Predators and Prey: Lithium in the Gascoyne

Tightening capital markets and strong commodity prices are combining to create the “ideal” conditions for consolidation. Pic via Getty Images Pic: Getty Images

- WA’s Gascoyne region has captured investor attention thanks to DLI’s lithium discoveries

- As the most mature operator in the district, it is an obvious takeover target

- But who are some lithium microcaps in the region that could well be on the consolidator’s radars?

Merger and acquisition (M&A) activity can be a huge value creator for shareholders, especially for those invested in the target firm. Stockhead’s Predator & Prey column examines mining’s biggest corporate power plays and some of the ASX explorers ripe for consolidation.

WA’s remote, under-explored Gascoyne region has captured the hearts (and wallets) of resources investors in recent times, thanks to a flurry of lithium discoveries.

When Delta Lithium (ASX:DLI) began exploring its Yinnetharra project near Gascoyne Junction late last year, the Mid-West region of WA was anything but a lithium hub.

But numerous big hits, like 56m at 1.12% lithium in a field full of “great big slabs of unmapped pegmatites sticking out of the ground” now has Yinnietharra “looking more like a province than a project”.

It sparked a pegging rush, featuring big names like FMG and a collection of savvy small cap explorers.

Meanwhile, Gina Rinehart’s Hancock Prospecting and Chris Ellison’s $13.39bn Mineral Resources (ASX:MIN) are jostling for control of Delta, which is concurrently working towards first production at the Mt Ida project and a maiden resource at Yinnietharra.

Earlier this week, the acquisitive Ellison took another swing at regional consolidation, joining the ranks on DLI’s board as non-executive chairman as MIN increased its stake to 17.44%.

Delta: an obvious takeover target

Latest research out of BDO suggests that more M&A activity could be on the way so long as cash balances remain high, commodity prices continue to come off, and equity valuations remain in discount territory.

Guy Le Page, director of Perth-based RM Corporate Finance says more corporate activity is likely in what is turning out to be a WA ‘lithium super province’.

“Consolidation is likely to happen where you have discoveries in and around bigger players,” he says.

“It is clear MinRes want to control as much lithium production out of WA as possible.

“I suppose Gina Rinehart and others are nipping at the heels, but MinRes have the dominant position and are the ultimate consolidator with all the downstream infrastructure.”

Delta has yet to define a resource for Yinnietharra but drilling to date suggest a significant discovery. As the most mature operator in the district, it is an obvious takeover target, Le Page says.

“They are moving ahead quite quickly, and I expect there could be some consolidation,” he says.

“Talking principally about Yinnetharra — attractive things are grade, strike length, width, mineable widths, near surface – from a mining and grade point of view, they tick a lot of boxes.

“They’ve got six pegmatite swarms, a lot of mineralisation down to 300 or 400m deep, mineralisation expanding over several kilometres.

“And metallurgy test work has been pretty good, getting recoveries on even some of the higher-grade concentrates of 60 to 70 per cent.”

What about the juniors?

Le Page doesn’t see consolidation on the junior end until they outline resources and for a lot of them, “they are a long way off”.

“My experience with M&A activity is that the Mineral Resources or the Albemarles want to see a project get a bit more advanced,” he says.

“They’ll certainly invest and put money in and take positions, but majors are more inclined to let the junior explorers in the district do the hard work first before they a lob a takeover bid.”

But there are a lot of explorers having a crack in the Gascoyne, which has potential to host 30-50Mt lithium resources, he says.

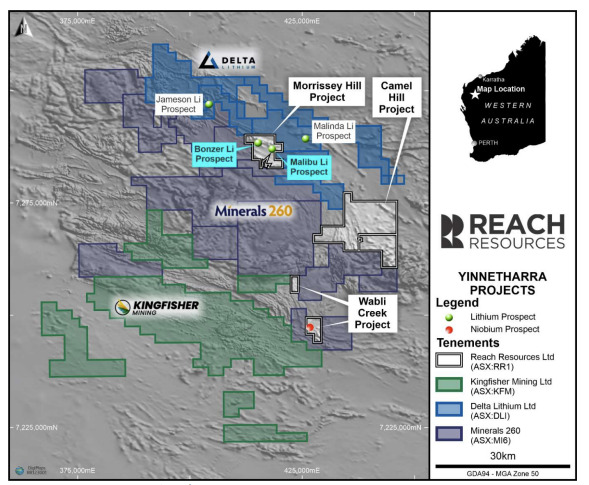

They include Tim Goyder-backed Minerals 260 (ASX:MI6) and its large Aston project, as well as active juniors like Voltaic Strategic Resources (ASX:VSR), Reach Resources (ASX:RR1), Dalaroo Metals (ASX:DAL), Kingfisher Mining (ASX:KFM) and Odessa Minerals (ASX:ODE).

“That is the feeling you get in the Gascoyne. There is enough of these pegmatites outcropping in that part of the Yilgarn that can deliver on that sort of scale,” Le Page says.

“Decent grades, widths and strike lengths – you need all these elements to form a fertile lithium province.”

Gascoyne lithium plays

Gascoyne small caps on the M&A radar

REACH RESOURCES (ASX:RR1)

One likely candidate is Reach Resources, which has ground wedged between Delta Lithium and Minerals 260.

The company’s Morrissey Hill project is along strike, and in the same system of rocks as Delta’s Malinda discovery at Yinnetharra.

In May, rock chips grading 2.3% lithium were returned at the Bonzer target, described by the company as a “clear walk-up target” and a “very large pegmatite”, sitting at least 1.5km long with lithium bearing minerals at surface.

Its Phase 1 drilling program recently intersected multiple, thick, stacked pegmatites at Bonzer where target pegmatite units have been returned in every hole drilled so far.

While still early days, Le Page says the company has good potential.

“They certainly have a bit of strike length, a couple of kilometres of strike length in fact, and they’re getting the right geochemistry and good grades.

“The next phase for them is to see what the drilling results look like.”

VOLTAIC STRATEGIC RESOURCES (ASX:VSR)

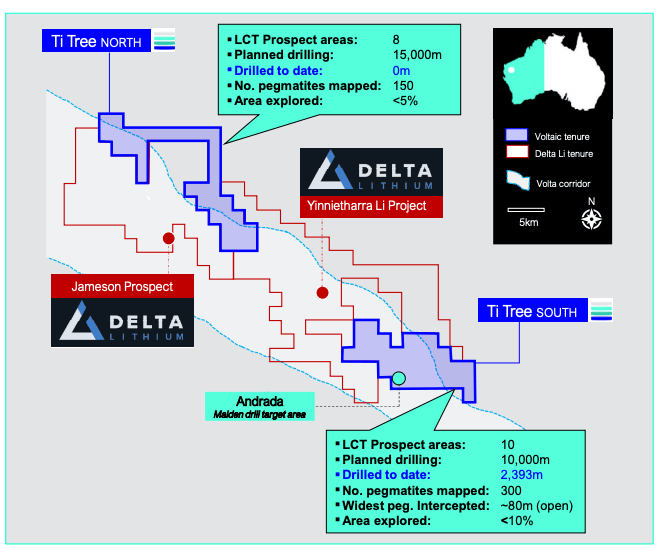

Voltaic Resources’ Ti Tree lithium project also sits around Delta’s potentially monstrous Yinnetharra tenements.

“Voltaic has a great ground position, they are absolutely in the right place from a structural corridor point of view,” Le Page says.

“They have come off the boil a bit, but I expect a lot more discoveries from them, they announced a 4,000m drill program in August which will test their many targets including 10 LCT targets in the southern part of the project.

“The company has 14km of strike at Ti Tree North and another 12km to the south so plenty of room to find zones of outcropping mineralised spodumene.

“To me, Voltaic are right in the guts of it and have found something pretty serious.”

At Stockhead, we tell it like it is. While Reach Resources and Voltaic Strategic Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.