Ora Gold drilling is right on the money at Lydia

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: If there is one thing that Ora Gold can take away from drilling at the Lydia prospect in WA, it is that there is potential for plenty of gold.

After all, the recently completed reverse circulation drilling program has returned outstanding shallow hits such as 7m at 116.3 grams per tonne (g/t) gold from a depth of 7m in oxide/supergene mineralisation from below thin transported cover. This 7m intersection included a stunning result of one metre at 794.2 (g/t) gold.

Drilling also demonstrated the potential for open-ended deeper mineralisation in the primary zone with hits such as 5m at 2.23g/t gold from 74m and 13m at 1.49g/t gold from 81m that finished in mineralisation.

Ora Gold (ASX:OAU) noted that the current interpretation of mineralisation at Lydia near the Crown Prince deposit is of persistent high-grade mineralisation within the oxide zone and open primary mineralisation at depth.

It added that these are all positive indications for development potential and with historical mining over a strike length of about 500m, there may be extensions or repetitions uncovered with further drilling.

Importantly, the drill program has improved the outlook for mine development in the oxide/supergene zone and at depth while following up on previous drilling by Ora in 2016-18 that confirmed strong mineralisation to a depth of over 200m.

The company plans to carry out deep reverse circulation drilling to follow up the northwestern plunge of the primary mineralisation along with several sections of core drilling to better define the structural setting of the mineralised system.

Lydia gold prospect

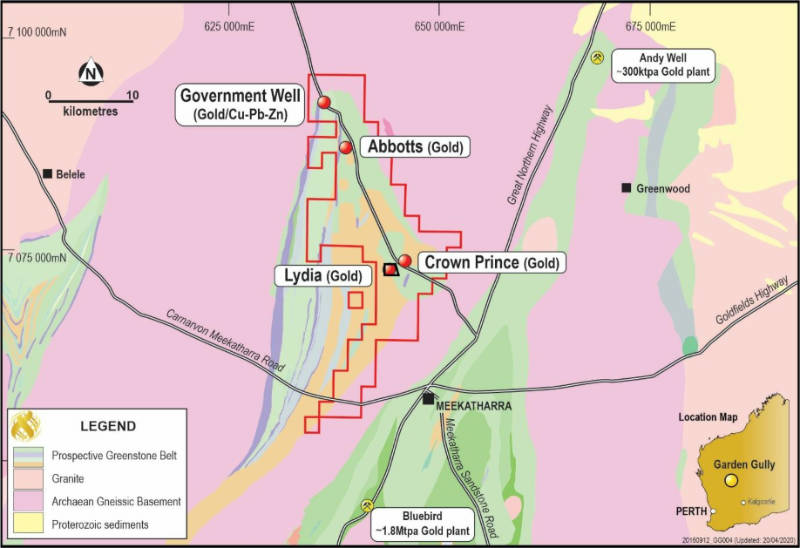

The Lydia prospect, located 1.2km from the Crown Prince within the Garden Gully project near Meekatharra, was defined by several shallow rotary airblast and reverse circulation lines drilled by a previous explorer in the late 1980s to a maximum depth of 40m.

On acquiring Lydia, Ora Gold undertook deep drilling that returned high-grade intersections to depths of over 200m before it turned its focus to Crown Prince.

Supergene gold mineralisation has been intersected along the main mineralised structure and is considered to strengthen to the east of the competent mafic sill, and to the north, where there is intense mineralised faulting and a deeper weathering, and these areas are yet to be drilled.

Primary mineralisation intersected at Lydia is below 80m under the more competent mafic unit and has been drilled to depths beyond 200m.

While these intersections have modest grades, the depth potential for the Lydia deposit is similar to the Crown Prince and other prospective targets in the Abbotts greenstone belt, which could be mineralised to depths of up to 1,000m like other Archaean greenstone belt gold deposits.

Low-cost gold development

Lydia was previously flagged as a potential source of ore for an open pit development at the Crown Prince deposit.

In December last year, Ora Gold released a positive scoping study indicating that it could mine 177,472 tonnes of oxidised ore grading 4.1g/t to produce about 22,444oz of gold from Crown Prince.

The mine would cost an estimated $4.7m to develop. All-in-sustaining costs (AISC) are estimated at a very low $1,006 per ounce, with Ora Gold expecting the project to generate $21.1m profit before tax at a gold price of $2,000/oz.

Gold is currently selling above $2,600/oz.

This article was developed in collaboration with Ora Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.