Resources Top 4: Ardea aims to weather nickel industry storm; PMT looks strong

The latest UK tourism ad was refreshingly honest. (Pic via Getty Images)

- Amid torrid time for the Aussie nickel industry, Ardea Resources is up as it reinforces Japanese support

- Gold and copper junior Norfolk Metals rises on project updates

- Patriot Battery Metals, meanwhile, is one of several lithium stocks enjoying a strong turnaround this week

Here are some of the biggest resources winners in early trade, Thursday February 29.

Ardea Resources (ASX:ARL)

Nickel’s not exactly having the best time of it outside of the Rocky Marciano of the game in Indonesia right now, but that’s not stopping Ardea Resources from surging up the bourse today.

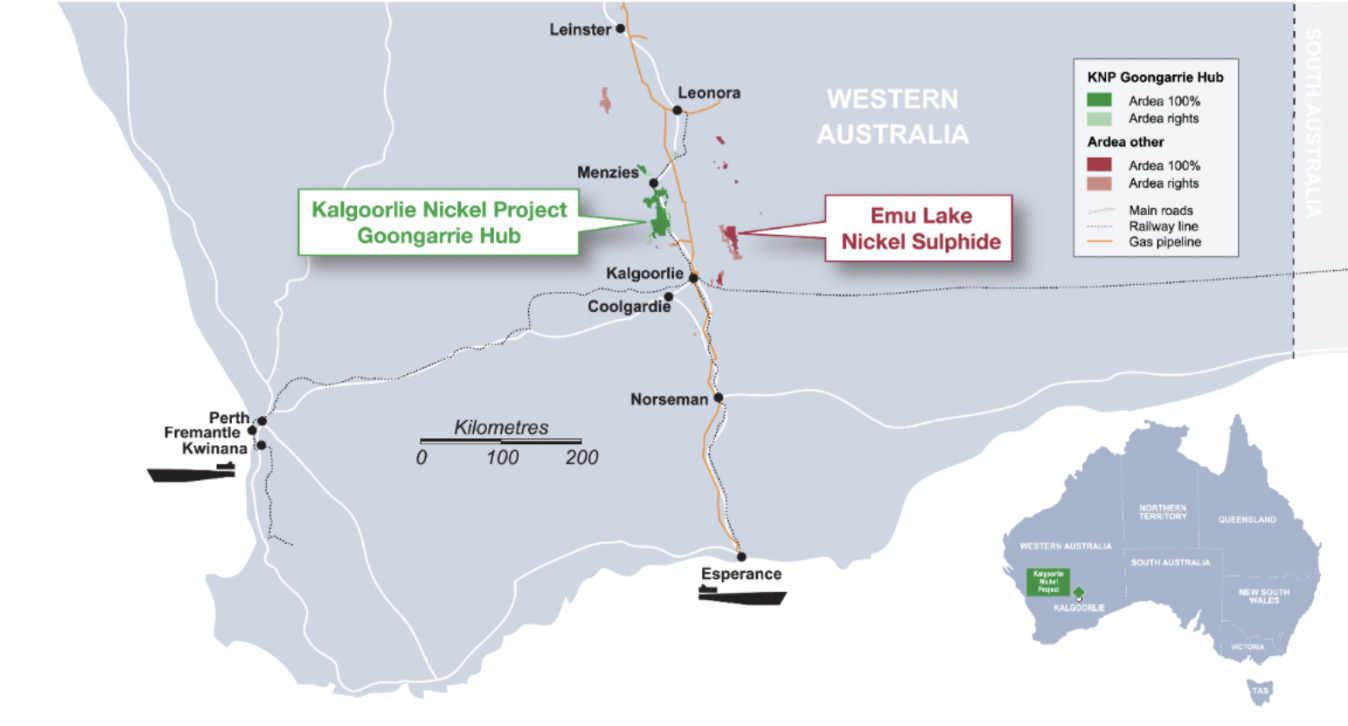

The company and its Japanese consortium partners have reached an agreement on the scope and budget for the Goongarrie Hub Definitive Feasibility Study (DFS) at Ardea’s flagship Kalgoorlie Nickel Project.

The consortium, which includes Sumitomo Metal Mining and Mitsubishi Corporation, has advised Ardea due diligence is done and dusted, and a final investment decision is in the works. That should be made by the end of March.

The company says that along with a final investment decision, future work will be aimed at completing the DFS, and securing project development funding for the Goongarrie Hub to become a globally significant producer of nickel-cobalt.

ARL share price

Norfolk Metals (ASX:NFL)

This gold ‘n’ copper ‘n’ uranium explorer is up nicely today thanks to some news from the beaut bottom-end Aussie state.

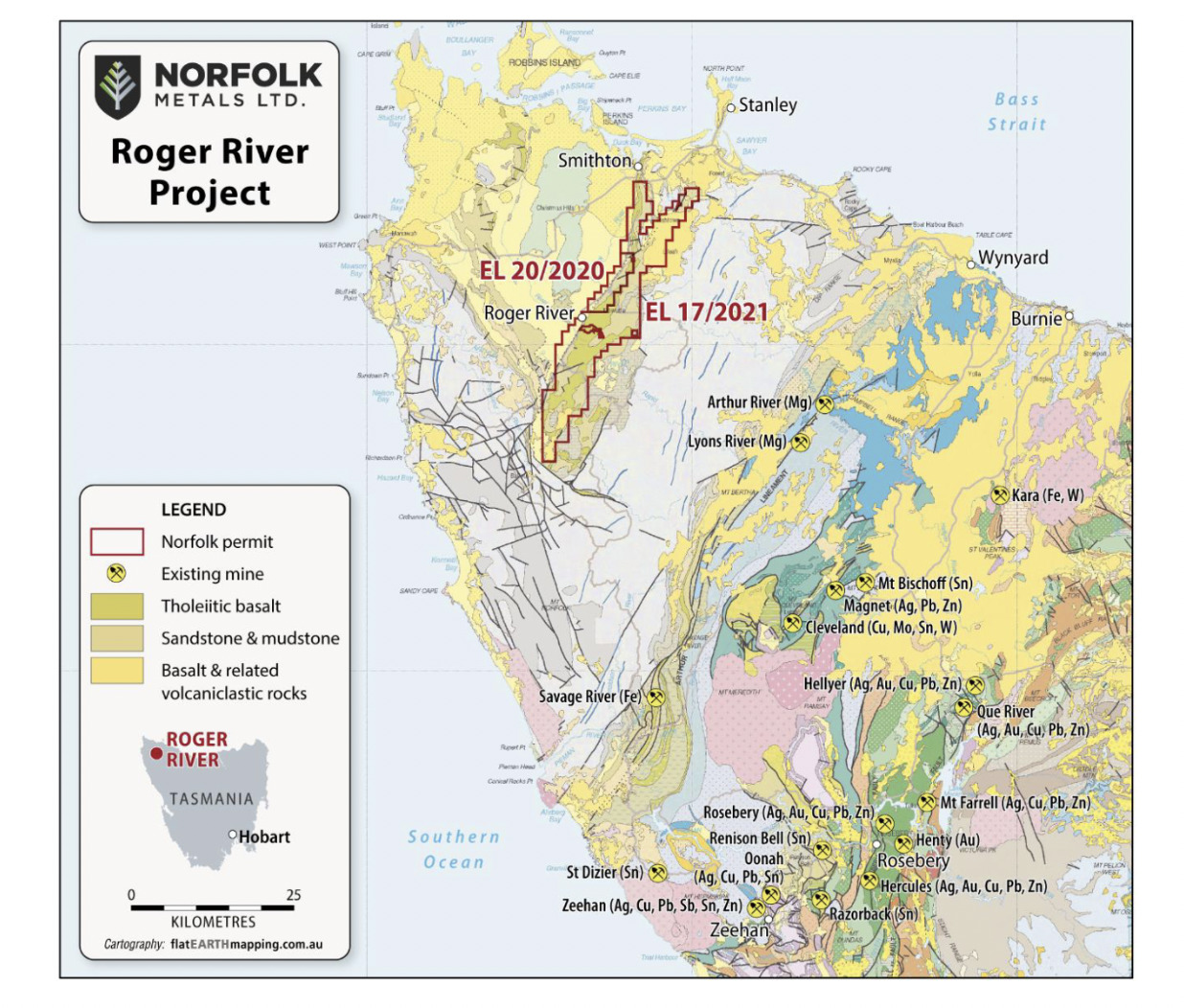

Its copper-gold play in Tassie, the Roger River Project, has updates including the completion of a soil study reanalysing historic samples.

The junior reckons it has a better understanding of the copper and gold mineralisation at the project to guide its next exploration phase and potential drilling.

Norfolk also provided an update this morning on its South Australian uranium operations, having been awarded permit EL6948, which allows for the westwards expansion of both its Orroroo and Johnburgh projects.

The company also notes it is nicely cashed up right now, with $3.49m sitting in the coffers as of the end of December.

NFL share price

Native Mineral Resources (ASX:NMR)

(Up on no news)

Another copper-tinged goldie, NMR is so far one of the top ressie gainers today, on reasonable volume at time of writing.

The explorer is known for its tenements hunting for copper and gold in the Palmerville fault and Mount Morgan regions in North Queensland and its gold search in the Eastern Goldfields region of WA.

But it’s also sniffing around in Canada, looking for lithium in possibly all the right places. In this instance, that means Manitoba, which is heating up as another Canuck white gold hot spot.

Some recent highlights from its McLaughlin Lake project include strong assay results returning 2.77% and 2.25% Li2O, as well as elevated levels of Rubidium (Rb), Cesium (Cs), Tin (Sn) and Tantalum (Ta).

Meanwhile, discussions with First Nations groups for a land access agreement at the site are ongoing.

NMR share price

Patriot Battery Metals (ASX:PMT)

Another Canadian lithium player, and a prominent and sizeable one at that, C$1.44b market capper PMT has managed to move the needle more than 18% over the past week.

The Ken Brinsden-led firm, like other ASX lithium stocks, appears to be the beneficiary of some much-needed market sentiment, partly based on a potential turnaround for global lithium prices, frontrun by a lithium futures upswing over the past number of weeks.

Also, investment bankers Morgan Stanley had a semi-positive narrative to spin regarding the lithium market the other day, too.

But PMT had some news of its own on Feb 26, announcing further drill results at its notable peggie site CV13 at the Corvette project over in James Bay, Quebec, intersecting spodumene with these highlights:

• 22.5 m at 1.10% Li2O, including 15.2 m at 1.57% Li2O

• 19.4 m at 1.20% Li2O

• 16.1 m at 1.54% Li2O, including 7.2 m at 2.57% Li2O

An updated mineral resource estimate for Corvette, including both the CV5 spodumene pegmatite and a maiden MRE for CV13, is planned for Q3 2024.

Ken on stage at the @BMOmetalsmining conference talking about $PMET, Corvette and its potential impact on the North American supply chain. #lithium pic.twitter.com/Oiq7pLGBF5

— Patriot Battery Metals Inc. (@Patriot_Battery) February 27, 2024

PMT share price

At Stockhead we tell it like it is. While NMR and NFL are Stockhead advertisers at the time of writing, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.