Resources Top 2… and the rest: The gains are here! 11 uranium stocks hit +20pc in early trade

Pic: Via Getty

- White Cliff to acquire historical uranium project in the Northwest Territories of Canada called Radium Point

- Terra Uranium pegs more ground in Canada’s famous Athabasca Basin

- Most ASX uranium stocks up at the open, with 12 stocks gaining 20% or more

Here are the biggest resources winners in early trade, Monday January 15.

WHITE CLIFF MINERALS (ASX:WCN)

Uranium prices are now edging toward US$100/lb, from less than US$40/lb in 2022.

Stocks have ostensibly lagged the rise, and we are far from the frothy nonsense that defined the lithium market in 2022.

With battery metals currently in the toilet, more speculative exploration stocks on the ASX may look to a commodity with a bit of ‘go’ about it.

Former lithium explorer WCN today announced plans to acquire a historical uranium project in the Northwest Territories of Canada called Radium Point.

The Iron Oxide Copper Gold Uranium (IOCGU) plus silver operation produced 13.7Mlb uranium, plus silver, copper gold, nickel and lead pre-1982.

According to this doco, Port Radium provided 11% of all the uranium used in the Manhattan project.

WCN says exploration has been largely non-existent in the area since uranium production ceased in the ’60s and silver and copper mining stopped in early ’80s.

Initial exploration will focus on finding extensions to previously exploited orebodies, as well as known outcropping prospects throughout the licence area that have never been followed up.

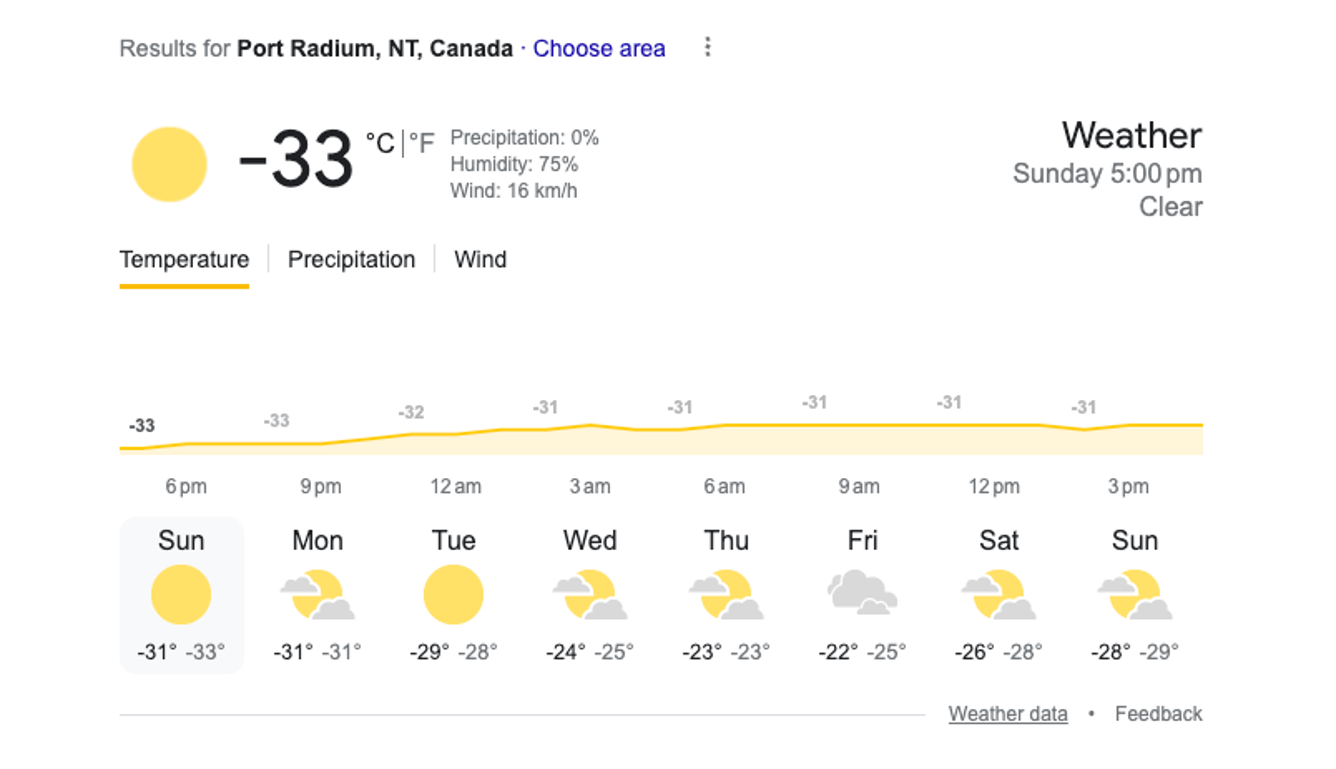

Pray for those poor fieldies. The project area, near the Arctic Circle, is inhospitably cold right now:

Radium Point was secured via licence applications and cost the company just CAD$150,000 in shares to a Canadian consultant.

$16m capped WCN, which is now looking to divest various Australian assets, is up 30% in early trade.

White Cliff Chart

TERRA URANIUM (ASX:T92)

T92 will also pick up ground in Canada, this time in the famous Athabasca Basin.

The small explorer staked two claims called Rapid River. All up, it now has a total of 1108sqkm to play with across four projects.

“The ongoing internal technical work by our Canadian team identified an excellent new target at Rapid River on the western side of Pasfield Lake opposite our base camp,” T92 boss Andrew Vigar says.

“The move to stake 2 claims over the strongest anomalies was very timely as all remaining ground in this area has now been taken.

“Great original work from our people with initial exploration to be undertaken this year.”

Work programs planned for this year at Rapid River include early-stage stuff like sampling, airborne geophysics and ambient noise tomography (ANT).

T92 is also “actively advancing discussions” with several potential JV partners to fund drilling on its other, more advanced projects.

Terra Uranium Chart

… AND THE REST

All up, it has been a good morning for uranium stocks on the ASX.

ENRG Elements (ASX:EEL), Cauldron (ASX:CXU), Peninsula (ASX:PEN), Aurora Energy (ASX:1AE), Adavale (ASX:ADD), GTI Energy (ASX:GTR) and Global Uranium & Enrichment (ASX:GUE) all made +20% gains in early trade.

GUE has successfully offloaded its 80% stake in a lithium project called Maggie Hays Hill for $2.1m in cash and shares to Intra Energy Corp (ASX:IEC), which was flat on the news.

The big boys of yellowcake also chalked up wins, led by Energy Resources of Australia (ASX:ERA), Deep Yellow (ASX:DYL), Bannerman Energy (ASX:BMN) and Lotus Resources (ASX:LOT).

ASX Uranium stocks

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.