PNX discovers multiple new high-grade gold targets to support Fountain Head development

PNX is lining up the targets in the Northern Territory. Pic: Via Getty Images

PNX Metals has uncovered multiple new targets with the potential to host economically significant gold mineralisation that could provide another important source of feed for its proposed Fountain Head plant in the Northern Territory.

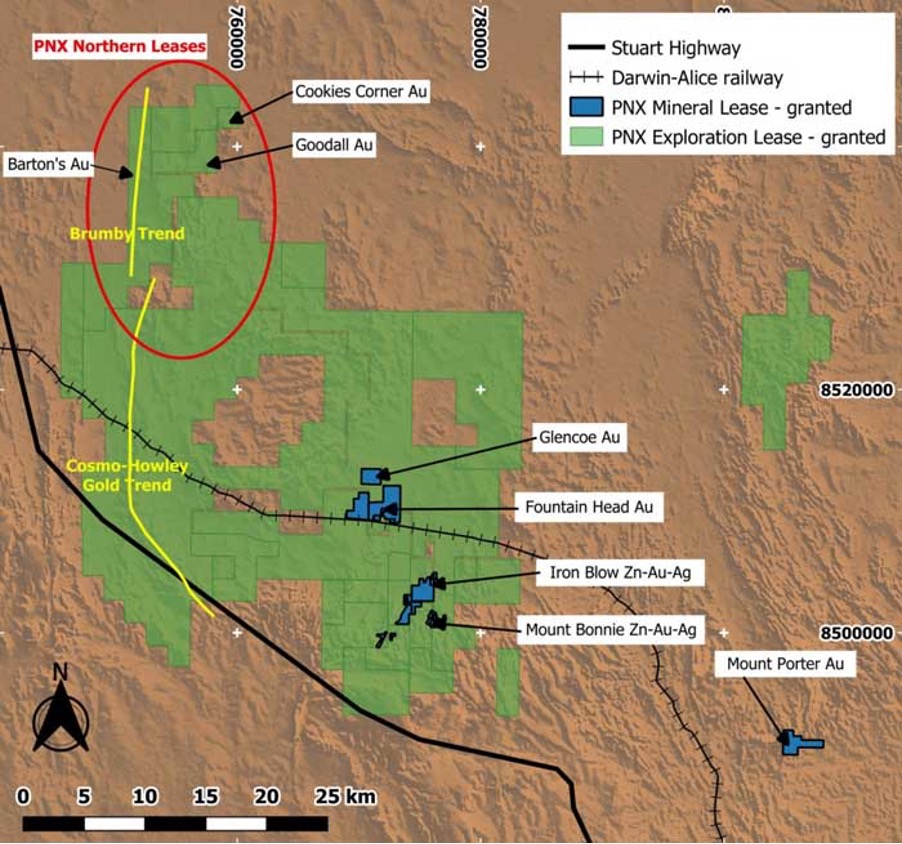

PNX Metals (ASX:PNX) is further strengthening the case for its Fountain Head gold project in the Northern Territory to be established as a central processing hub in the Pine Creek region with the discovery of new high-grade gold targets in the company’s northern leases.

Multiple targets, with the potential to host economically significant gold mineralisation, have been identified within prospective kilometre-scale gold corridors.

Investors welcomed the news, propelling shares up as much as 33% on a day the broader market was down.

PNX Metals (ASX:PNX) share price chart

Rock chip sampling across the northern exploration leases of the Burnside project have delivered high grades of up to 11.6 grams per tonne (g/t) and 25 g/t gold.

The recent sampling, combined with large geochemical anomalism and field mapping, support the strong potential for the discovery of new gold deposits within trucking distance of Fountain Head that could provide additional feed to the planned processing plant.

Historic drilling, not followed up until now, in the same area also returned numerous intercepts with significant gold grades such as 8m at 6.16g/t from surface, including 2m at 18.90g/t from 4m, in RC drillhole RTB2; and 3m at 5.6g/t from 10m, including 1m at 12.6g/t from 10m, in RC drillhole BYDC551.

During reconnaissance of the Burnside project in late 2022, PNX collected a total of 114 rock chip samples from outcrop that returned numerous high-grade gold values.

The results highlight two north-south corridors – Brumby and C6 – with very strong surface and historic drilling gold results that have been prioritised for follow-up.

“The high-grade gold in rock chips being reported, and assessment of historic data, highlight the potential for further discovery of economically significant gold mineralisation within our existing exploration leases,” managing director James Fox told investors this morning.

“Away from the known deposits, historic mines and prospects, minimal exploration has taken place.

“We look forward to drill testing these prospective ‘gold’ corridors early in 2023, after the NT wet season, and continuing to define other targets in our Pine Creek land package.”

Multi-million-ounce gold region

The Burnside project forms part of the broader Pine Creek region that hosts a significant gold endowment exceeding 20 million ounces.

The northern exploration leases cover about 20 x 20km of the Burnside project.

PNX has determined that large parts of the northern leases remain essentially untested despite being highly prospective for potentially economic gold mineralisation.

Most of the regional exploration in the Burnside area took place between the late 1980s and early 2000s when low gold prices prevailed.

This meant that the various gold anomalies and targets identified during the period were not investigated and now provide PNX with significant opportunities for discovery.

The scale potential of the area is supported by the historic Goodall mine, located in the eastern part of PNX’s northern leases where between 1998 and 2003 Western Mining Corporation mined over 4 million tonnes at 1.99g/t to produce around 260,000oz of gold.

PNX noted that historic wide-spaced soil sampling defined kilometre-scale north-south gold-in-soil anomalies to the west of the mine.

A preliminary feasibility study completed in mid-2021 on the combined Fountain Head and Hayes Creek projects showed it would be a profitable long-life operation.

PNX’s larger plan is to mine and process ore from three wholly owned gold deposits – Fountain Head, Glencoe, and Mt Porter – and two wholly owned zinc-gold-silver deposits – Mt Bonnie and Iron Blow. All five of the deposits are located on granted mining leases.

A prefeasibility study on the Fountain Head gold and Hayes Creek gold-silver-zinc projects completed mid-2021 highlighted a robust, multi-commodity, two-stage mine development that would have an initial mine life of 10 years, a pre-tax net present value (NPV) of $171m and a pre-tax internal rate of return (IRR) of 63%. This was excluding the upgrade to Glencoe, and excludes the recently acquired Mt Porter gold deposit.

Environmental Approvals for the Fountain Head plant and infrastructure are pending, and due at any time.

The discovery of additional deposits surrounding the operation is a big advantage that could build scale, provide more ore for the processing plant, and boost the economics of the integrated project.

Cashed up

This latest discovery comes close on the heels of news that PNX received firm commitments for $2.1m of a larger $4.4m rights issue, which is a sign of the strong support from existing shareholders for the company’s plan to build an integrated zinc-gold-silver project in the Northern Territory.

Shareholders are being offered one new share for every three existing shares at 0.3c each under the non-renounceable pro-rata rights issue.

Substantial shareholder and cornerstone investor DELPHI Unternehmensberatung Aktiengesellschaft pledged its commitment to the raising.

The cash will be used to support the ongoing development of the 100% owned Fountain Head and Hayes Creek integrated zinc-gold-silver projects, as well as continue near mine and regional gold and base metals exploration.

This article was developed in collaboration with PNX Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.