Resources Top 4: 2.48 million reasons why Simon Lawson’s Spartan is going gangbusters

Pic: Getty Images.

- Speaking to Stockhead, Spartan CEO Simon Lawson lays down the mindset behind the explorer’s impressive 47% resource upgrade of Dalgaranga

- iTech Minerals continues high-grade copper, silver and gold finds at Reynolds Range

- Quartz in vogue as Australasian Metals runs on exploration target

Spartan Resources (ASX:SPR)

SPR wins the day with a killer 47% resource upgrade to 2.48Moz at its Dalgaranga gold project in WA’s Mid West after incorporating its new high-grade Pepper deposit and upgrading the Never Never resource.

It now sits at an impressive 16.1Mt at 4.79g/t gold. With gold prices stretching all-time highs, that bullion is going to put a smile on a lot of people’s faces.

It’s not too much of a surprise – the gold developer has been uncovering hit after hit after hit, of high-grade gold mineralisation in and around Never Never, launching the junior’s share price up 416% in a year.

Speaking with Stockhead, SPR MD Simon Lawson says there’s a reason why he called it Spartan.

“It’s about mindset. And sometimes it takes challenging the accepted and not being afraid of failure,” Lawson says.

“Coming from Gascoyne to where we are now, it was all about having a crack and testing new ideas.

“It’s an incredible turnaround in anyone’s books. We went back to drill where we were told not to look and had a go, and now we have a 2.8Moz high-grade resource with upside growth potential.”

Never Never upgrade

The Never Never deposit itself continues to pay dividends for this year’s gold darling, with resources upgraded from 5.16Mt at 5.74g/t gold, or 952,900oz, to 5.72Mt at 8.07g/t gold for ~1.49Moz of contained gold.

SPR also just awarded an $18.3m contract for 2350m of twin decline access for underground drilling across four mining areas, which also include the Four Pillars and West Winds areas.

“Since its discovery in mid-2022, the high-grade Never Never gold deposit has consistently delivered some of the most eye-catching drill intercepts seen in the Australian gold sector in many years,” Lawson says.

“This is an incredible outcome only two years from discovery and the direct result of a consistent high-grade drill focus, a highly effective drill strategy and the team’s extensive experience interpreting, modelling and estimating high-grade gold resources.”

A huge amount of volume on this budding gold producer today, rising a whopping 21.61% to $1.21 – tipping the explorer into the $1 billion market cap club (a monster of rock, so to speak).

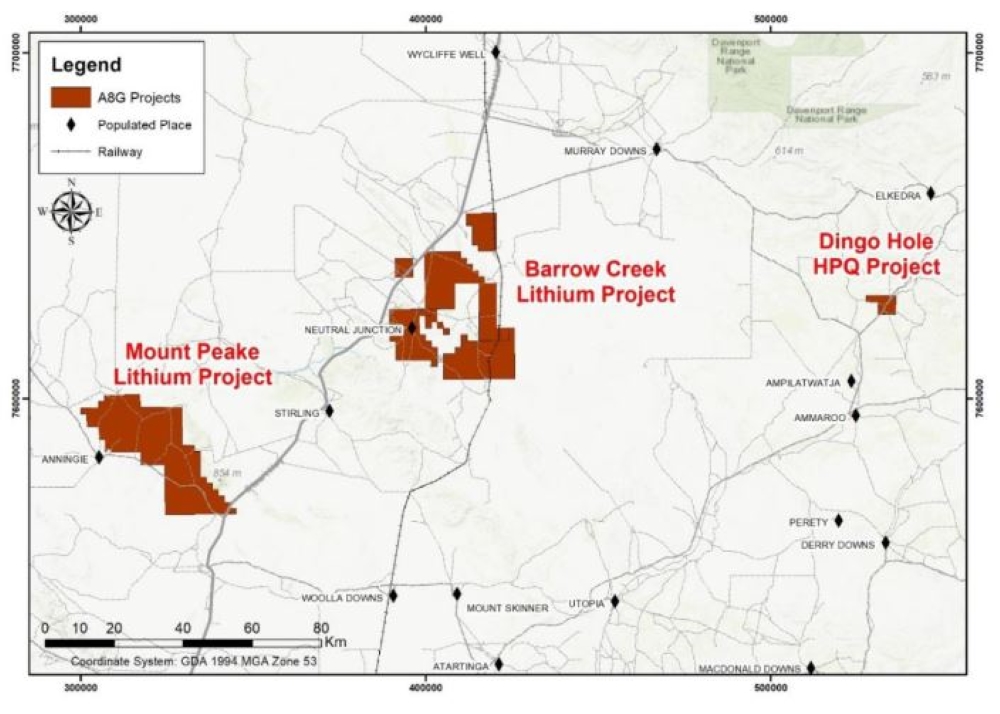

Australasian Metals (ASX:A8G)

And now to the relatively unfamiliar world of highly pure quartz, where Australasian Metals is up today on a new exploration target for super pure silica at its Dingo Hole project in the red centre.

280km north-east of Alice Springs, Dingo Hole now boasts an exploration target compiled by SRK Consulting of 10.4Mt to 42.6Mt at a post-leached SiO2 grade of 99.37-99.85%.

That’s over only 1.16-1.7km2, with shallow buried quartz potentially sitting beneath cover across a larger 35km2 tenement area.

Initial study work has shown low levels of impurities like iron, aluminium, titanium and lithium, with A8G champing at the bit to drill down on the potential of the project via an option agreement with Verdant Minerals.

What does high pure quartz do, you may be asking?

It’s silica with under 50ppm of impurities – in other terms 99.995% SiO2. Ultra-high pure quartz is less than 20ppm impure, with less than 16.2ppm aluminium.

It’s worth noting the market is very, very niche and only a few deposits have the potential to meet purity benchmark IOTA and even tighter IOTA8 standards.

IOTA standard ultra-high pure quartz rakes in around US$5000/t, with a market of 100,000tpa at the moment. But the rise of tech means demand is climbing due to its use in optical fibres, silicon crystals in transistors and chips, PV cells and more.

“We are encouraged by the initial Exploration Target which has been independently assessed for Dingo Hole and which only covers the central part of the project area, highlighting additional potential,” A8G MD Qingtao Zeng said.

“Dingo Hole has unique geological characteristics, including extremely low impurities, which positions it well for the global HPQ market at a time when there is significant growth in the market for AI-related semiconductor applications and photovoltaic solar silica growth.

“We look forward to conducting further exploration within the Exploration Target area. The extensive outcrop of quartz means we can deliver high impact and low-cost exploration programs, and potentially shorten the timeframe to a maiden resource estimate.”

A8G was trading up 14.3c to 8c per share at time of writing.

iTech Minerals (ASX:ITM)

ITM is on a winning run, up over 50% in the past month with rock chip assays at its Reynolds Range project in the NT wafting smoke for investors hopeful there’s a copper and gold fire burning.

The latest revelation is a spectacular collection of rock chips including one grading 18.2% copper, 285g/t silver and 1g/t gold.

Another rates as high as 14.2% Cu, 1490g/t Ag and 3.3g/t gold and another at 16.4% Cu with silver and gold credits.

There’s even some high grade antimony and lead in there, coming on top of previous assays grading up to 182g/t Au.

It’s worth noting that rock chips do not a deposit make. It’s hard to tell exactly where mineralisation found on surface has come from and how deep its source goes.

But that’s plenty of encouragement given the breadth of outcropping copper on the site at the Scimitar and Reward prospects.

The former, a 1.7km electromagnetic target with a coincident multi-element soil anomaly and outcropping mineralisation , screams “high priority drill target”.

Permitting has begun to get a drill rig turning at Reynolds Range in the coming months, which iTech is acquiring from Prodigy Gold (ASX:PRX) (two licences 100% owned and one 80% owned) sitting on 375km2 in the Aileron Province, not far from WA’s hot West Arunta region.

Just 90-230km north-north-west of Alice Springs close to the Stuart Highway, the discovery of arguably 2024’s hottest metal copper there would be a major fillip.

Importantly, very little drilling on the project to date has targeted copper despite the prominence of the high-grade outcrop.

“The new copper and silver results, combined with previously released gold results provide an exciting picture of the potential for high grade mineralisation,” ITM MD Mike Schwarz says.

“To get results like 18% copper, 1,490 g/t silver and 182 g/t gold from rock chip sampling, over a wide area, demonstrates the potential for large scale mineralising systems at Reynolds Range.

“The results give us confidence to forge ahead with drill testing of the significant 1.7km long EM conductor at the Scimitar Copper-Gold prospect (with) geophysical modelling and drill permitting already underway.”

Up 11.3%, ITM was swapping at 8.4c per share after morning trade.

Labyrinth Resources (ASX:LRL)

After entering a 12-month option to acquire the remaining 49% of its Comet Vale gold project from Sand Queen Gold Mines for a cool $3m cash, LRL is still rocketing up the charts.

Comet Vale, 32km south of Menzies, is currently endowed with a resource of 96,000oz at 4.8g/t gold.

LRL is also snapping up the Vivien gold project by acquiring private company Distilled, whereby its vendors Alex Hewlett and Kelvin Flynn are expected to emerge with 12.3% and 10.2% voting power in the company once transactions are finalised.

LRL’s new shiny project is also just a hop, step and 6km jump from South African mining major Gold Fields’ >250,000ozpa Agnew mine and was previously a major producer, churning $130m in cash out for Ramelius Resources (ASX:RMS).

Shares are up another 27% today after a retrace on Monday, trading at 1.4c.

At Stockhead we tell it like it is. While Spartan Resources and iTech Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.