15 million back in 2018 to list with Creasy projects in Norseman and the Fraser Range.

Its Norseman cobalt-nickel project is more advanced but Galileo, run by ex-Creasy geo Brad Underwood, does control some 602km2 of tenure on the Fraser Range. A 1000m diamond drill program is currently testing its Delta Blues target.

Constellation Resources (ASX: CR1) owns 70 per cent of the 558km2 Orpheus Project, with Enterprise Metals (ASX: ENT) holding the balance. It is currently aircore testing the 3km-long Ni-Cu-Co-PGE Eyre anomaly.

Hannans Limited (ASX: HNR), Errawarra Resources (ASX: ERW), Mt Ridley Mines (ASX: MRD), Wildcat Resources (ASX: WC8) and S2 Resources (ASX: S2R) are all among the companies with ground. S2 was spun out of Sirius during the IGO deal and counts former Sirius boss Mark Bennett as its chairman.

Among the companies with which IGO has farm-in or JV deals are Rumble Resources (ASX: RTR) which is clearly more focused on its exciting Earaheedy zinc discovery near Wiluna, Arrow Minerals (ASX: AMD), Orion Minerals (ASX: ORN), Classic Minerals (ASX: CLZ), Carawine Resources (ASX: CWX), Boadicea and Matsa.

The aforementioned Boadicea is eagerly awaiting assays from drilling on its ground which included the north-west margin of the Orion intrusion, one of IGO’s top exploration targets, saying “positive indicators for nickel accumulation within the Orion chonolith (were) found resulting in plans for further drilling.”

“A nickel discovery on our licence would provide IGO with a close source of production feed to IGO’s adjacent Nova Operation,” Boadicea MD Jon Reynolds told the market.

“The preliminary results from drilling indicate many qualities necessary for sulphide accumulation within the Orion intrusion and potential exploration success.”

At Stockhead, we tell it like it is. While Boadicea Resources and Classic Minerals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.