Paterson targets offer plenty of encouragement for Antipa and big-name partners

Getty Images

Special Report: Antipa Minerals’ exploration projects with two of Australia’s largest miners in Western Australia’s Paterson Province have produced several juicy targets that hold the promise of delivering the region’s next big discovery.

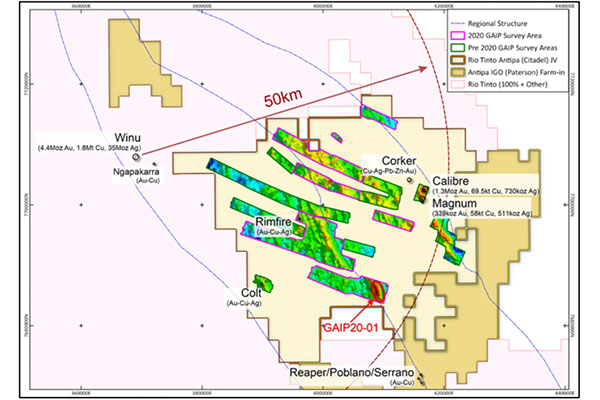

Antipa (ASX: AZY) notified the market this morning that a gradient array induced polarisation (GAIP) geophysical survey conducted at its Citadel joint venture with Rio Tinto in the Paterson had defined a large gold-copper target (+1.2km long by 900m wide) that would be given high priority in follow-up work.

GAIP is an electrical geophysical technique that has the ability to identify disseminated sulphide mineralisation such as that found in gold-copper-silver systems in the Paterson including the Telfer and Winu deposits.

Antipa said the high priority target, GAIP20-01, had shown anomalous IP chargeability responses approximately 2-2.5 times background and comparable IP chargeability and structural setting characteristics to the Calibre and Magnum gold-copper-silver deposits, which are located within the Citadel joint venture.

The GAIP survey has been significantly expanded to cover potential strike extensions to the GAIP20-01 anomaly and prospective regions nearby.

Antipa and Rio plan to drill test GAIP20-01, along with up to six other greenfields targets identified in a GAIP survey conducted at Citadel in 2019, before the end of the year subject to appropriate approvals.

Havieron lookalikes at Wilki

News of the Citadel target comes just days after Antipa announced that an aerial electromagnetic (AEM) survey had defined multiple new targets, including three that have been deemed high priority, at its Wilki Project in the Paterson, which is being farmed in to by Australia’s largest goldminer, Newcrest Mining.

AEM surveys have resulted in several significant discoveries in the region, with the technology very effective in identifying conductors representing gold and/or copper mineralisation beneath the transported cover that is commonly encountered in that part of the world.

The three high priority targets, AEM 20-01, AEM 20-02 and AEM 20-03, are within 10-37km of the Havieron gold discovery and 12-44km of Newcrest’s Telfer mine and processing facility.

Subject to Antipa and Newcrest obtaining the appropriate approvals, they will also be drill tested by the end of the year, along with other targets identified in the Wilki Project area.

Antipa said these targets bore some or all of the same characteristics that were present at Havieron prior to its discovery in 2018.

Newcrest signed an agreement to farm in to the Wilki Project in February this year and can earn up to 75% of the project by spending $60 million on exploration over eight years.

Under the deal, the gold miner is required to spend a minimum of $6 million within the first two years.

Farm-ins limit Antipa expenditure

Antipa is also free-carried at Citadel where Rio Tinto has approved a budget of $9.2 million for this calendar year as it seeks to expand the Calibre deposit as a potential additional source of feed for any development at Winu and make new discoveries.

The 2020 Citadel exploration program includes up to 13,000m of RC and diamond drilling at Calibre, which contains 1.3 million ounces of gold, 69,500 tonnes of copper and 730,000 ounces of silver in inferred resources.

Rio Tinto earned a 51% interest in Citadel at the start of the year after meeting an expenditure commitment, triggering the formation of the joint venture.

It can increase its interest in the project to 65% by spending another $14 million within five years, which it will be well on track to do following this year’s program.

Antipa signed a third major farm-in deal in July, entering an agreement with IGO Limited over a 1,563km2portion of its 100%-owned tenements in the Paterson.

Under that deal, IGO can earn 70% of the project by spending $30 million over 6.5 years with a minimum spend of $4 million required in the first 2.5 years.

The exploration program for the IGO project is in the process of being finalised.

Both IGO and Newcrest took equity positions in Antipa as part of their farm-in deals, with IGO holding 4.9% of the company and Newcrest 9.9%.

Antipa also retains 100% ownership of 144km2 of ground in the Paterson, which includes 723,340 ounces of gold, 26,390 tonnes of copper and 233,290 ounces of silver in resources at the Minyari-WACA deposits.

This story was developed in collaboration with Antipa Minerals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.