Peak makes its mark in new copper province as prices set to go ‘far higher than anyone expects’

Pic:Getty

Peak is building its presence in a newly identified, underexplored emerging copper province in WA at the same time macroeconomic factors and strikes at two big copper mines are propelling the price of the red metal back up.

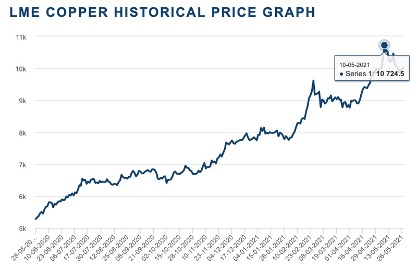

Earlier in May, copper hit an all-time high of $US10,724 ($13,848) a tonne on the London Metal Exchange before dipping back to below $US9,800 a tonne.

However, the sudden rumoured export ban on cobalt and copper concentrate from the Katanga province in the Democratic Republic of Congo (DRC) and workers walking off the job at BHP’s Spence and Escondida mines in Chile have reversed the downward trajectory of the price.

Both moves are increasing supply-side pressure at a time when major discoveries are few and far between.

This has led New York-based resources fund manager Goehring & Rozencwajg to an extremely bullish prediction that copper will hit over $US33,000 a tonne by the latter part of this decade.

Managing partners Leigh Goehring and Adam Rozencwajg said recently the previous copper bull market took place between 2001 and 2011 and saw prices rise seven-fold, from $US0.60 to $US4.62 per pound.

“We wholeheartedly embraced that copper bull market and maintained sizable exposure throughout the rally,” they said.

“The fundamentals today are even more bullish. We would not be surprised to see copper prices again advance a minimum of seven-fold before this bull market is over.”

Goehring & Rozencwajg say the leading driver of this price momentum is the expectation that copper mine supply growth will grind to a halt this decade.

“The number of new world-class discoveries coming online will decline substantially and depletion problems at existing mines will accelerate,” they said.

“Also, geological constraints surrounding copper porphyry deposits, a subject few analysts and investors understand, will contribute to the problems.

“Stagnating copper mine supply, already colliding with strong demand, will push copper prices far higher than anyone expects.”

This is good news for copper explorers like Peak Minerals (ASX:PUA), which has secured itself a first-mover advantage in an overlooked emerging copper province in Western Australia.

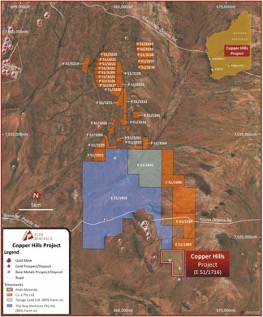

Peak was already advancing what is shaping up to be a large copper sulphide system in the Meekatharra region. But not long after reporting early success at its Copper Hills project, the company unveiled an exclusive deal to pick up more highly prospective ground surrounding the project.

Peak is acquiring CU2 WA, which has a portfolio of 33 base and precious metals tenements spanning about 225sqkm in the Meekatharra region, an area which has previously been only primarily explored for gold and titanium-vanadium mineralisation.

Peak Minerals tenure inclusive of acquisition & farm-in tenure.

The acquisition gives Peak control over a significant ground position in an underexplored region that has shown similarities to OZ Minerals’ (ASX:OZL) Succoth copper and Nebo-Babel nickel-copper prospects in the Musgrave Province of Western Australia. The Nebo and Babel deposits extend for 5km.

A pre-feasibility study update on the Nebo and Babel deposits released in December last year highlighted the potential for an operation producing 32,000 tonnes of copper and 26,000 tonnes of nickel each year for at least 26 years. It is estimated to deliver around $220m in average net cash flow each year.

Exploration results for the CU2 tenements that Peak is acquiring indicate mineralised gabbroic intrusives throughout the project area similar to those at Copper Hills and Lady Alma where copper sulphide mineralisation has been confirmed.

Limited previous exploration for copper mineralisation has been completed over the CU2 tenements, but in the coming months, Peak will undertake extensive field-based exploration to determine the potential of the province.

This article was developed in collaboration with Peak Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.