Has China snubbed Aussie coal for good?

Is it China's turn to snub Oz? Pic: Getty

There is little sign China’s indefinite ban on Australian coal imports is going to be lifted anytime soon and it’s holding down coal prices.

Back in February news was widespread that North China’s largest port, the Port of Dalian, had banned Australian coal imports indefinitely and placed a 12 million tonne cap on all other international imports.

But experts suggested a long-term ban would be unlikely.

Mike Cooper, a senior editor covering the coal market for S&P Global Platts, told Stockhead that Australian coal cargoes were still getting tied up in extended customs clearance times of up to 60 days.

“This is making buyers in China risk averse when coming to the market for thermal coal imports, and they have been tendering for other grades such as Indonesian,” he said.

“China also has an unofficial cap on its coal imports of around 280 million tonnes (coking and thermal coal combined), and because imports have been running ahead of trend in the first half of the year, there is less room left for imports in the second half.”

On top of that, Japan is backing away from thermal coal in favour of more environmentally friendly options.

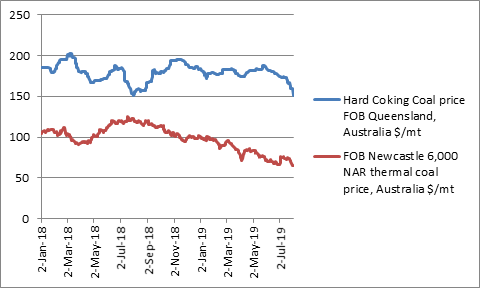

“In terms of coal prices, these have been on a downward trek these past couple of months,” Cooper said. “Newcastle 6,000 NAR, the grade that mostly goes to Japan, is trading this week at its lowest point since August 2016.

“This is despite a summer heatwave in Japan for the past few weeks.

“Japan, we hear, is tapping into more solar-generated electricity, instead of fossil fuels like thermal coal and some of its idled nuclear plants are back online, also reducing the need for coal.”

Australia gearing up for more coal exploration

But Australia has no immediate plans to wind back its coal mining activity.

The two largest coal mining states are Queensland, with 63 per cent of Australia’s black coal resources, and New South Wales, which accounts for about 23 per cent.

On Friday the Queensland government opened up five new exploration areas with “high potential” for steel-making coal and thermal coal for electricity and industry.

But there is likely to be some backlash from anti-coal activists that are still reeling from the government’s decision to approve Adani’s contentious Carmichael mine.

The five areas, made up of 147 sub-blocks, are in the Bowen Basin, a 60,000sqkm area in central Queensland that hosts Australia’s biggest coal reserves and virtually all of the known mineable prime coking coal, according to the Bowen Basin Underground Geotechnical Society.

“The coal industry supports 36,000 jobs across the state, and this is an investment in future projects and jobs,” Queensland mines minister Anthony Lynham said.

“Exploration is the lifeblood of the resources sector, and the thousands of jobs and business opportunities it provides, particularly in regional Queensland.”

Coal was a big factor in the outcome of the recent federal election – with Labor failing to win valuable seats in Queensland because of its vague stance on Adani’s Carmichael mine.

READ: Does a re-elected Coalition government mean the dawn of a new age for coal?

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

A large cohort of Queenslanders rely on coal mining to provide for their families.

Resource Industry Network chairman David Hartigan told Stockhead previously that even if regional Queenslanders didn’t work directly in the coal industry, “an awful lot” of them were connected to it in some way.

Queensland Resources Council CEO Ian Macfarlane said combined metallurgical and thermal coal were Queensland’s largest export commodity.

“The value of those exports increased by 12 per cent to almost $37 billion over the 12 months until the end of May this year,” he said.

“Coal exports earn Queensland more than $100m every day.”

Warren Pearce, the head of industry advocate Association of Mining and Exploration Companies, said recently Queensland’s future prosperity was heavily dependent on the health of its mining sector.

“With stamp duty and GST income significantly reduced, the expected $5 billion income the state will receive from royalties is critical to its ability to meet its targets,” he said after the 2019-20 Queensland State Budget was handed down.

Since 2015, when Labor came into power in Queensland, resources companies have invested in or committed more than $20 billion to projects in the state.

Aussie coal explorers call for more land

The new exploration areas that have been released follow interest from resource companies, according to the Queensland government.

There are several ASX-listed coal explorers with projects in Queensland.

Stanmore Coal (ASX:SMR) is producing from the former Vale-owned Isaac Plains mine in the Bowen Basin that it picked up in 2015 for just $1.

In FY19 Stanmore produced 2.4 million tonnes of coal, beating its guidance of 2.3 million tonnes and a 76 per cent increase on FY18.

Full-year EBITDA (earnings before interest, tax, depreciation and amortisation) is expected to come in between $154m and $156m – the top end of Stanmore’s target of $140m to $155m.

Bounty Mining (ASX:B2Y) is also a producer in the Bowen Basin.

In its latest quarterly, the company said its Cook coal operation set several new production records during the June quarter.

Second-half FY19 production jumped 24 per cent on the first half.

While Allegiance Coal’s (ASX:AHQ) flagship project is in British Columbia, Canada the company also has two coal projects in Queensland.

However, the Kilmain project in the Bowen Basin and the Back Creek project in the Surat Basin remain under review.

Bowen Coking Coal (ASX:BCB) is exploring ground in Queensland’s Bowen Basin, specifically at its Cooroorah project.

The project lies between the $3.1 billion Coronado Global Resources (ASX:CRN) owned Curragh mine and the Anglo, Marubeni and Sojitz owned Jellinbah mine.

Lustrum Minerals (ASX:LRM) owns the Consuelo thermal coal project south of Rolleston in the Bowen Basin.

Moreton Resources (ASX:MRV) has coal projects in the Tarong, Bowen and Surat Basins, and TerraCom (ASX:TER) has ground spanning 9,500sqkm, including land in the Bowen Basin.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.