Producers play a different tune as coal climbs out of the crapper, again

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Last year was tough, but 2020 is shaping up nicely for coal players on the ASX — thanks to the recently signed US-China phase one trade deal.

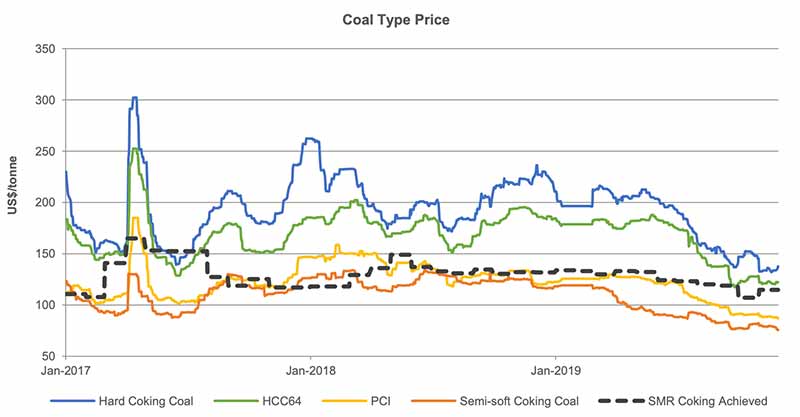

A few days ago, Stanmore Coal (ASX:SMR) warned that coking coal prices had fallen ~30 per cent since mid-2019, which would have a large impact on its earnings guidance.

This was driven by US-China trade tensions, Chinese import quotas and reduced demand in general.

Low LNG prices certainly didn’t help either.

There’s no doubt demand growth will continue to slow for thermal coal long term, (the type used in power stations) but dying? Not yet.

There’s also no replacement for steel-making coal (called metallurgical or coking), which means demand is impacted more by economic factors like trade wars.

$2.6 billion market cap Whitehaven Coal (ASX:WHC) says the recently signed phase one trade deal will “provide a boost” to both thermal and coking coal demand.

“Whitehaven continues to see strong end user and trader demand for high-quality thermal coal,” it told investors.

“The dynamics of the steel market are impacted by the trade tensions between China and the US, so the signing of the phase one trade deal should have a welcome positive impact.”

Russia-based producer Tigers Realm (ASX:TIG) agrees that 2020 is starting positively for coal.

“As expected, the resetting of import quotas in China has led to a rebound in demand,” the company told investors today.

“This has pushed up thermal coal and coking coal prices. A shortage of low ash South African thermal coal has also helped to support prices in India and the Asia Pacific region (where Tigers Realm sells its coal).”

Producers, seeing prices finally start to move, have been pushing for higher prices, Tigers Realm says.

“There appears to be some optimism in the markets that a thawing in the US-China relationship may be a positive catalyst for economic activity in 2020,” it says.

“This would support coal prices in TIG’s markets.

“At this stage, we expect to see continued improvement in coal pricing through Q1 into Q2 2020.”

READ: 2020 energy trends in Asia and what they mean for Australia

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.