Poseidon wins investors over, keeps the high-grade nickel coming

Mining

Mining

Poseidon is clearly ticking the boxes for investors, with its recent share purchase plan closing 4.5x oversubscribed and the final results of its resource definition program at the Golden Swan deposit delivering yet more high-grade nickel.

Poseidon Nickel (ASX:POS) is on the cusp of delivering a maiden resource for its Golden Swan deposit in Western Australia, having now completed resource definition drilling and presenting investors with the final results.

And just like previously, the results didn’t disappoint.

Top hits were 3.8m at 5.05% nickel, including 0.6m at 12%; and 5.15m at 8.62% nickel, including 0.5m at 13.1%, 0.5m at 14.7% and 0.35m at 16.1% nickel.

Given the continuous run of high-grade nickel results, it’s perhaps not surprising shareholders are eager to top up their holdings.

It’s a clear vote of confidence that Poseidon is on the right track when it receives oversubscriptions for up to $13.5m worth of stock, when the company was only aiming for $3m.

Poseidon has decided to accept oversubscriptions to raise a total of $6m. It boosts the coffers even further following the successful completion of a $22m placement.

That news saw shares close over 4% higher, and today they are on the move again.

Managing director Peter Harold said the funds raised would support Poseidon’s strategy to build the high-grade nickel inventory at its Black Swan project and progress the project toward a potential recommencement of operations in 2022.

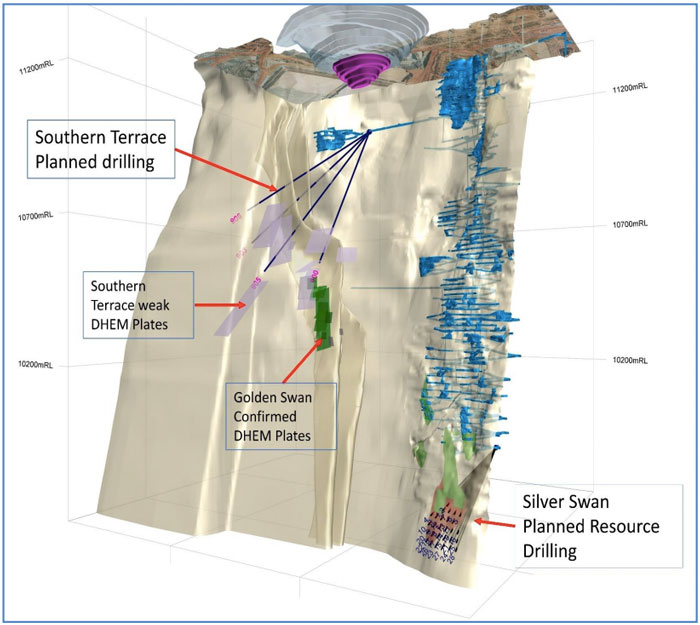

“The funds raised will be used to continue exploration activities at Golden Swan and across the Southern Terrace, undertake drilling to convert additional Silver Swan mineral resources to ore reserves, further test for extensions to the known Silver Swan mineralisation and complete mining and production studies at Black Swan,” he said.

“Funds will also be allocated to reviewing the exploration potential of our Lake Johnston and Windarra nickel projects.”

Poseidon began the resource definition drilling program at Golden Swan in April, targeting an increase in the confidence in the continuity of mineralisation to JORC 2012-compliant inferred and indicated levels.

Golden Swan was first discovered in March 2020 after the first two holes hit high-grade massive nickel sulphides.

Since then, drilling has confirmed the continuity of high-grade mineralisation at the discovery, which remains open in both plunge directions.

Poseidon’s focus is now firmly set on finding more Golden Swan replicas.

“Drilling is continuing on the Southern Terrace where we are looking for more Golden Swan style high-grade mineralised zones,” Harold explained.

“Three holes have been drilled to date and a down hole EM crew is due on site this week to survey those first three holes.

“The Silver Swan reserve upgrade drill program, designed to increase the high-grade nickel mining inventory at Black Swan, and test for extensions is also underway.”

Black Swan, which Poseidon bought from Norilsk Nickel at the end of 2014, already has a 2.2Mtpa processing plant in good condition and contains 195,000 tonnes of nickel in resources including 16,000 tonnes grading 9.5% nickel at the Silver Swan underground and 179,000 tonnes in lower grade open pit and stockpiled material.

This article was developed in collaboration with Poseidon Nickel, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.