Panoramic gets $40m to restart Savannah nickel mine; shares climb 14pc

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Panoramic Resources has given the greenlight to the restart of its Savannah nickel, copper and cobalt mine after securing a $40 million loan.

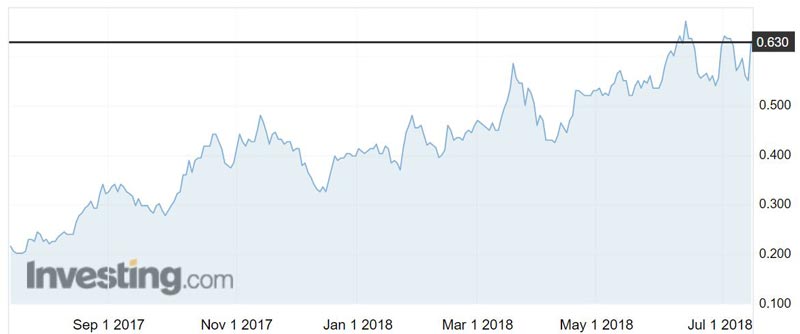

The news sent the company’s (ASX:PAN) shares up 14.5 per cent to an intra-day high of 63c before they edged back to close Tuesday at 58.5c.

The mine has been on care and maintenance since May 2016 when the nickel price bottomed at around $US7700 ($10,397) per tonne. It has since recovered to around $US13,865 per tonne.

Once commissioned, the Savannah mine will ramp up to full production over 15 months to an average annual production rate of 10,800 tonnes of nickel, 6100 tonnes of copper and 800 tonnes of cobalt metal contained in concentrate.

With the $40 million loan from Macquarie Bank and the money raised from a recent rights issue, the restart of the mine is now fully funded.

The financing also includes a nickel and copper hedging facility for 7000 tonnes of nickel and 3000 tonnes of copper to protect against any slide in the price of the commodities.

Panoramic is aiming to ship the first nickel concentrate to China early in the March quarter of next year.

The company announced in late June that it had struck a new deal to sell all of the concentrate from Savannah over a four-year period to Sino Nickel – a joint venture company of Chinese state-owned Jinchuan Group and investment and trading firm Sino Mining International.

Between 2004 and 2016, when the Savannah mine was operational, Panoramic shipped over 1.2 million tonnes of nickel, copper and cobalt concentrate, worth over $US1.4 billion, to Jinchuan’s smelter/refinery in Gansu province.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.