Queensland’s going big on battery metals; here are some of the stocks who could ride the funding wave

Pic: via Getty Images.

- QLD is funding a $75m vanadium processing facility in Townsville

- Plus $5b to connect and upgrade the CopperString 2.0 project

- The State is also investing $5m in its Battery Industry Strategy

There’s been a lot of focus on Western Australia’s battery metal potential in recent years, but sneaking up to overtake in the outside lane is Queensland.

The Maroons are making big investments into their burgeoning battery metal industry, which covers lithium, copper, cobalt, nickel, manganese, graphite for electric vehicles – along with vanadium for battery storage.

A fact not missed by a discussion paper released by Accenture earlier this year which flagged the battery industry has the potential to contribute $1.3 billion to Queensland’s annual economy and produce 9,100 jobs by 2030.

And while lithium-ion batteries will play an important role in the industry, the report also highlights the potential of Queensland’s vanadium reserves which amount to approximately 28% of global reserves.

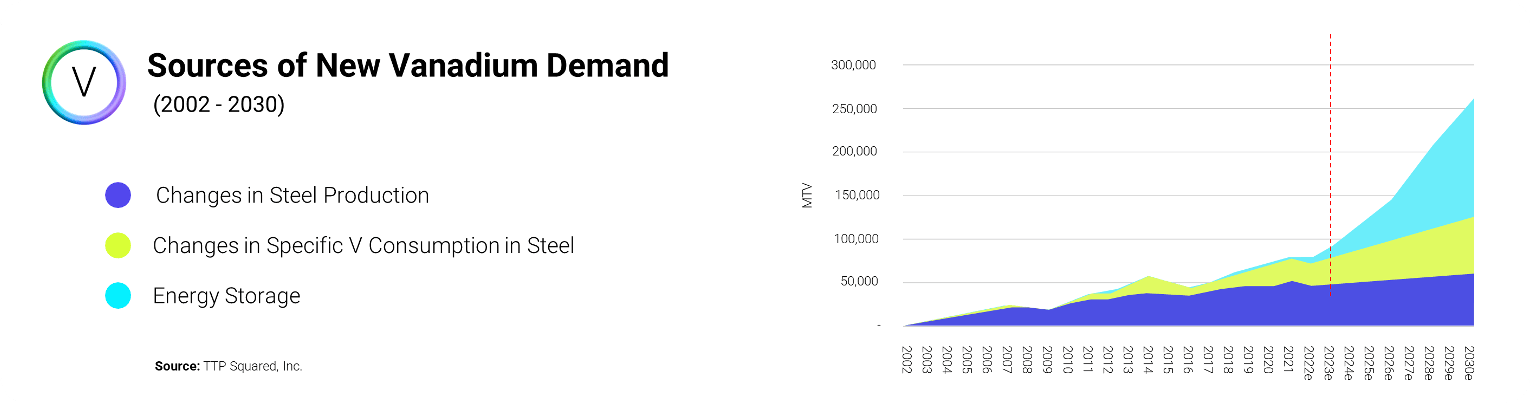

Traditionally, vanadium is used in high strength steel but is increasingly being used in Vanadium Redox Flow Batteries (VRFBs) for large scale, battery storage systems that store excess power from the grid for use during peak demand periods.

Managing director of vanadium explorer QEM (ASX:QEM) Gavin Loyden says VRFB has the highest potential to capture the largest market share of energy storage in the coming decades.

“We require around 24GWhr of storage just in Queensland alone, so the market here in Australia is huge,” he said.

The Accenture paper reckons the State’s vanadium reserves could be converted to around 2,000 GWh.

QLD’s $75m commitment to vanadium

Loyden says Queensland is putting its money where its mouth is, backing vanadium with a $75m commitment to the Queensland Resources Common User Facility (QRCUF) facility that is being built by the State Government in Townsville.

“This is facility designed to allow vanadium proponents to demonstrate their extraction processes at scale and this will in turn lead to support for off take arrangements and financing support from Goverment. The facility will then be opened up to the wider critical minerals industry,” he said.

The facility is expected to commence operations in 2025 and will focus initially on vanadium processing, with capacity to expand over time to encompass processing other critical minerals like cobalt and rare earth elements.

QEM is keen to make use of the facility. The company is looking to produce ~10,000t/yr of high purity V2O5 (99.5%) which is suitable for VRFB electrolyte (but can also fall back into the other established markets for vanadium) and even has an agreement to take all of the spent catalyst from Sun Metals acid production for the next five years (with an option for a further five years after that) with the plan to convert the industrial waste stream into high grade V2O5 for VRFB electrolyte production.

“We have already processed samples of catalyst and produced a 99.6% V2O5 from this waste,” Loyden said.

“The intent is to process this material through the QR-CUF facility, as this leaching circuit will be universal to other producers also and will form part of what is to be built at the Townsville facility, meaning we will not have to pay for the circuit itself, just the OPEX and this will get some electrolyte into the eco-system quickly, so that battery manufacturers can get a start on delivering batteries, while we are developing our main project in Julia Creek.

“This will also us to develop those relationships with VRFB manufacturers earlier, whilst awaiting primary production from the mine.”

$5 billion for the CopperString upgrade

And the investments don’t end there. QEM is set to power its Julia Creek vanadium and oil shale project with renewable energy after the Queensland Government announced a major purchase.

The deal will see the Queensland government spend $5 billion to buy and upgrade the CopperString 2.0 project to connect the North West Minerals Province (NWMP) – where Julia Creek is located – with the national energy grid near Townsville.

“CopperString will provide the transmission lines that allows that extra generation capacity to be fed into the National Electricity Market (NEM) and will not only firm our load but provide power to the NWMP as well as the coast,” Loyden said.

“[It’s] the final catalyst to bring this project to a reality, so it is vital that it comes online as quickly as possible and we commend the Queensland Government for seeing the advantage of building this project which will help to realise some of the vast resources of the NWMP and at the same time, adding substantially to Queensland’s renewable energy targets.”

Next steps for QEM include completing a scoping study in the next few weeks and then delving straight into a Pre-feasibility Study (PFS) which is expected to take around nine months, Loyden said.

QEM share price today:

Who else has a vanadium stake in Queensland

There’s a bunch of vanadium players in the State that could benefit from increased investment.

The Queensland Government has also provided funding to the tune of $26 million for the development of Australia’s first commercial-scale vanadium flow battery electrolyte manufacturing facility, (also to be built in Townsville) by Vecco Group (unlisted) which is developing the Debella critical minerals mine.

Townsville will be home to Australia’s first commercial-scale vanadium flow battery manufacturing facility.

This is what it’s all about. Queensland minerals, manufactured into critical parts by Queenslanders, to supply Queensland with reliable renewable energy. pic.twitter.com/fz1d4L8zdv

— Annastacia Palaszczuk (@AnnastaciaMP) March 7, 2023

The facility is expected to begin production later this year, and once operational, it will produce nine megalitres of electrolyte annually, equating to an energy storage capacity of 175MWh annually – with plans to expand to 350MWh.

Richmond Vanadium Technology (ASX:RVT) listed late last year with IPO proceeds earmarked to complete a Bankable Feasibility Study for its namesake project in North Queensland, which has a resource of 1.8 billion tonnes grading 0.36% V2O5 for 6.7Mt of vanadium pentoxide and an Ore Reserve of 459Mt at 0.49% V2O5 for 2.25Mt of contained V2O5.

And last month, the Queensland Gov finalised the terms of reference for an Environmental Impact Statement (EIS) for the proposed $242.2 million mine.

RVT is now working on the draft EIS, and reckons its mine could extract up to 4.2 million tonnes annually of vanadium ore, processed on site to produce 790,000 tonnes annually of vanadium concentrate.

“There are huge opportunities to grow production of critical minerals in the North West Minerals Province and our investment in Copperstring 2032 and the Queensland Resources Common User Facility will support companies like Richmond Vanadium Technology,” Resources Minister Scott Stewart said.

There’s also Critical Minerals Group (ASX:CMG) who listed last year with the Lindfield vanadium project in Queensland, with Japanese petroleum heavyweight Idemitsu on the register (32% stake).

The project has a resource of 210Mt at 0.39% V2O5 (vanadium pentoxide) and this month the company increased the grade (+10%) and tonnages (+73%) to 363mt @ 0.43% V2O5 and 4.8% Al2O3.

The company also holds the Figtree Lake project and Lorena Surrounds project in Queensland which are prospective for copper and gold.

RVT and CMG share prices today:

What other battery metals players are there?

The Queensland Government is also investing $5 million to develop the Queensland Battery Industry Strategy which will help deliver the Australian Government’s investment of up to $100 million in an Australian-made Battery Precinct in Queensland.

The strategy is focused on leveraging economy minerals — such as copper, zinc, vanadium and cobalt — and battery manufacturing capabilities.

The Accenture paper was part of the development of this strategy, with the drafting now underway and due for release in mid 2023.

Notable copper plays in QLD include QMines (ASX:QML) with its flagship Mt Chalmer project – a historic mine that produced 1.2Mt at 3.6g/t gold, 2% copper and 19g/t silver between 1898 and 1982.

The company has a two resources that it plans to deliver in the near term at the Mt Warminster and Botos prospects ahead of targeted production in 2025, subject to a final investment decision.

QMines’ focus in 2023 is on transitioning its Mt Chalmers deposit towards production whilst continuing to undertake further regional exploration and making new discoveries.

Alma Metals (ASX:ALM) is another explorer who recently announced further assays from its core drilling at the Briggs copper project and had extended the copper-molybdenum sulphide mineralisation.

Alma is making good on its deal with Canterbury Resources to earn up to 70% of the project by spending up to $15.25m on exploration over nine years, and has its sights set on an easy-mining, shallow porphyry deposit.

Porphyry mines are huge, responsible for ~60 per cent of the world’s copper and their large volumes make up for the low grades, typically between 0.2% to 0.7% copper equivalent.

Then there’s Austral Resources (ASX:AR1), a copper cathode producer and copper miner which last month released an independent pit optimisation study that applied a A$12,500 per tonne copper price to previously mined pits (Lady Annie, Lady Brenda, Mount Clarke, and Flying Horse), confirming an additional ~94,000 tonnes of contained copper could be mined by Austral in the next two to five years.

It also flagged an additional lens adjacent to the existing Lady Colleen deposit was identified that could potentially offer a further ~36,000 tonnes of total copper production to Austral’s mine life, pushing the total to an additional ~130,000 tonnes of contained copper.

The company plans to fast-track development of these pits, combining them with existing production at Anthill to mine an additional 20,000 – 23,000 tonnes of Contained Copper oxide ore – increasing Austral’s current oxide production by 110% between 2024 and 2025.

QML, ALM and AR1 share prices today:

Cobalt, nickel, and manganese projects

The State Government is also supporting projects like Queensland Pacific Metals’ (ASX:QPM) Townsville Energy Chemicals Hub (TECH) nickel-cobalt project and battery metals refinery, announcing in March TECH had received Significant Investment Project status.

Possibly spurred on by the fact that the company nabbed an offtake deal with EV car maker General Motors last year to purchase all uncommitted nickel and cobalt sulphate produced in the first 15 years of Phase 1 of the TECH Project.

Under the deal, GM agreed to investment up to US$69m ($108m) in equity in QPM including an initial binding commitment of US$20.1mn at A$0.18 per share.

According to a recent feasibility study, stage 1 of the TECH project would produce 16,000t nickel and 1750t cobalt in sulphate per year, with additional iron ore and high purity alumina credits.

Stage 1 steady state annual EBITDA would be $546m, with a NPV and IRR (pre-tax) of $2.6bn and 18.4%, respectively.

Aeon Metals (ASX:AML) is a copper-cobalt play in the State, which updated the mineral resource estimates for its advanced Walford Creek copper-cobalt project in March by 65% to 72.6 Mt at 1.6% CuEq for 1,173 Kt of CuEq metal.

“Of particular note is the high-grade Amy Mineral Resource, delivering 8.3Mt at 1.35% copper and 0.22% cobalt (2.95% CuEq),” MD and CEO Dr Fred Hess said at the time.

“Globally, Walford Creek is now arguably the largest primary cobalt deposit in Australia, and, the Copper Mineral Resource at Amy (0.22% cobalt) is comfortably the highest grade substantial cobalt resource in Australia.”

For nickel and cobalt, we have Australian Mines’ (ASX:AUZ) Sconi project, which has seen some delays and a recently settled civil complaint from ASIC over disclosures made about offtake agreements in 2017 and 2018.

The company is targeting a final investment decision for 2025 and says discussions are underway with offtake partner LG Energy Solution to amend the agreement to meet future cobalt and nickel requirements.

Firetail Resources (ASX:FTL) which listed last year with assets including the Mt Slopeaway nickel-cobalt-manganese project, where six historical holes were ‘twinned’ to confirm the resource of 4Mt @ 1% Ni, 0.2% Co and 1% Mn.

QPM, AML, AUZ and FTL share prices today:

At Stockhead we tell it like it is. While QEM, Alma Metals and Austral Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.