Resources Top 4: Spartan and Dalaroo lead the high-grade golden resources charge

Pic via Getty Images

- Dalaroo leads ressie pack gains after it uncovers promising gold target in the Gascoyne region

- More golden gains – very notably from Spartan Resources on a new high-grade discovery

- Meanwhile WMG is up on its nickel narrative and Hawsons Iron has a project update

Here are some of the biggest resources winners in early trade, Tuesday April 16.

Dalaroo Metals (ASX:DAL)

Another day, another goldie (or several) making golden gains.

Explorer Dalaroo is bagging bigly (a technical term – it’s up about 90% at the time of writing).

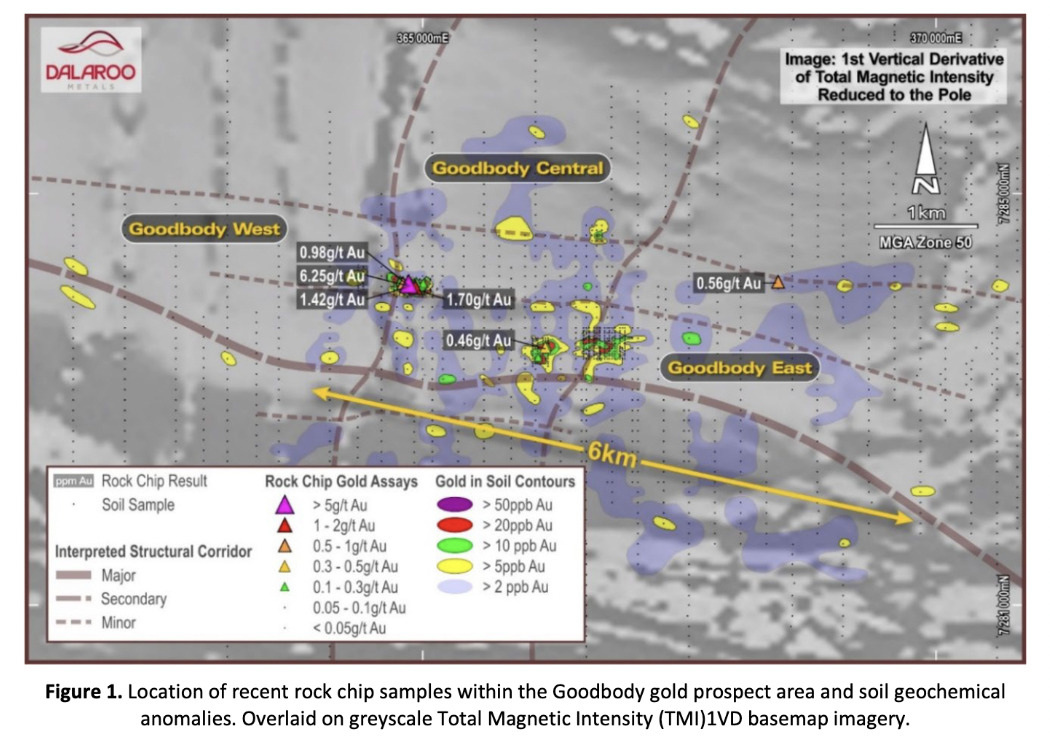

And that’s thanks to its maiden drilling uncovering a +200m long gold target at Goodbody West, part of the Lyons River project in the Gascoyne region of WA.

The exploration minnow (absolute minnow with a market cap of $2.4m) notes that assays from maiden air-core drill program testing of gold-bearing, outcropping quartz veins at the project have outlined gold mineralisation including:

• 5m at 0.85g/t Au from 9m, with 1m at 1.83g/t Au from 9m and 1m at 1.23g/t Au from 12m

• 1m at 0.98g/t Au from 3m

• 1m at 1.17g/t Au from 19m

• 19m at 0.23g/t Au from 24m

This gold mineralisation all remains open along strike and at depth.

Higher grade rock-chip gold assay results received to date at the Goodbody prospect include: 6.25g/t Au; 5.52g/t Au; and 1.70g/t Au.

Dalaroo’s MD, Harjinder Kehal, confirmed the following:

“Our maiden drill program has delivered a gold discovery by testing below the high-grade, gold-bearing, outcropping quartz veins at Goodbody, within the larger 6km Goodbody soil geochemical anomaly at our Lyons River Project in the Gascoyne Province.

“The Lyons River Project tenure has potential for the delineation new gold prospects over its strike distance of 30km”.

DAL share price

Western Mines Group (ASX:WMG)

The share price of this WA gold ‘n’ nickel explorer has had an up and down time of things this year, but taken as a whole, in part thanks to today’s 36% surge, it’s now up roughly 15% YTD.

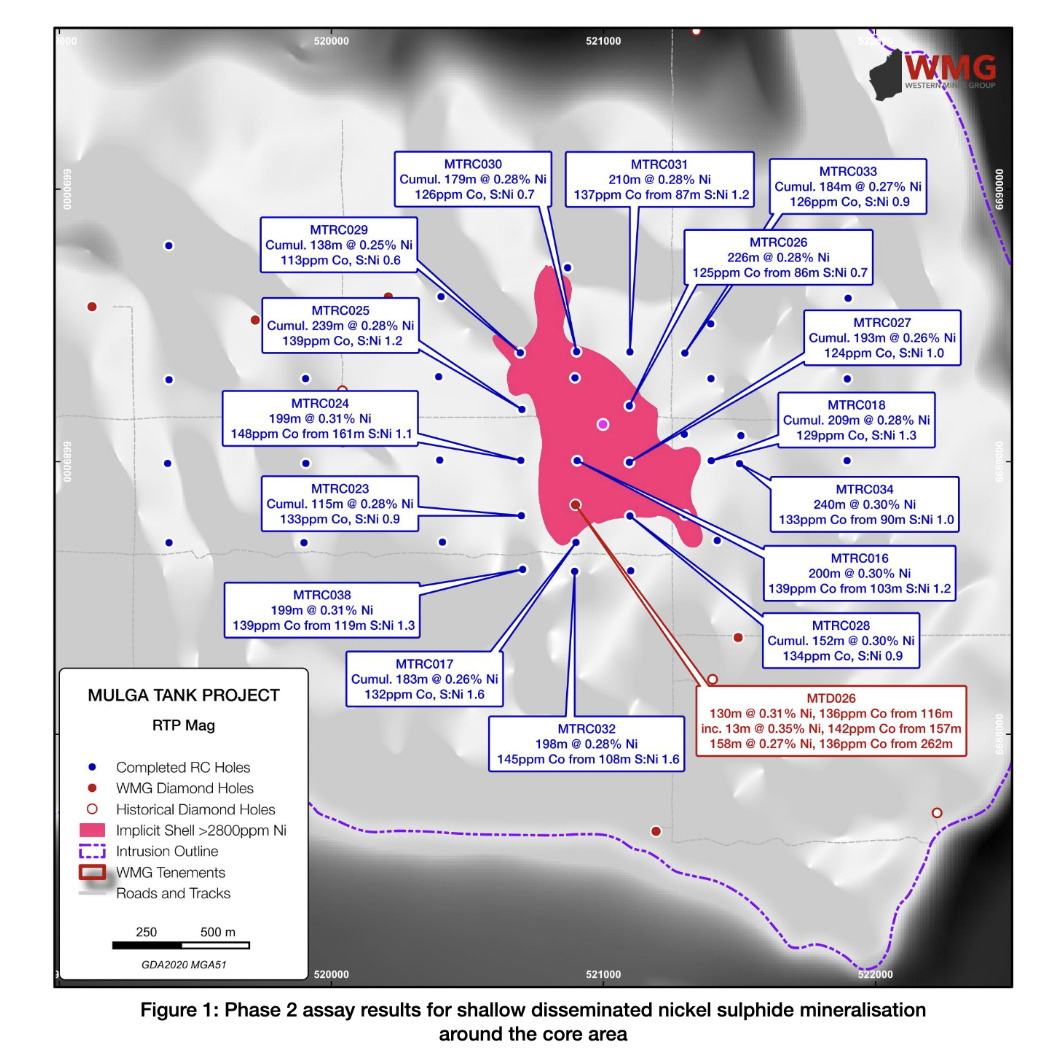

The company is focused on a significant nickel system at its Mulga Tank project, on the Minigwal Greenstone Belt, in Western Australia’s Eastern Goldfields.

What’s happening? Assay results have come in from Phase 2 RC drilling, and they highlight broad intersections of nickel sulphide mineralisation, with further intervals over 200m length.

The assays come from 13 of the 17 Phase 2 holes drilled so far. The results are many, but include a continuous interval of 240m at 0.30% Ni, 133ppm Co from 90m (ending in mineralisation) and 199m at 0.31%, 139ppm Co from 199m (ending in mineralisation).

The company adds that these results also included “multiple higher grade intervals of matrix to semi-massive sulphide”: 4m at 1.09% Ni, 0.43% Cu from 133m, 2m at 1.00% Ni, 404ppm Co, 0.10% Cu, 0.44g/t Pt+Pd from 169m and 1m at 3.16% Ni, 662ppm Co, 0.18g/t Pt+Pd from 192m.

WMG MD Dr Caedmon Marriott said the results highlight “what an extensive mineral system we are dealing with.”

WMG share price

Hawsons Iron (ASX:HIO)

This $46m market capped iron ore developer is focused on developing its flagship Hawsons Iron project near Broken Hill into a provider of high-quality iron ore products for the steel industry.

Magnetite, being one of the main iron ores, is very much central to that focus.

At the time of writing, its share price has burst up 35% after the company delivered an update on its namesake project. This comes amid a comprehensive strategic review of the operation with the following key points noted:

• Seven national and international potential strategic investors including miners, trading houses and steel mills have been selected to undertake detailed due diligence appraisal for BFS (Bankable Feasibility Study) funding.

• Successful testwork has enabled the company to confirm and define a comminution (reduction of solid materials) flowsheet process and the selection of major equipment for the job.

• Also, it’s been determined the company’s magnetite concentrate is to be railed to the Port of Adelaide using existing transport infrastructure, “significantly reducing upfront capital costs and project risk”.

HIO share price

Spartan Resources (ASX:SPR)

Well this is last, and least in terms of pure gainage today in our selected ressie winners, with about an 11% pump at the time of writing. But it’s very much by no means least in terms of hard-hitting, high-grade ressie news.

And it’s a stock with a much higher market cap than the others mentioned in this article.

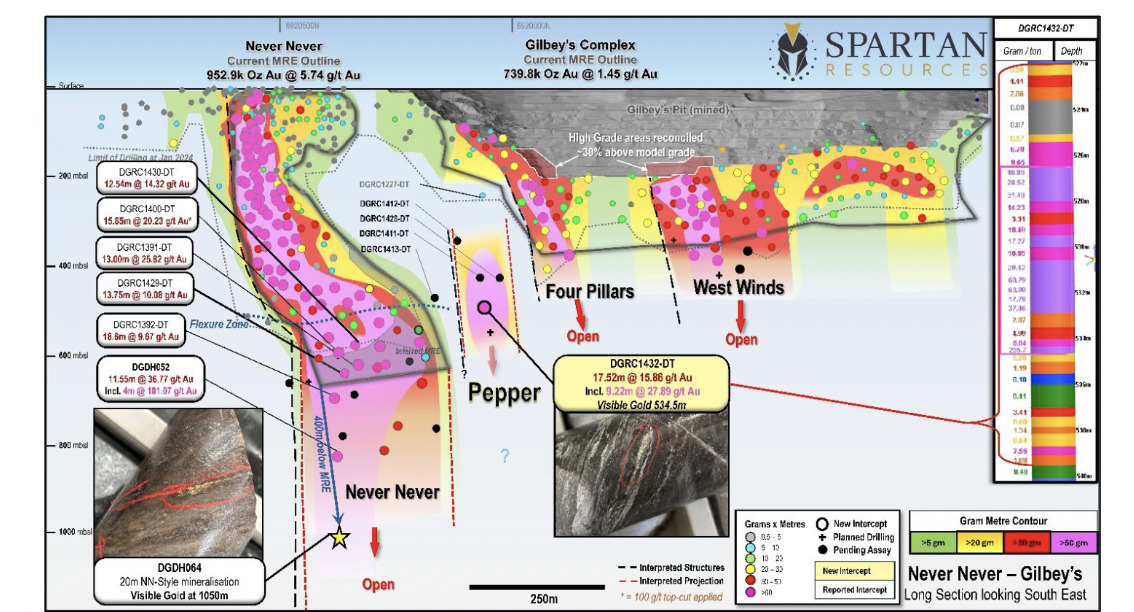

Only about a week after announcing visible gold sited 1km under Spartan’s Never Never deposit in the Murchison region of WA, this big, $620m goldie has announced a new high-grade discovery it’s dubbed the Pepper prospect.

That, reports the company, is a high-grade lode intersected immediately south of Never Never and has revealed similar high-grade mineralisation and grades.

The Never Never gold deposit, and this new Pepper find, by the way, falls within the company’s 100%-owned Dalgaranga Gold Project.

Some specifics, per the company’s ASX report this morning – the Pepper discovery reveals:

• 17.52m at 15.86g/t gold from 522.0m, including 9.22m at 27.89g/t.

• With the intercept located about 90m south and along-strike of the nearest intercept (<0.5g/t gold) defining the southern extent of the 952koz Never Never Gold Deposit.

• Three additional diamond drill-holes have also intersected various widths of logged mineralisation up-dip of hole DGRC1432-DT, confirming the discovery (assays pending).

What now? Further drilling in order to define this new high-priority target is currently getting underway.

Reckon the company is excited about it?

Spartan MD and CEO Simon Lawson described the Pepper find as “yet another game-changer for the Dalgaranga Gold Project”.

“Importantly, the Pepper discovery sits along-strike and in the same volcaniclastic sequence as Never Never but appears to be in a separate steeply north-west plunging fold shoot of its own,” he added.

SPR share price

At Stockhead we tell it like it is. While Spartan Resources is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.