Oklo feels the need for speed as Dandoko gold growth looms

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Drilling to expand an already-significant gold resource, in a white-hot district in Africa with $14 million cash in the bank – Oklo Resources is going from strength to strength in Mali.

Oklo’s (ASX:OKU) flagship Dandoko gold project only received a maiden mineral resource in late March, but that hasn’t stopped the company from pursuing an aggressive, self-funded strategy of further growth while also exploring its Dandoko development options.

The current resource at Dandoko is nothing to be sneezed at – we’re talking 11.34 million tonnes at 1.83 grams per tonne gold for 668,500 ounces. Of the resource, 79% already sits in the measured and indicated categories, with 65% in soft oxide mineralisation.

But management sees even more potential in Mali – both at the project and around it.

“There’s really two strategies to our exploration from here,” Oklo managing director Simon Taylor told Stockhead this week.

“There’s growing our existing mineral resource. To achieve that we can fund it from our existing cash of around $14 million, and we’ve got a 14,000m drill program underway looking at new growth opportunities on the project itself.

“That includes near-pit opportunities and opportunities along strike on the 15km Dandoko corridor, where we’ve got some pretty exciting IP and auger targets that we can drill.”

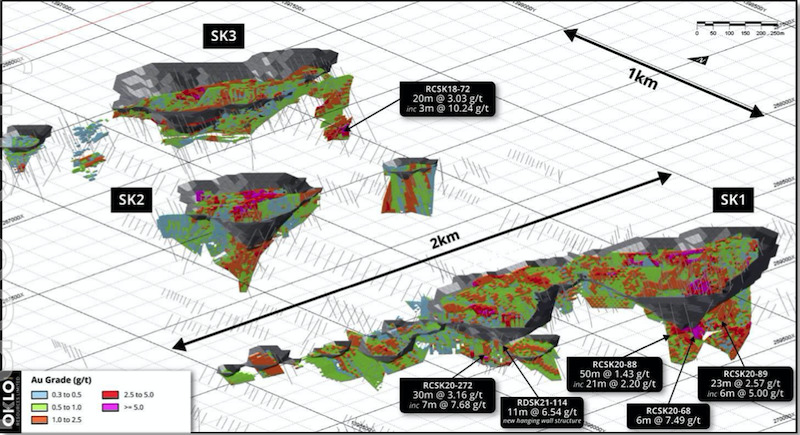

The major prospect within Dandoko is known as Seko, home of the SK1, SK2 and SK3 pit shells which at present contain 91% of the mineral resource estimate for the project.

Seko and the neighbouring Koko, Disse and Diabarou deposits all remain open, and each is expected to grow with ongoing drilling either along strike or at depth.

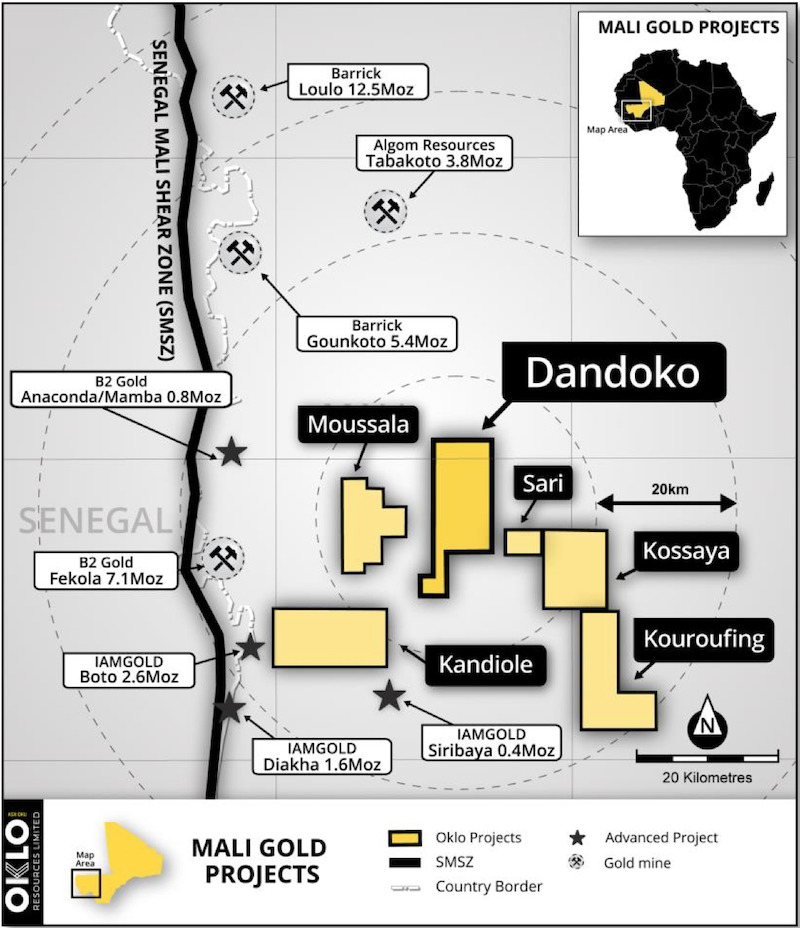

The opportunities abound beyond the immediate project area as well, according to Taylor, with Oklo carrying out a further 8,100m worth of aircore drilling at other prospective projects in the region.

“The additional growth opportunity is on our other projects within the 500km2 land package, all within close proximity to Dandoko” he said.

“We’ve just finished some first-pass reconnaissance aircore drilling at the Kandiole and Sari projects, and we’re waiting on results for the work we’ve done there too.”

There is significant precedent in the region for mammoth gold projects in Mali – nearby monsters include Barrick Gold’s 18-million-ounce Loulu-Gounkoto project and Canadian-listed B2Gold’s Fekola gold mine with resources above 7Moz.

Taylor said that now with a solid foundation at Dandoko, Oklo’s intention was to grow its own numbers in the West African nation.

“We’ve set the foundation with the initial resource and the key now is resource growth,” he said.

“The mineral resource is very robust, it’s good grade, it’s all open-cut from surface which should lead to very simple processing and mining.

“We’ve set that foundation, we have plenty of cash to continue drilling and add to the resource, so it’s a great platform and we’re really excited about all the targets we can continue to look at to add to the resource.”

Let’s get technical

With an interim resource in place, Oklo can concurrently progress technical studies around a mining project while exploring to grow its gold numbers.

The company has accelerated studies looking at the potential for a high-grade oxide mining operation based on initial resource numbers, which will likely be expanded as the resource grows.

“The nice thing about the resource to date is it gives us some optionality moving forward, particularly given our favourable grade profile,” Taylor said.

“We put out a resource using a 0.3 gram per tonne cut-off for just under 700,000 ounces at 1.8g/t, but if you use a higher cut-off of say one gram, we’ve actually got 570,000 ounces at 2.7g/t.

“This is all open-cut material, so it’s looking very simple at this stage as far as mining, metallurgy and processing goes.”

Oklo is also progressing its permitting at Dandoko, where it currently holds an exploration permit.

Digby Wells Environmental was appointed to undertake a series of baseline studies in the December quarter, to form the basis of the ongoing Environmental and Social Impact Assessment and environmental licensing requirements related to a mining licence.

Flora and fauna, aquatic ecology, soils, wetlands and water monitoring, socioeconomic and health, demographic and land use studies are all said to be progressing well.

There should be plenty of newsflow to come from OKU as things progress at Dandoko.

Taylor also recently spoke with Stockhead’s Barry FitzGerald as part of the Explorers Podcast – that recording can be found here.

This article was developed in collaboration with Oklo Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.