Ora has gold in hand, eyes big base metals prize

Pic: Getty

Special Report: Ora Gold could have a very exciting WA exploration play on its hands, after recent drilling intersected broad zones of shallow base metal mineralisation.

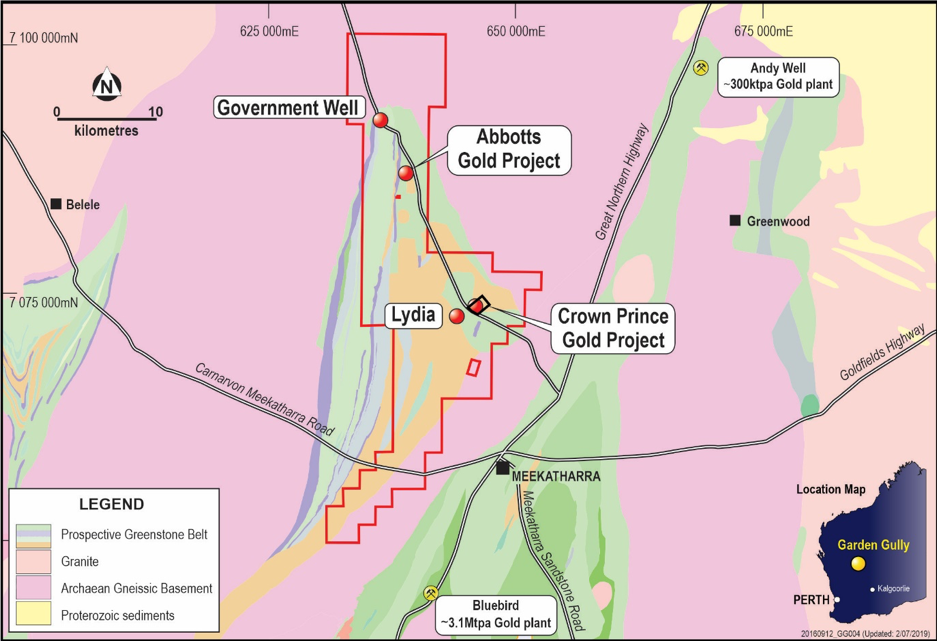

In December last year, Ora Gold (ASX:OAU) (Company) acquired the Abbotts gold project from Doray Minerals. Together with its existing Garden Gully project, this gave the Company control over the majority of the Abbotts Greenstone Belt, just 20km northwest of Meekatharra.

The Company is now embarking on the low cost development of its existing shallow gold resources, while exploring for larger gold and base metals deposits at its tenements.

The expanded 393sqkm Garden Gully project currently hosts the advanced Abbotts, Crown Prince and Lydia gold prospects and numerous partially-drilled high grade gold prospects.

Historical underground mining on the tenements totals about 60,000 ounces at a grade of 30 grams per tonne (g/t) gold – but the shallow, open pittable gold hasn’t been touched in recent times. The Company also plans to follow up on deeper extensions to these deposits.

Prospectivity is demonstrated by the recent announcement of an upgraded Mineral Resource at Crown Prince of 479,000 tonnes at 3.6g/t gold with most of the top 100m being open-pittable Indicated Resources of 218,000 tonnes at 4.3g/t containing 30,000oz.

A feasibility study is underway for a high grade open pit, followed by an underground operation, and a Mining Lease application has been submitted. The deposit is still open at 250m depth and many adjacent zones need drilling.

Between 1908 and 1915, Crown Prince was partially developed along two strongly mineralised quartz veins on four underground levels to a depth of 90m below surface.

Mine production was 29,400 tonnes for 20,178 ounces of gold at a recovered grade of 21.7g/t. The new JORC 2012 Resource has included close-spaced drilling to 100m and the recent deeper drilling to 270m by Ora Gold.

Adjacent zones and other near surface mineralisation on the Mining Lease has been discovered by drilling or indicated by pathfinder element trends and geophysical surveys.

Crown Prince is interpreted to have depth potential and similar mineralisation style to the high grade Great Fingall/Golden Crown deposits near Cue.

Great Fingall was an open pit mine that produced more than 1 million ounces of gold between 1899 and 1928.

The Company plans to carry out drilling to test this depth extension and of the partially drilled sub-parallel zones.

The Company is also working on delineating shallow mineralisation for its Abbotts project where recent drilling confirmed the high grade Eastern Zone extends to the north under the historical workings.

Additional drilling is required to confirm the initial pit design at Abbotts and to assess the potential for an underground development of the high grade Eastern Zone.

A third advanced gold project at Lydia, which is 2km west of Crown Prince, has been drilled at depth by the Company and requires shallow drilling to delineate the shallow oxide material.

Base metals point to VMS potential

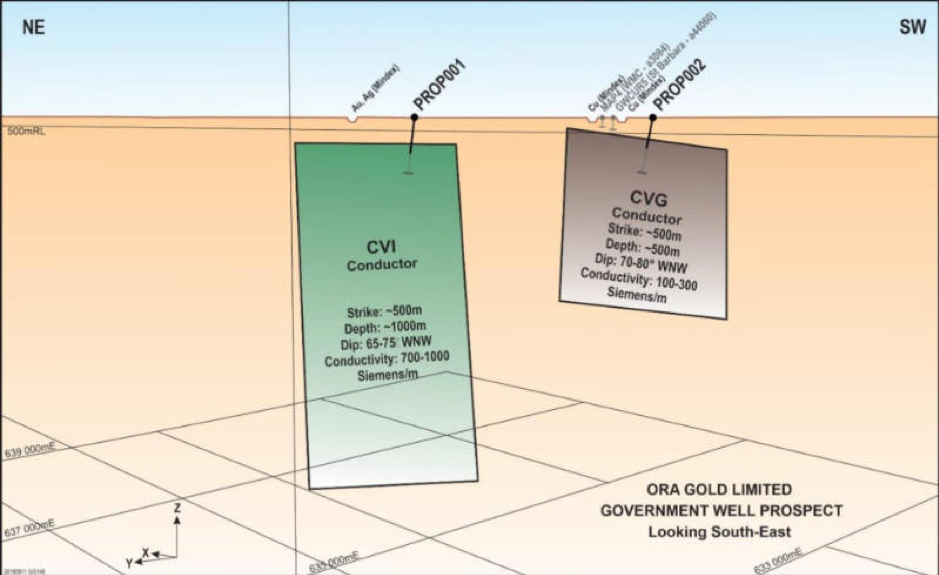

However, it is the recent EM survey and follow up base metal hits that the Company made while drilling the Government Well prospect which has gripped the company’s imagination.

EM surveys have picked up two strong conductors of 500m strike extent which may be VMS deposits. Portable XRF readings, which provide an early picture of a potential find, indicate that the initial 34 hole program has confirmed two parallel zones of anomalous base metals striking north-northeast and between 20m and 30m wide, with readings of up to 3 per cent zinc, 1 per cent copper and 1 per cent lead.

Highly anomalous arsenic is also present in some of the readings, which may indicate the presence of gold.

While previous exploration in the Government Well area has focused primarily on gold, with previous shallow historical drilling by Western Mining Corporation intersecting base metals while St Barbara Mines hit gold and copper mineralisation in the same area.

But what really makes for interesting reading is a technical report “VMS mineralization in the Yilgarn Craton, Western Australia” for the WA state government that highlights the potential for volcanogenic massive sulphide.

On top of the rich Crown Prince deposit, if the Company has indeed stumbled on a VMS deposit, it could represent a lucrative exploration prospect that could substantially re-rate the company.

This story was developed in collaboration with Ora Gold Limited, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.