Is Carnavale about to uncover Kookynie’s golden sugar hit?

Pic: Schroptschop / E+ via Getty Images

They say a spoonful of sugar makes the medicine go down. In the gold space, junior explorer Carnavale Resources believes it may be building towards a Goldfields ‘sugar’ hit of its own.

Carnavale (ASX:CAV) is a WA-focused gold and nickel sulphide explorer with a trio of Goldfields projects, and some particularly compelling early gold hits in a region hot with activity.

At Kookynie, the most advanced of the three, Carnavale has made great strides in early drilling, recording bonanza gold intercepts from early aircore and first-stage reverse circulation programs.

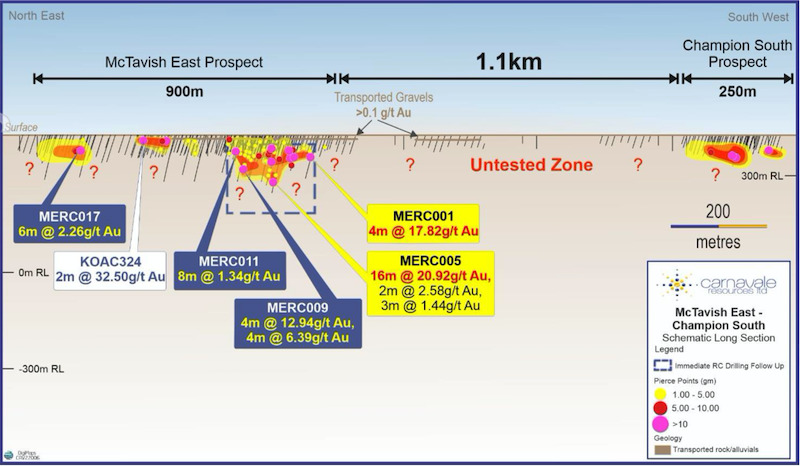

A high-grade 550m gold anomaly detected at the project’s McTavish East prospect returned standout, shallow aircore intercepts reported mid-2021 including:

- 2m at 16.25 grams per tonne (g/t) gold from 54m;

- 4m 31.08g/t from 94m, ending in mineralisation;

- 2m at 32.5g/t from 18m, and;

- 2m at 16.5g/t from 20m.

Follow-up RC work expanded on the discovery at McTavish East early this year, with bonanza intercepts including 16m at 20.92g/t from 161m; 4m at 17.82g/t from 78m; 4m at 12.94g/t from 126m; 4m at 6.39g/t from 114m; and 6m at 2.26g/t from 50m.

Those are big grades at shallow levels, and funded following a February capital raise, Carnavale is back on-site to target extensions to the mineralisation detected to date.

The cross-section below, highlighting multiple areas of unknown mineralisation, says everything you need to know.

But it’s the activity in the region where the project really starts to hit its sweet spot, according to CEO Humphrey Hale.

In the district is Genesis Minerals (ASX:GMD), now helmed by Raleigh Finlayson and developing the Ulysses gold project with a resource of 39.3 million tonnes at 1.6g/t gold for 2.01 million ounces.

Saturn Metals’ (ASX:STN) Apollo Hill gold project has a resource of 35.9Mt at 0.8g/t for 944,000oz, while Azure Minerals has reported positive early exploration results from its Barton gold project.

Immediate neighbours include Metalicity (ASX:MCT), which is currently targeting Nex Metals Exploration (ASX:NME) in a potential takeover bid.

Hale said Carnavale’s high grade Kookynie hits meant the project was shaping up with the sort of potential to be the sugar hit needed to make the region’s projects come to life.

“Our thesis in the area is to try find something high grade, which could then have the potential to turn on a project which can’t necessarily move on its own,” he told Stockhead.

Hale pointed to the example of Ramelius Resources’ deal to acquire smaller player Spectrum Metals for $208 million in 2020 – a move which added the high-grade Penny West gold project to the former’s books. That project is now in development with a view to processing at the company’s existing Mt Magnet plant – improving overall economics significantly.

“Ramelius knew that would be very valuable to their whole company, and the upside was important to be able to add a sprinkle of high-grade sugar and make something of the overall project,” he said.

“In their grand strategy of having four major feed sources, this is the little sprinkle of sugar that makes everything work.”

RC and aircore drilling are currently underway to further understand the Kookynie project’s full potential.

Carnavale certainly has a pedigree in gold. In addition to Hale, whose background includes a stint as exploration manager at AngloGold Ashanti’s Sunrise Dam mine, the board features De Grey Mining (ASX:DEG) executive director Andy Beckwith as a non-executive director.

DEG manager business development Allan Kneeshaw is also engaged as an exploration consultant.

Ora Banda calling

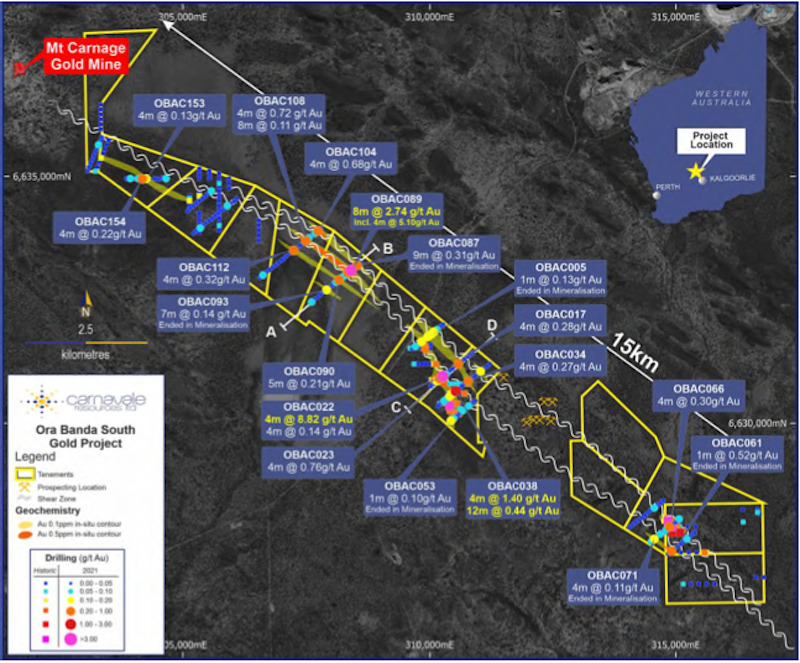

Kookynie is not the only prospective gold project on the books, with Carnavale adopting a similar exploration approach to its ground at the Ora Banda gold project in the Yilgarn Craton.

The Ora Banda project is located in a geologically analogous sedimentary setting to Gold Fields’ Invincible mine at its St Ives project, and Hale said the company was modelling its thinking around the Invincible model.

Invincible is the largest gold mine in the St Ives area.

“Invincible was discovered in 2012, so not that long ago in the grand scheme of things, and before that people didn’t really explore for gold within the sedimentary horizons,” Hale said.

Carnavale did its first aircore at Ora Banda last year, with results far exceeding expectations despite broad spacing on 80m centres. These included:

- 4m at 8.82g/t gold from 40m;

- 8m at 2.74g/t from 48m;

- 12m at 0.44g/t from surface, and;

- 4m at 1.4g/t from 24m.

“We were only really looking for grades of about 0.2g/t during this phase of drilling, as a lead-in to the next round where we’d be able to zoom in, if you like, like we did at Kookynie,” Hale said.

“But we were getting really good hits straight away, and we’ve just come back in recently with 30,000m of infill to define what we found in that aircore. Those results are expected within the next month or so.”

The project’s Carnage and Highlander prospects have since been identified and will be tested with RC drilling subject to the results of follow-up aircore.

Grey’s anatomy

While gold has dominated Carnavale’s newsflow of late, the company also holds a highly prospective nickel sulphide project along strike from Ardea Resources’ (ASX:ARL) Emu Lake massive sulphide discovery.

Soil and passive seismic work have detected five anomalies of interest at the Grey Dam nickel-cobalt project, where electromagnetic surveying is planned next month.

“The EM will dictate where we go from there,” Hale said.

“If we get conductors out of those anomalies then we’ll be looking to drill those in the month post that.

“Ardea found nickel sulphides in the same geology, and that’s been a good story – it’s an exciting opportunity in its own right.”

This article was developed in collaboration with Carnavale Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.