Regener8 IPO gifts new life to lucrative Kookynie gold assets

Pic: Aluxum/E+ via Getty Images.

A suite of highly prospective gold exploration assets near Kookynie will soon be given new life on the ASX, spun out from GTI Energy to IPO Regener8 Resources.

In recent years GTI (ASX:GTR) has emerged as a leader in ASX-listed uranium explorers, with its focus on ISR deposits in Wyoming – a state at the heart of the US nuclear energy renaissance.

But the uranium focus has put the company’s gold assets on the backburner, creating an opportunity for soon-to-be-listed Regener8 to swoop in on a red-hot gold district with a long history of fruitful production.

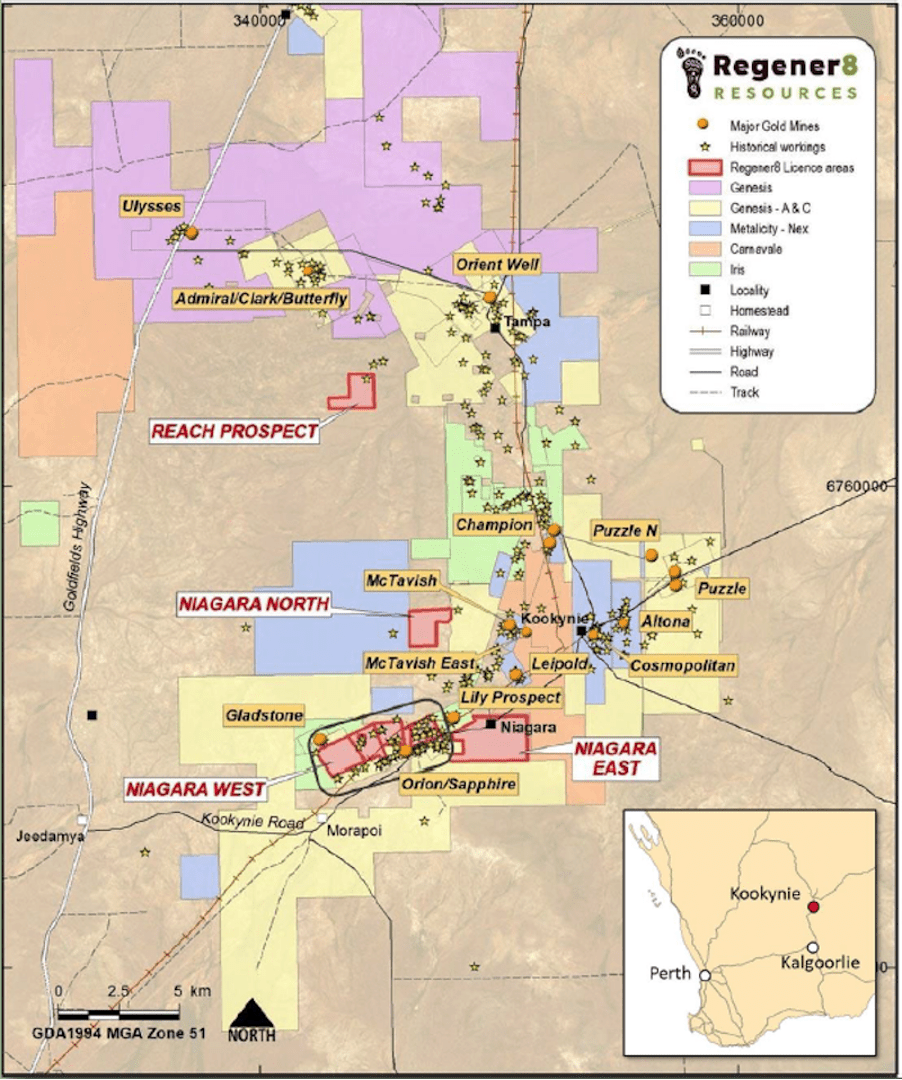

Regener8 will list on the ASX with ownership of the Kookynie gold project in its namesake region, between Leonora and Kalgoorlie in the heart of WA’s premier gold region.

Kookynie, formerly on GTI’s project books, hosts a key tenement package in a highly active, underexplored region of the northern part of the Goldfields.

It incorporates the Niagara West, Niagara East and Niagara North projects, as well as the Reach prospect, and is surrounded by active explorers.

These include Raleigh Finlayson-led Genesis Minerals (ASX:GMD), who’s high-grade Leonora gold project currently has a 2 million ounce resource open along strike and at depth, incorporating the Ulysses, Admiral, Orient Well and Puzzle deposits. That company has a market capitalisation of around $344 million.

Iris Metals (ASX:IR1) and Metalicity (ASX:MCT) are both active in the exploration space. Iris’ first drill program in February hit near-surface gold in every prospect drilled, while Metalicity recently expanded its Kookynie drilling plans and is in the midst of a takeover play for project partner Nex Metals (ASX:NME).

IR1 and MCT have market caps of ~$54 million and ~$13 million respectively.

Meanwhile, Carnavale Resources (ASX:CAV) reported bonanza hits from early aircore at its Kookynie project, and has a market cap of ~$24 million.

By contrast, Regener8 will list with a market cap of $6.2 million, with just over 31 million shares on issue, ~$4.2 million cash and a book of gold projects with known mineral potential.

All of this in a region where more than 500,000 gold ounces have been historically produced.

It’s a compelling place to play.

Not just nearology

Far from a nearology play, Regener8’s project playbook is full of interesting gold projects of its own right.

The Niagara West project is home to substantial historical workings, with 6,800 tonnes of material processed at a remarkable average grade of 25.8 grams per tonne for 5,100oz gold.

Adjacent to this is the historical Gladstone mine from which 10,000t of ore was processed at a phenomenal 80.2g/t, as well as Genesis Minerals’ Orion/Sapphire project which has an inferred mineral resource of 690,000t ore at 2.2g/t for 48,000oz.

Despite Regener8’s Niagara West project being largely underexplored, historical, near-surface high grade intersections have been recorded in the May-White Cross areas.

These include:

- 2m at 70.5g/t gold from 7m;

- 2m at 15.4g/t gold from 10m;

- 2m at 11.3g/t gold from 22m;

- 2m at 10.7g/t gold from 19m, and;

- 5m at 9.7g/t gold from 13m.

At Niagara North, gold anomalism was identified from historical rotary air blast drilling and geochemical surveys, with potential for underlying mineralisation to be investigated.

First-pass exploration by GTI at Niagara East revealed elevated gold and anomalism intersected by aircore and RC drilling, up to 1m at 2.78g/t from 19m.

A review of initial results is ongoing.

Meanwhile, the Reach project also demonstrates encouraging gold anomalism which Regener8 intends to follow up. Limited historical soil sampling and drilling has been undertaken, with drilling intersections including 1m at 2.97g/t gold from 25m and 4m at 0.49g/t from 32m.

Early exploration programs planned include geophysical surveying across the tenement package, a priority target drill program at Niagara West, project-wide targeted auger investigation, and first-pass AC drilling at Niagara North and Reach.

Gr8 exposure for GTI

As part of the transaction for the ground, GTI will receive 5 million Regener8 shares, to a total value of $1 million at $0.20, as well as $1.5 million performance rights and $150,000 cash at completion of the IPO and acquisition.

Its escrowed interest in Regener8 will be 16%.

GTI shareholders were also entitled to a priority offer of up to 12.5 million Regener8 shares, which closed on May 31.

The Regener8 public offer will remain open until 14 June.

This article was developed in collaboration with GTI Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.