Pan Asia’s new project has exciting geothermal lithium potential

Pan Asia's new Kata Thong project has both lepidolite and geothermal lithium potential. Pic: via Getty Images

While lithium products from Pan Asia’s low cost and low carbon Reung Kiet project could attract a premium, its latest move could be transformational.

Reung Kiet already had the potential to be at the bottom of the lithium cost curve thanks to its lepidolite-style mineralisation, which includes plenty of by-products that can reduce the overall cost of extraction, as well as proximity to the 240 megawatt Rajjaprabha hydroelectric power plant promising a near zero carbon footprint.

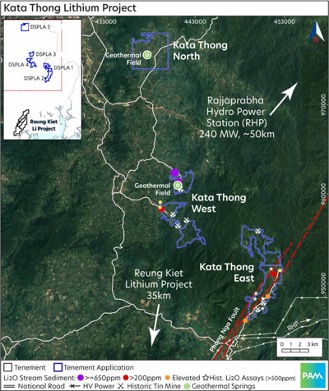

However, Pan Asia Metals (ASX:PAM) has now applied for five Special Prospecting Licence Applications (SPLAs) – collectively known as the Kata Thong project – in Southern Thailand’s Phang Nga Province that also have both geothermal style lithium and lepidolite style lithium potential, which could further reduce its carbon footprint to zero.

This is thanks to the presence of geothermal fields within two of the SPLAs, one of which abuts the lithium rich Khao Kata Khwam granite batholith, a 145sqkm granite intrusion with rock-chip assays up to 2,700 parts per million lithium oxide.

Speaking to Stockhead, managing director Paul Lock noted that Kata Thong had two potential sources of lithium.

“There’s the lepidolite, which we are also targeting at Reung Kiet and then there’s the geothermal lithium,” he noted.

“They’re a hedge on each other, we expect to get something out of it; either lepidolite hard rock or geothermal, but hopefully both.”

The geological picture for the geothermal lithium at Kata Thong looks remarkably like Cornish Lithium Limited’s United Downs Deep Geothermal Project in Cornwall where hot water interacts with lithium-rich granites to produce a lithium-rich brine.

However, there are some significant differences.

“At Cornwall, the geothermal fluids are only just over 50C at 400m, we’re at 73C at surface and it gets up to over 125C at a depth of just 500m,” Lock explained.

This high heat level could allow Pan Asia to take a page out of Vulcan Energy’s (ASX:VUL) playbook and utilise the geothermal energy to power the direct lithium extraction process, which would produce lithium with zero carbon emissions.

Any excess energy could potentially be used to help power its lepidolite operations with any shortfall in power sourced from Rajjaprabha.

Kata Thong project

The Kata Thong project area – located about 35km north-northeast of Reung Kiet and 50km southwest of Rajjaprabha – and the broader region has an extensive history of tin production dating back to the 16th Century.

Previous mining is dominated by onshore and offshore alluvial deposits with production from primary sources generally limited to soft rock and alluvial mining using hydraulic methods.

While little modern exploration appears to have been carried out in the project area, an extensive review and compilation of relevant historical data by Pan Asia has revealed anomalous lithium in stream sediments and the presence of pegmatites in the Kata Thong project area.

Four of the SPLAs are highly prospective for lepidolite style lithium and tin, with the company’s stream sediment assays returning strong lithium oxide values from these catchments.

This is seen by Lock as being complementary to the Reung Kiet project, where its Phase 1 objective is to develop a 5,000 tonne per annum to 10,000tpa lithium carbonate or hydroxide plant.

Additional discoveries, such as Kata Thong, could increase this to 20,000tpa or more.

Pan Asia has been working on the rigorous Kata Thong application process, which includes extensive consultation with various stakeholders including local communities and provincial governments, since late 2020 and is now waiting for final approvals from Thailand’s Department of Primary Industry and Mines and the Minerals Committee.

Once the licences are approved, no further permissions are required other than landholder access.

Future activity

Pan Asia’s focus is currently on progressing Reung Kiet through to a maiden mineral resource that Lock hopes to deliver in November with a scoping study following close behind.

“While that’s happening, we will be at the point soon where we can start initial field work at Kata Thong,” he told Stockhead.

The company will start with ground surveys like soils and rock chips along with geophysics to determine the geothermal potential.

“We can do that very cheaply while we’re doing the expensive work at Reung Kiet,” Lock added.

Once all data is assessed and modelled, Pan Asia may then proceed with drilling to fully assess the geothermal/lithium resource and inform conceptual production scenarios, before leading into full scale pre-production/production drilling and associated feasibility work.

And there’s more, with Lock noting that Kata Thong is just the first of a suite of applications.

“We’ve got another set of applications that we hope to deliver to the market by the end of this year to the north,” he noted.

“We’ve basically locked up the geothermal belt there, so anything with lithium and geothermal that’s available to apply for, we have it.”

This article was developed in collaboration with Pan Asia Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.