RareX looks to demerge gold, nickel, platinum group metals assets

Rare earths company RareX plans to focus on its flagship Cummins Range project in WA. Image: Getty

Rare earths company RareX is to spin off its gold, nickel-copper and platinum assets into a new IPO company to focus on its flagship Cummins Range project.

The spin-off company, Cosmos Exploration, will hold RareX’s (ASX:REE) Byro East project in WA for nickel-copper-platinum group elements and its Orange East gold project in NSW.

RareX has decided to spin off its non-core assets into a separately-listed ASX company following a strategic review of its asset base and drilling success at Cummins Range.

The Cummins Range rare earths project located in WA’s East Kimberley region is host to an inferred resource of 13 million tonnes at 13 per cent TREO for 147 million kg of REO.

RareX is about to begin a major drilling program for its Cummins Range project.

“The board considers that, given the company’s strategic focus on the continued exploration and potential development of the Cummins Range project, the value of Orange East and Byro East is not currently reflected in RareX’s share price,” said the company.

“It would be beneficial to the company and its shareholders that the projects be housed in a separately listed vehicle specifically focused on progressing their exploration and development,” the company stated.

Nickel-copper-PGE asset

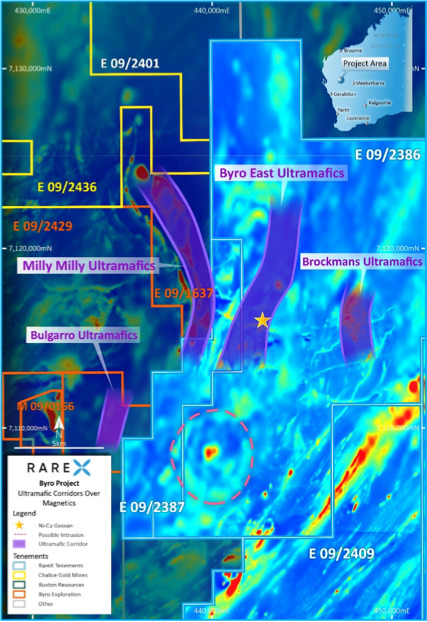

The Byro East project has copper-nickel-PGE targets along the Milly Milly intrusions in WA, in the Western Gneiss Terrane, approximately 300km northwest of Geraldton.

The project has five tenements for 900sqkm along the western edge of the Yilgarn Craton.

It is considered similar geologically to WA’s Gonneville intrusion that hosts Chalice Mining’s (ASX:CHN) world-class Julimar discovery near Perth.

RareX secured Byro East in January 2020 prior to Chalice Mining’s Julimar discovery.

Chalice Mining and other companies have subsequently applied for exploration tenure surrounding the company’s Byro East project.

At least one nickel-copper-PGE gossan, an exposed mineral deposit, is noted as present on the Byro East tenure’s ultramafic corridor.

Some exploration activity has been carried out on the Milly Milly intrusion because of its size and affinities to the very large Jinchuan deposit in China.

Since the start of 2020, the price of nickel metal has risen by more than 15 per cent to ~$US16,000 per tonne from ~$US13,000 per tonne, according to London Metal Exchange data.

The rising price is widely attributed to increasing demand for minerals that are integral in the production of electric vehicles.

Orange East gold project

RareX’s Orange East gold project is 15km along strike from Regis Resources’ (ASX:RRL) McPhillamys gold mine and both are hosted in the Gunnarbee geochemical anomaly that extends over an area of 1,000m by 200m east-west.

McPhillamys has a probable reserve of 60.1 million tonnes at 1.05 grams per tonne gold for 2.03 million ounces and is 250km west of Sydney.

The regionally significant Godolphin-Copperhannia Thrust Fault Zone traverses through the centre of the Orange East gold tenement.

The GCTFZ is host to dozens of historical copper-gold-silver workings, including the Carangera mine that produced 784 tonnes of copper at a grade of 14 per cent.

RareX said its recent assets review had concluded that numerous exploration targets exist in the project area that have yet to be tested with exploration drilling.

Precious metals including gold have also appreciated significantly over the past year.

Gold has soared to ~$US1,780 per ounce Friday from ~$US1,550 per ounce in early 2020.

Cosmos Exploration

RareX said it intended to spin off its Byro East and Orange East assets into a separate company, Cosmos Exploration.

The company said the demerger will enable further funding to be raised for their exploration and provide investors with leverage to the projects’ exploration upside.

Cosmos Exploration will first acquire the two projects and then seek to list on the ASX by way of an IPO during 2021 to raise funding for exploration activities.

RareX has recently signed an agreement with Chinese rare earths producer Shenghe Resources that opens up growth opportunities for the company.

This article was developed in collaboration with RareX, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.