Resources Top 4: Trendy nickel stock uncovers ‘some of the richest shallow sulphide mineralisation seen so far’

Pic: Stockhead, Via getty Images

- Western Mines’ Mulga Tank nickel discovery now ~3.2km long: “multiple deposits may well be expected given the scale of this clearly well mineralised system”

- Strickland to release updated resource estimate for the 346,000oz Millrose deposit this quarter

- Feasibility study on Arcadia Minerals’ 2.584Mt @ 486ppm Swanson tantalum project due soon

Here are the biggest small cap resources winners in morning trade, Thursday April 27.

ARCADIA MINERALS (ASX:AM7)

(Up on no news)

Namibia focused AM7 is exploring for a bit of everything: lithium (in brines and clays), copper, gold, nickel, PGMs and tantalum.

The main game is Bitterwasser, where lithium in brines sit underneath the 85.2Mt of clay hosted resources.

That initial clay resource is ~287,000t LCE, or equivalent to a 1% lithium hard rock resource of 11.6Mt, the company says.

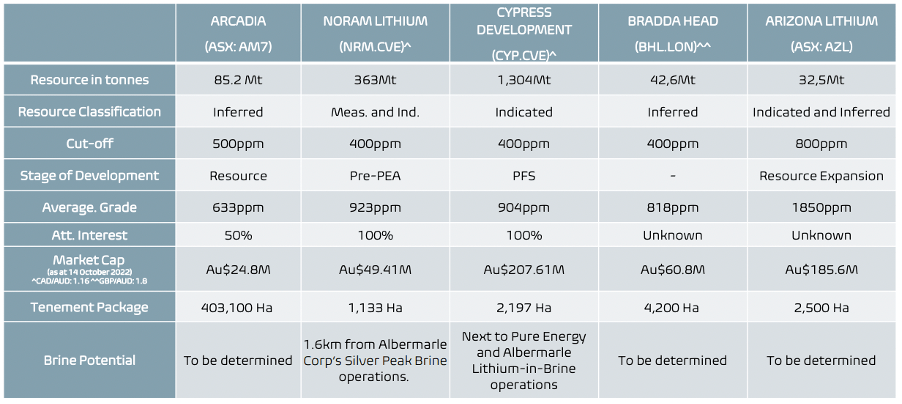

Here’s a basic comparison with some listed peers:

Meanwhile, a feasibility study on the advanced 2.584Mt @ 486ppm Swanson tantalum project has been pushed back but is due to come out soon.

AM7 says the proposed open pit mine is expected to be a low-cost affair.

The $10m capped stock is up 16% year-to-date. It had $1.1m in the bank at the end of December.

WESTERN MINES GROUP (ASX:WMG)

Another strong morning from this uber popular explorer, which is edging back towards Monday’s all time high of 82c.

With only 65m shares on issue this tightly held, $32m capped stock has gained 570% since hitting nickel paydirt at its Mulga tank project early April.

It is still early days, but subsequent news flow has been very promising.

Further drill assays are pending, and the rig continues to spin as WMG attempts to dial in on the motherlode.

WMG says drill hole MTD026 is currently at ~400m depth “with significant examples of disseminated and remobilised nickel sulphides observed in top 250m”.

The top 250m on this hole appears to contain some of the richest shallow sulphide mineralisation seen so far, WMG managing director Dr Caedmon Marriott says.

The shallow mineralised footprint at Mulga Tank is now ~3.2km long, and “multiple deposits may well be expected given the scale of this clearly well mineralised system”, Marriott says.

Following the company’s recent cap raise a further eight holes have been planned to expand the original Phase 2 drilling program.

Additional drill holes will continue to be added to the program with ongoing targeting work and as results are received, WMG says.

LABYRINTH RESOURCES (ASX:LRL)

(Up on no news)

The LRL share price has been bouncing around on a bit of volume since it reported a super high grade 95,710oz gold resource at the historic Comet Vale project in WA earlier this month.

The resource, which includes an Indicated component of 42,000oz @ 10g/t gold, is open in all directions “demonstrating substantial growth potential through both the near-mine and regional drilling”.

“Importantly, the estimate shows high grade mineralisation continues at depth and along strike,” LRL CEO Matt Nixon says.

“This provides immediate high priority drill targets to further grow the resource.”

It also includes a 39,477oz @ 3.3g/t (0.5g/t cut-off) open pittable resource, which could “open the door to near-term mining and cashflow options”.

More step out drill results are due soon. Planning is also underway to chase the high grades at depth and test a bunch of regional gold-copper and nickel laterite targets.

Meanwhile, drilling to grow LRL’s 500,000oz at 5g/t resource at its namesake project in Quebec, Canada is in the works.

$18m capped LRL is up 50% over the past month, but down marginally year-to-date. It had $1.3m in the bank at the end of December.

STRICKLAND METALS (ASX:STK)

(Up on no news)

STK’s focus is the Yandal East gold project in the eastern goldfields of WA, right next door to Northern Star’s (ASX:NST) Yandal production centre.

It has a bunch of targets, some more advanced than others. Its current 600,000oz resource comes from the Millrose, Horse Well, and Dusk ‘til Dawn deposits.

Less than 6km of the total 120km strike length is covered by resource estimate, STK says, with 7 drill-ready advanced exploration targets at Millrose West, Cowza, Mizina, Ward, Filly, Bronco and Clydesdale yet to be included in the resource base.

An updated resource estimate for the 346,000oz Millrose deposit, including the newly discovered Wanamaker and Central lodes, is expected Q2 2023.

Recent hits from Wanamaker include 7m @ 22.2g/t Au from 72m.

Meanwhile, STK has plans to spin out its Iroquois zinc-lead (80% Strickland; 20% Gibb River Diamonds (ASX:GIB)) and Bryah Basin copper-gold projects into a new ASX company.

Iroquois lies directly along strike from Rumble Resources’ (ASX:RTR) world-class Earaheedy project.

$65m capped Strickland is flat year-to-date. It had $500,000 in the bank at the end of December and raised an additional $4m in February.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.