Q+A: Platinum and palladium stock Future Metals wants ‘a mining operation of global scale’

Pic: Getty

The group of six platinum group metals (PGM) — platinum, palladium, rhodium, iridium, ruthenium and osmium — are highly valued.

The biggest demand sector for PGMs is ‘auto catalysts’ in car exhausts which reduce polluting emissions in ICE and hybrid vehicles. These catalytic convertors account for 40% and 80% of annual platinum and palladium production, respectively.

An ongoing supply deficit and increased catalytic convertor demand has seen prices, especially for palladium, soar since 2019.

Platinum currently sells for $US983/oz, which is chump change next to palladium ($US2,220) and rhodium ($US19,000/oz).

Recently, palladium prices spiked to all-time highs of ~US$3100/oz after sanctions and boycotts escalated against Russia, which produces about 40% of the world’s mined palladium.

This price shock highlights the importance of where a commodity is sourced, and puts explorers in Australia – a safe, tier 1 jurisdiction – in a great spot.

Looking forward, there’s also the accelerated a shift towards green hydrogen, a large growth market for platinum which is used in electrolysers and fuel cell vehicles.

Future Metals (ASX:FME) has one of the most advanced PGM projects on the ASX.

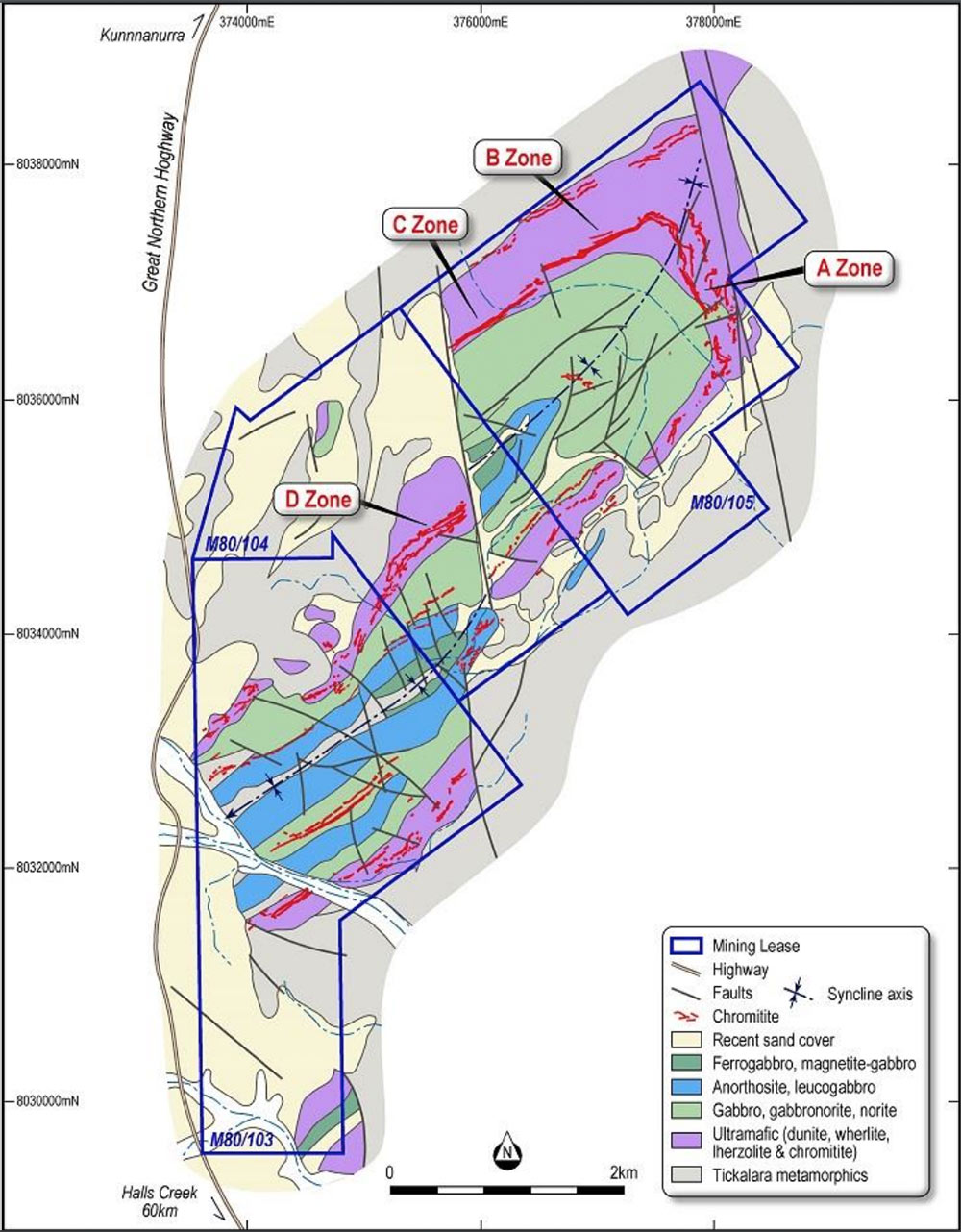

‘Panton’, in the Kimberly region of WA, has a pre-existing high grade 2.4Moz palladium-platinum-gold (plus nickel, copper and cobalt) resource, which FME inherited along with a wealth of data and multiple economic studies from the project previous owners.

FME CEO Jardee Kininmonth explains why Panton is going to be Australia’s first PGM operation.

Tell us about the history of the Panton project.

“It was discovered in the ’60s. A company called Pancontinental Mining did some drilling and put out a study in the 80s before [formerly listed] Platinum Australia (ASX:PLA) picked it up in 2000,” Kininmonth says.

“At the time Panton already had about 10,000m of drilling put into it. Platinum Australia drilled another 35,000m and put together the current high grade +2.4Moz resource estimate, updated now for 2012 JORC.

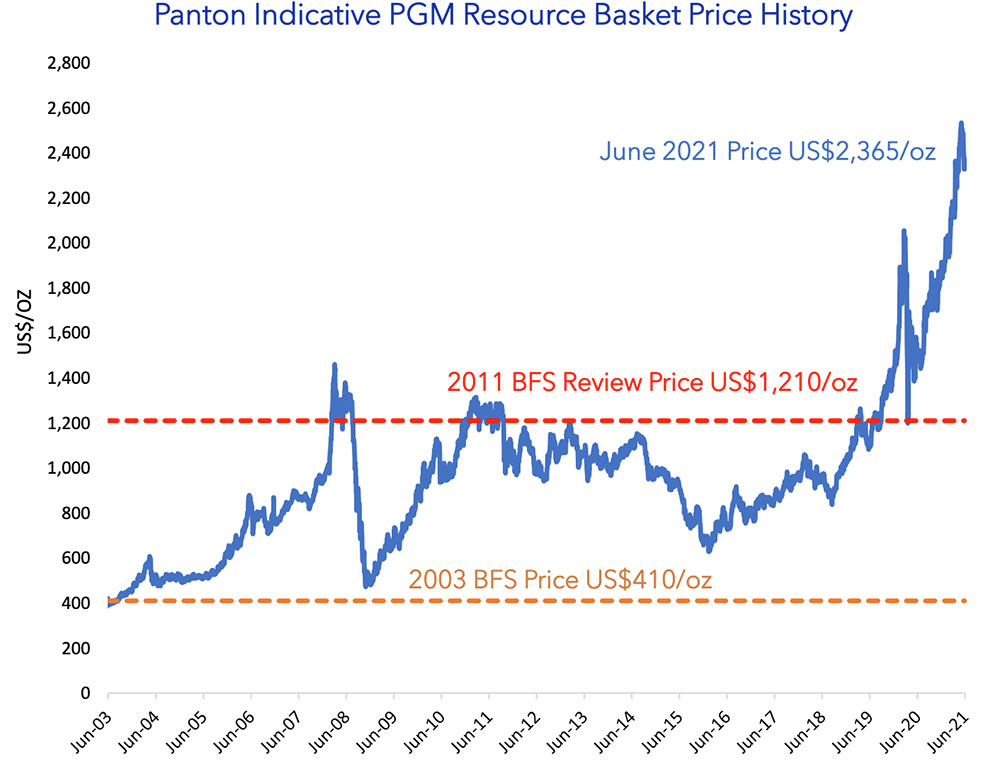

“During that 2000 to 2003 period, they also put a bankable feasibility study (BFS) [advanced economic study] around an underground operation at Panton but were a victim of prices at the time as well as some metallurgy issues.”

[Metallurgy involves removing valuable metals from ore, and then refining the extracted raw metals into a purer form.]

“Platinum and palladium were both around $US400 to US$500/oz back then.

“Platinum Australia ended up turning their focus to developing their Smokey Hills project in South Africa, before going into administration in 2012. Nickel miner Panoramic Resources (ASX:PAN) bought it just before Platinum Australia went into administration.

“Nickel has always been the main game for Panoramic, but Panton was only 70km up the road from their Savannah operation. They were looking at it as a potential supplementary feed source for that existing mill.

“While Panoramic didn’t do any drilling over the eight years they held the project, they did a lot of met work, and managed to unlock a high-grade concentrate suitable for feeding into the South African smelters.

“Future Metals has now acquired all this work from both Platinum Australia and Panoramic with the project, and we are taking it in a different direction that hasn’t really been looked at before – a bulk tonnage mining project.”

What’s the difference?

“Platinum Australia & Panoramic went at it from a high grade, underground mining angle. We are looking at it as a large open pit and underground operation,” Kininmonth says.

“In simple terms, the strike of the current resource – 14Mt at 5.2g/t – is 3.5km, down to a depth of about 600m. The mineralised width in that resource (at +2g/t cut-off) is about 2m.

“What we discovered by going through previous work done by Platinum Australia is that mineralisation extends laterally by up to ~50m at a lower grade.

“You have these high-grade reefs, and around those reefs is ‘dunite’ mineralisation which grades between 1g/t and 1.5g/t. The dunite also hosts a lot of nickel, with a fairly consistent grade of 0.20% throughout the orebody. Platinum Australia often didn’t assay the dunite, and terminated holes in mineralisation because they were always just chasing the reef.

“We put in 19 new holes to prove up the lateral extent of that 3.5km of strike, and recently released results like 140m at +1g/t palladium eq.

“A representative true width you would expect to be around 25m to 50m; far bigger than 2m.

“The mineralisation here is very continuous and is outcropping at surface. You can follow the reefs along that complete 3.5km extent. It’s a great orebody.”

What makes you think you can succeed at Panton where others have failed?

“Firstly, there has been a fundamental change in the demand drivers for platinum and palladium over the past few years, particularly palladium. The increase in nickel prices on the back of EV demand is also a boon for the project,” Kininmonth says.

“The other thing we haven’t been talking much about is the other noble elements, particularly rhodium and iridium. The high-grade resource has a fair amount of rhodium which is currently selling for around $20,000/oz.

“You don’t need much of it to improve the economics.

“Second is on the metallurgy side. Panoramic applied their big pool of talent on the met side to the challenge and unlocked a decent recovery and decent concentrate grade.

“There will be material differences to the feed sources we will be using, but we have all the work from Platinum Australia and Panoramic behind us and a really strong team looking at that currently to create a saleable concentrate.”

I was going to say – Future Metals has a fairly experienced leadership team for a small cap.

“I come from [lithium miner] Galaxy Resources, which merged with Orocobre to create the $7bn Allkem last year,” Kininmonth says.

“A large part of my role in corporate development, aside from managing the merger, was the commercial assessment of potential downstream partners for Galaxy’s assets. Prior to Galaxy I was at EMR Capital, one of the biggest mining private equity funds globally.

“Future Metals Technical Lead Brian Talbot was essentially COO at Galaxy. He had operational oversight of the Mt Cattlin mine, and technical oversight of the development of the Sal de Vida project flowsheet. He started his career commissioning PGM and gold plants in South Africa and has a strong background in both minerals processing and hydrometallurgy.

“Shane Hibbird also adds a lot of value to the team in that he was the senior exploration geologist running the drilling programs in the Platinum Australia days.

“He was there from 2001-2003 and was responsible for that initial 35,000m of drilling.”

Is there a lot of value in just having someone who was heavily involved back in the day? Like – ‘Nah we tried that, didn’t work. Try this’.

“100 per cent,” Kininmonth says.

“There is so much information that doesn’t make it into a data room or onto a Feasibility Study.

“It is huge advantage for us [to have Shane] as Future Metals designs our drill programs, and also provides some context for operating in the Kimberley region.”

And I guess it’s hard to get a strong management team involved in a crap project.

“Exactly, I didn’t put a pin in my prior sabbatical plans to manage moose pasture,” Kininmonth says.

What are some of the major project milestones coming up?

“We have 47 drill holes we are waiting on from the assay lab,” Kininmonth says.

“They will underpin a resource update that we will look to release in May, which will coincide with a metallurgical update to guide the market on where we are at in terms of a processing solution.

“Following that, we will kick off a scoping study to give the market an idea of what Panton will look like, and what project configurations we will be exploring in the PFS [pre-feasibility study].

“That PFS will kick off after the scoping study. We would look to have the PFS out to the market by Q2, 2023.”

Are you confident the scoping study numbers will be good?

“I think they will be very well received,” Kininmonth says.

“The first number which I think the market isn’t aware of is how big the resource could be.

“If we use the same strike length of 3.5km but take our mineralised width from 2m out to 20-50m — even though we would only go down to 200m — it is significantly larger the 2.4Moz we are working with currently.

“The scoping study will outline a mining operation of global scale.”

Are you going to be exploring further out along that 12km of strike?

“There is significant dunite mineralisation and outcropping reefs outside of that 3.5km of strike we would look to drill out taking the bulk tonnage route,” Kininmonth says.

“In particular, there’s a 2.5km-long Northern Anomaly which shows thick mineralisation – 1.2g/t palladium eq over 80m or so.

“The other exciting thing we are still trying to wrap out heads around geologically are these zones of sulphides – copper, nickel, and gold — which are ‘cross cutting’ the reef system.

“Because of the way drilling is oriented we aren’t intercepting them when we drill the reef. We are currently completing a detailed geological review which will inform how we better target these zones.

“The orebody is also open at depth and flattening so as part of this review we are determining the most prospective zones to put a few deeper holes into.”

To summarise — why should investors take a closer look at Future Metals?

“We believe we are undervalued compared to our peers,” Kininmonth says. “You would have to form a view about where you think our resource is going, but I think it’s fair to say that the leadership team believes the project has significant resource growth potential which will be realised when we release our new MRE in May.

“We are also on granted mining leases, right next to a well-maintained major highway, there’s a port within 300km, and potential access the hydro scheme up there.

“We also have a very strong management team across geology, processing and corporate.

“We aim to be the first PGM player in production in Australia.”

FME share price chart

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.