Pilbara Minerals’ Ken Brinsden on that record-breaking lithium auction and why high pricing is ‘expected to persist’

Pic: John W Banagan / Stone via Getty Images

Last week, the share price of Aussie hard rock lithium miner Pilbara Minerals (ASX:PLS) hit an all-time high off the back of its second Battery Material Exchange (BMX) auction.

The miner sold an 8,000t spodumene cargo on the spot market for an extraordinary $US2,240/t, essentially doubling the $US1,250/tonne received via the inaugural auction held late July.

This is a record price for spodumene concentrate — far above the peak at the last price cycle in 2017/18, where the highest spodumene price reached $US1,000/tonne.

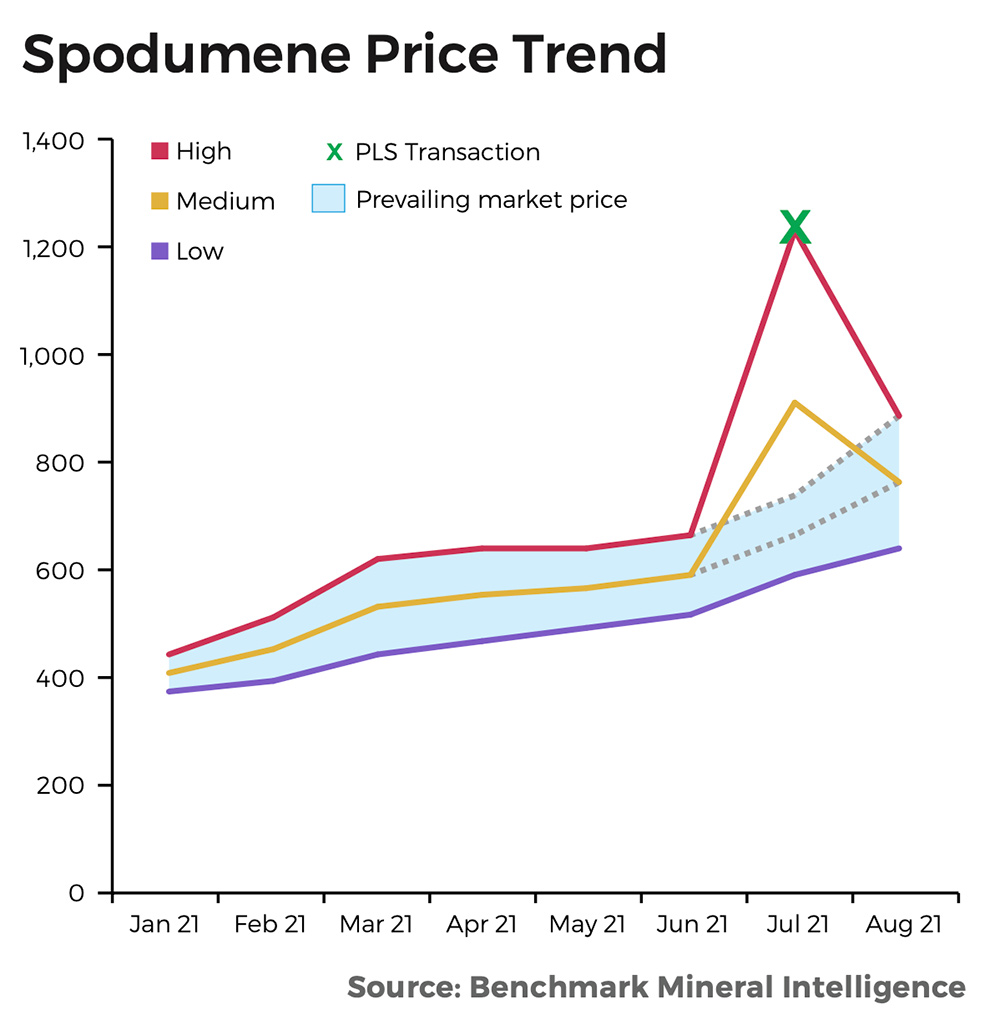

The first PLS auction price (green cross below) was so far outside the trendline it caused the average price to spike in July.

BMX #2 will have an even bigger impact.

While the super high price can be partially attributed to the relatively unique and competitive form of sale (open auction), it also verified what has long been suspected – there is not enough lithium being produced to meet current demand.

Good news for miners.

Pilbara Minerals managing director Ken Brinsden says significant participation in the first round of the BMX auction, combined with lithium chemicals pricing continuing to accelerate, meant the company was always confident of strong response in the second auction.

“We were optimistic it would be a healthy price and well bid. That was certainly the case,” Brinsden told Stockhead.

“As to the final price – look, we were probably a little surprised as to where it landed.”

While a date has yet to be set, Brinsden expects at least one more BMX auction before the end of the year.

“We would say the lot size would not be much different – 8,000 to 10,000t, up to a maximum of 15,000t,” he says.

“What it boils down to is the restart of the Ngungaju operation because that’s where the volumes for the spot market will come from.”

The restart of the ‘Ngungaju’ facility at Pilgangoora — or the former Altura operation – is a very important part of the business.

At full capacity that plant should be about 200,000t of uncontracted spodumene concentrate by about the middle of next year.

“It will be about 30% of our underlying production from Pilgangoora,” he says.

“Those tonnes are well positioned to feed the emerging spot market.”

A maturing lithium market

Brinsden says the Pilbara Minerals would consider having other lithium companies use the BMX platform “because we advocate for greater transparency in pricing”.

The contract market — where most tonnes are sold — has traditionally been very opaque, with prices determined behind closed doors.

This, amongst other things, makes it harder for aspiring miners to get finance.

“Greater volumes in the spot market makes sense because it represents a step toward the maturity of lithium markets,” Brinsden says.

“Greater transparency is going to translate to greater, more definitive pricing outcomes, the potential for futures markets, hedging instruments – all the financial tools being built around the industry that support the flow of capital.

“That is very natural, and it happens in the growth of just about every commodities market.

“Lithium raw materials won’t be any different.”

The lithium price boom ‘expected to persist’

This high pricing is fundamental, Brinsden says.

“It’s all about the next round of incentive pricing to attract capital to lithium raw materials supply,” he says.

“That is what is going to be required to grow the pool of producers to support this pretty significant global demand.”

Solving the lithium shortage isn’t as easy as turning on production.

“In the hard rock space – at least as it relates to merchant spodumene supply – the next available [production] uplift besides us is probably late next year at the earliest, I would say,” Brinsden says.

Australia’s next miner is shaping up to be Core Lithium’s (ASX:CXO) ‘Finniss’ project in the NT, which is targeting first production in the second half of 2022.

That is why tightness in the market is expected to continue.

And while one cannot say that the market price for spodumene is now ~$US2,000/t — when the majority of spodumene supply is currently being shipped for between $700/tonne and $1,100/tonne – it does demonstrate that more is needed, Benchmark Mineral Intelligence analyst George Miller says.

“Spodumene prices such as this indicate that converter margins are being passed upstream to where the tightness is in that market — spodumene supply,” he says.

“Feedstock inventory with many spodumene converters is either non-existent or quickly dwindling.

“Meanwhile, very little additional tonnage [will] come online in the near-term as a result of underinvestment and low prices within the lithium industry over the past three years.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.