Queensland pulls out all the stops to secure critical mineral supply chains

Queensland is pushing hard to be a leader in supply critical minerals. Pic: Getty Images

- Critical minerals supply chains under threat from geopolitical tensions and shortages

- Queensland leveraging world-class deposits and skilled workforce to secure future tech needs

- Initiatives such as the $170m fund are supporting extraction and processing of critical minerals in the state

Critical minerals of all types are essential to a whole range of high technology applications that are essential for modern economies and national security.

However, supply chains for these materials, be they battery metals, rare earths or even copper, are at threat whether from geopolitical tensions impacting on access or just simply supplies not being sufficient to meet needs.

The desire to secure these supply chains is one that’s clearly understood by a Queensland state government keen to leverage its world-class mineral deposits and highly skilled workforce.

Queensland already has a well-established copper mining industry while new players are emerging in vanadium, rare earths, cobalt and graphite.

To really boost the sector, the state government is moving to reduce approval times, cut red tape and provide industry with the certainty to develop projects.

It established the Resources Cabinet Committee in December 2024 following the victory of the Liberal National Party in October 2024 to bring key decision-makers together and ensure fast, clear decisions that keep Queensland globally competitive.

The state government has also released an updated Critical Minerals Prospectus that showcases the state’s most promising, investment-ready critical minerals projects as a direct invitation to investors.

Funding support

Queensland also supports the critical minerals sector with funding.

Along with federal government funding initiatives such as the $7bn Northern Australia Infrastructure Facility and Export Finance Australia, the state also offers the Queensland Investment Corporation-managed $170m Queensland Critical Minerals and Battery Technology Fund (QCMBTF).

The QCMBTF supports businesses looking to enhance the extraction and processing of critical minerals in Queensland.

It also aims to accelerate the development of battery technologies and the production of precursor and advanced materials.

The most recent beneficiary is Ark Mines, which has just secured a $4.5m investment from QCMBTF to accelerate near-term works at its Sandy Mitchell rare earths and mineral sands project (see below).

ASX Queensland critical minerals plays

There are plenty of junior companies looking to capitalise on Queensland’s push to support the sector.

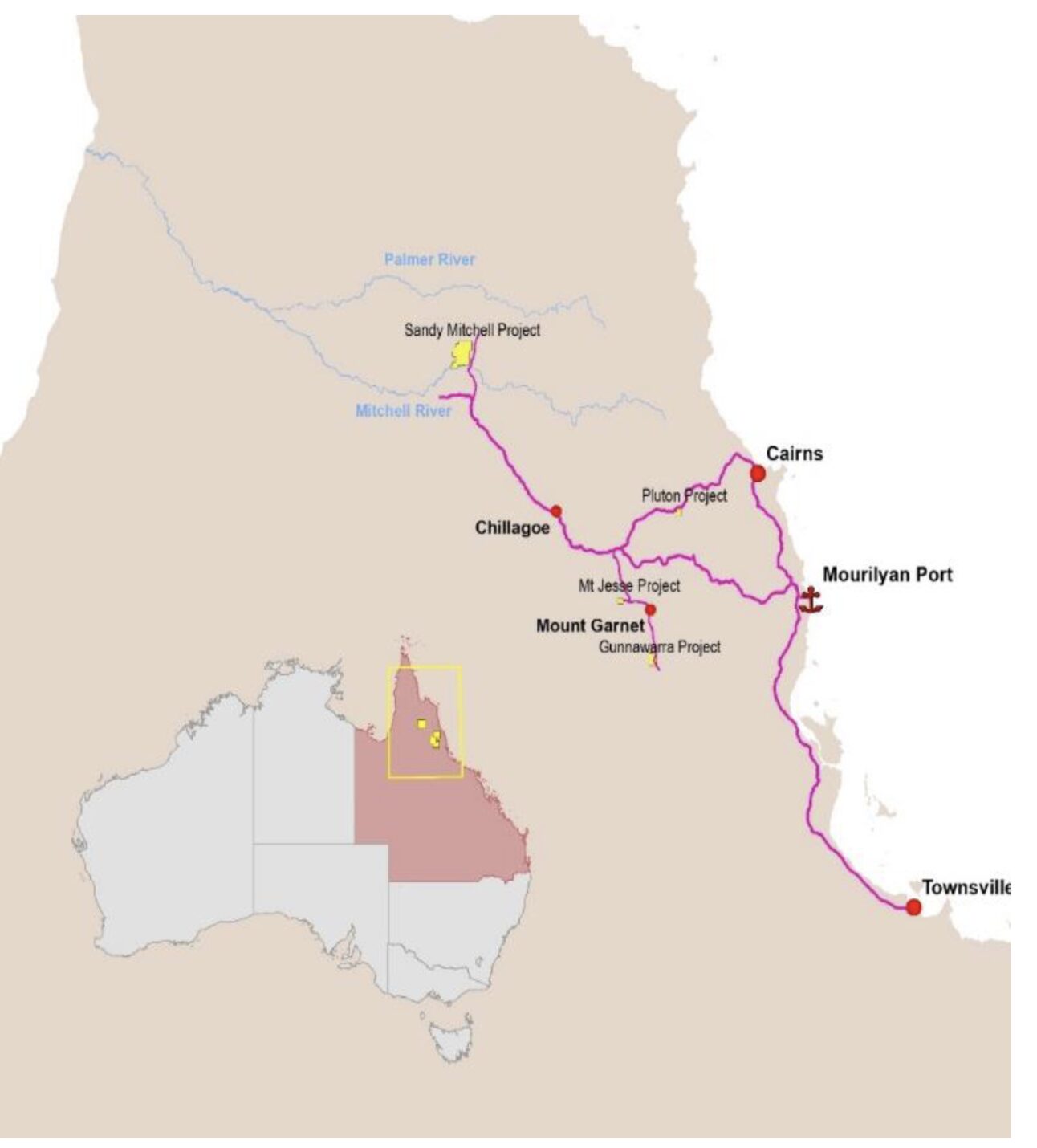

As mentioned above, Ark Mines (ASX:AHK) has been pushing to advance its Sandy Mitchell project, which has a high confidence measured resource of 71.8Mt at 1732.7ppm monazite – a mineral containing REEs – equivalent.

Proceeds from Ark’s $4.5m investment from QCMBTF will be used to accelerate near-term works such as the start of Stage 3 infill drilling to increase measured resources.

There is potential for exploration to deliver scale that could place it in a similar ballpark as Red Metal’s (ASX:RDM) Sybella project in northwest Queensland given the exploration target of 1.3 billion to 1.5 billion tonnes at 1,286 to 1,903 ppm MzEq.

A scoping study released in December has placed a $120-150m cost on a development underpinned by the current measured resource.

This is expected to generate annual EBITDA of $45m-$53m and annual post-tax-free cash flow totalling ~$25m-30m while payback is expected within 3-4 years from first rare earth mineral concentrate production.

It also benefits from having near-surface mineralisation that only requires simple, low-cost gravity separation to process, two factors which would enable the project to be quickly developed.

With funding for all near-term activity already in place, the company is currently carrying out a detailed metallurgical testing program to improve both the beneficiation process and mineral separation process for rare earths and heavy minerals at Sandy Mitchell.

Results from the drilling and metallurgical testing will feed into a comprehensive pre-feasibility study scheduled for early 2026 that is expected to deliver significantly improved economics across all key project metrics.

QEM (ASX:QEM) holds the Julia Creek vanadium and oil shale project that has a resource of 2.87Bt at 0.31% V2O5 with 461Mt at V2O5 in the indicated category.

It also hosts an in-situ 6.3 million barrels of oil equivalent resource.

Interest in vanadium as a battery metal has buoyed over the past decade as an alternative to the widely adopted lithium-ion batteries around the world.

Vanadium redox flow batteries were pioneered by Australian chemical engineer Maria Skyllas-Kazacos in the 1980s at the University of New South Wales.

In late June 2025, the Queensland government finalised the terms of reference for an environmental impact statement for Julia Creek, allowing the company to progress its environmental assessment.

Critical Minerals Group (ASX:CMG) holds the 295km2 Lindfield vanadium project in northwest Queensland near the town of Julia Creek.

The project has a resource of 713Mt at 0.32% vanadium pentoxide with over 68% in the higher confidence indicated category.

Part of this resource is contained within the oxidised zone, which also features higher grades.

This is expected to result in significantly lower vanadium mining costs due to the low strip ratio.

It recently received a $900,000 progress payment under its $2.7m grant agreement with the Department of Industry, Science and Resources after achieving key milestones in the development of its domestic vanadium electrolyte end-to-end supply chain.

This includes pilot plant test work and processing flowsheet development, environmental field studies, preparation of the mining lease application, identification of the preferred bulk sampling site, and completion of front-end engineering and design for the vanadium electrolyte manufacturing facility.

While Green Critical Minerals (ASX:GCM) is focused on its Very High Density graphite block technology, it does hold the Torrington minerals project in Queensland.

The project has 4-6km2 of silexite bodies. Processing of silexite is expected to yield high recoveries of both tungsten and topaz.

Tungsten is used in aerospace, defence, and industrial applications requiring extreme heat resistance. Its strength and durability also makes it essential for cutting tools and wear parts that are used in mining, machining and precision manufacturing.

At Stockhead we tell it like it is. While Ark Mines, Green Critical Minerals and QEM are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.