Ora’s Crown Prince could take throne as low-cost gold play

The Crown Prince deposit is looking like a low cost gold development for Ora Pic: Getty

Special Report: Ora Gold’s study envisages its Crown Prince deposit as a low-cost gold development that will bestow on it attractive returns.

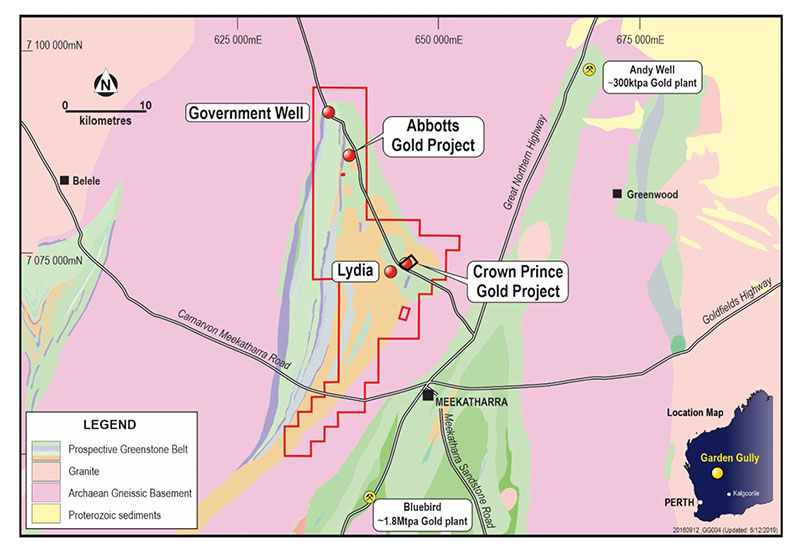

The focus on shallow gold plays that have low development costs could pay off for Ora Gold (ASX:OAU), which has unveiled a scoping study that forecasts a positive financial result for its Crown Prince deposit near Meekatharra, Western Australia.

This study envisages an open pit project to a depth of 75m that will mine 177,472 tonnes of oxidised ore at Crown Prince at a grade of 4.1 grams per tonne (g/t) to produce about 22,444 ounces of gold.

All-in-sustaining costs are estimated at $1006 per ounce and the project is estimated to generate a net distributable surplus of $21.1m before tax.

Ore processing will be carried out at an offsite facility.

This may seem small-scale compared to some gold projects in the market, but development costs are estimated to be a very palatable $4.7m, which Ora expects could be funded through a combination of equity, loan and project financing.

Subject to additional studies, negotiation of offsite processing arrangements and approvals, Crown Prince is proposed to be established and mined over a 15 to 18-month timeframe.

Mining may proceed to an underground operation, depending on deep drilling and further evaluation.

Additional ore may also come from nearby prospects such as Crown Prince East and Lydia.

Crown Prince has a current resource of 479,000 tonnes at 3.6g/t gold, with most of the top 100m being open-pittable indicated resources of 218,000 tonnes at 4.3g/t containing 30,000oz.

Indicated resources have sufficient information on geology and grade continuity to support mine planning.

The deposit is ideally located for access, haulage and available infrastructure as a satellite ore source for a local processing plant.

Between 1908 and 1915, Crown Prince was partially developed along two strongly mineralised quartz veins on four underground levels to a depth of 90m below surface.

Mine production was 29,400 tonnes for 20,178 ounces of gold at a recovered grade of 21.7g/t. The current resource includes close-spaced drilling to 100m and the recent deeper drilling to 270m by Ora Gold.

Crown Prince is interpreted to have depth potential and similar mineralisation style to the high-grade Great Fingall/Golden Crown deposits near Cue.

Great Fingall was an open pit mine that produced more than 1 million ounces of gold between 1899 and 1928.

Now read:

Ora has gold in hand, eyes big base metals prize

This story was developed in collaboration with Ora Gold, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.