Raiden enters strategic partnership with Mallina to farm-out Arrow gold assets

Mining

Mining

Special Report: Raiden Resources has reached an agreement with Mallina for the latter to farm-in to its Arrow gold project in WA’s Pilbara and earn up to a 75% interest within the tenements, while Raiden will retain 100% of LCT rights.

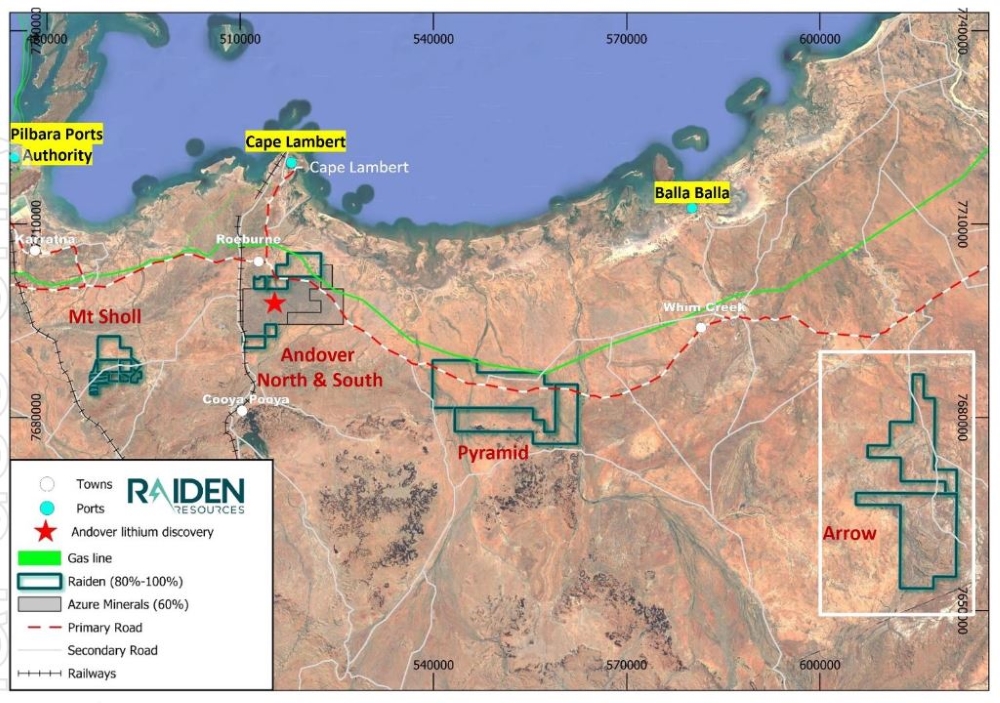

The 223km2 Arrow project has dozens of significant gold anomalies throughout the project area and is just 32km from De Grey Mining’s (ASX:DEG) massive >10Moz Hemi gold deposit, which, when developed, would instantly become Australia’s fifth largest gold operation.

It’s also nestled in a proven lithium district where Pilbara Minerals’ (ASX:PLS) Pilgangoora project – one of the world’s largest hard rock lithium deposits – is in production, and crucially, Raiden Resources (ASX:RDN) will retain the lithium-caesium-tantalum (LCT) rights over the tenements.

Raiden’s Arrow and other owned gold and lithium projects in WA’s Pilbara region. Pic supplied: (RDN)

The deal is part of RDN’s strategy to get exploration underway at non-core assets, while still retaining exposure to projects, as it is doing at its Mt Sholl project.

In December last year, RDN entered a strategic partnership with Canadia’s First Quantum Minerals for the mining major to earn up to 70% of the nickel-copper-PGE rights to the tenements while retaining a 30% free carry stake up to decision to mine.

RDN also retains the rights to lithium and gold at Mt Sholl.

Terms of the binding earn-in agreement with Mallina for the Arrow gold project include $250,000 payment to RDN on the 12 month anniversary and Raiden retaining 100% rights to all LCT and associated mineralisation, with Mallina committing a minimum of $600,000 in exploration spending within 12 months.

Mallina also commits to include at least 3000m of Aire Core drilling during the period and have the option to sole finance a further 17,000m of diamond or RC drilling within 24 months to earn 51% of the project.

Mallina then has a further option to sole finance a further 30,000m of drilling or complete a pre-feasibility study over the project for 75%.

RDN MD Dusko Ljubojevic says the transaction is part of management’s continued strategy of “generating strategic partnerships over the non-core assets to ensure that aggressive exploration campaigns are delivered and to maximise the discovery potential”.

“The company remains focused on the primary objectives, namely drilling the Andover North and South lithium projects,” Ljubojevic says.

“The Mallina team is led by an accomplished technical and corporate team, with a track record of discovery.

“We hope that their experience will lead to further technical success on the Arrow project, and in parallel, we plan to continue with the LCT exploration program at the tenements.”

This article was developed in collaboration with Raiden Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.