Off to Never Never Land: Can this growing gold discovery finally turn around a battered and bruised Gascoyne?

Pic: Jax973/iStock via Getty Images

- Gascoyne Resources burned through millions since the ill-fated opening of the Dalgaranga mine in 2017

- Fresh off a $50m recap and new high grade discovery called Never Never, MD Simon Lawson says the gold explorer is finally poised to realise value for shareholders

- A new resource estimate at Never Never is due in July with a restart decision planned for mid-2024

Mutter the words Gascoyne Resources (ASX:GCY) and Dalgaranga under your breath in a crowded corridor in West Perth and you’re sure to see one or two shudders as the ghosts of placements past flood back into small cap investors’ minds.

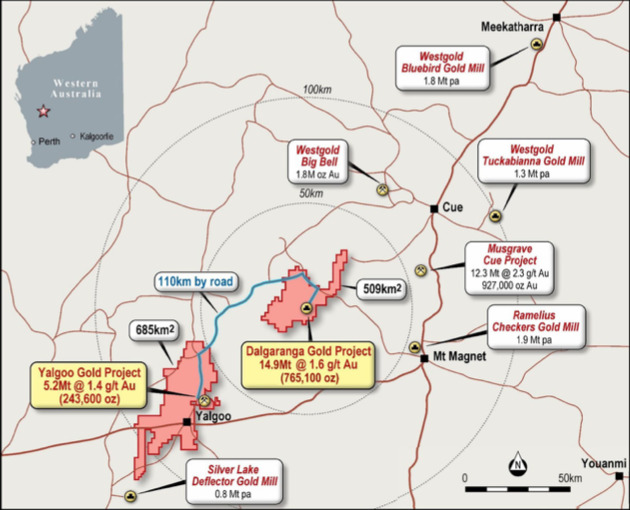

Through two iterations GCY has tapped the market for upwards of $200 million of equity since a $55m raising in early 2017 to fund the Dalgaranga mine in WA’s Mid-West, located near Mount Magnet in the vicinity of significant Aussie gold producers like Westgold Resources (ASX:WGX), Ramelius Resources (ASX:RMS) and Silver Lake Resources (ASX:SLR).

At first time of asking the resource drilling left plenty to be desired. Grades didn’t match what was promised in feasibility work and the mine struggled to pay its bills, sending Gascoyne into administration in 2019.

Mined out of its predicament before a $125m recapitalisation, the company merged with nearby junior Firefly Resources in 2021 before new management was forced to shut the loss-making mine again in November last year.

After yet another recapitalisation, managing director Simon Lawson, who made his name as a key part of the geology team at 1.6Mozpa Northern Star Resources (ASX:NST) going back to its early days as a single mine operator at the Paulsens gold mine, is confident the $100 million company’s shrink to grow decision was the right one.

Passed over by previous operators and running under a haul road, he says the true geological potential of the well-trodden gold field 550km northeast of Perth is emerging with the high grade Never Never discovery.

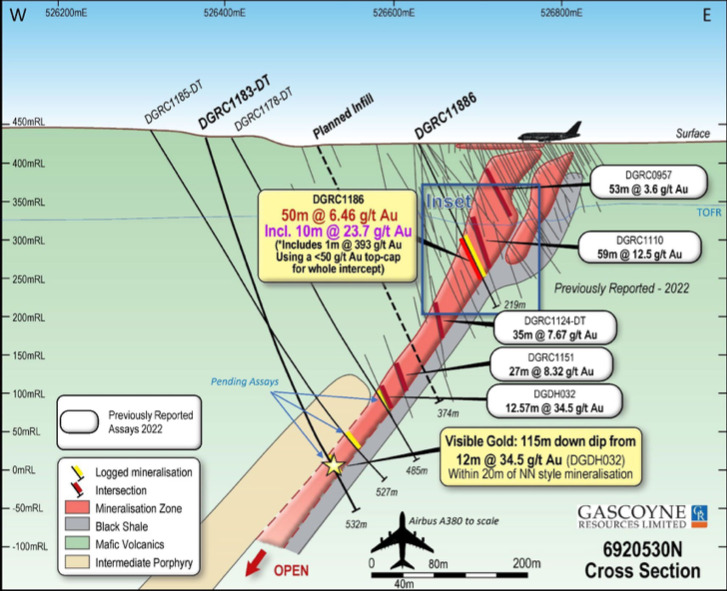

Since the find was announced last year, Never Never has grown to a resource of 2.03Mt at 4.64g/t for 303,100oz at a discovery cost of $20 an ounce.

But can this new iteration of Gascoyne vanquish the memory of its old poltergeists?

Honesty is the best policy

While he is quick to point out the millions tipped into GCY in the past six years has been filtered through what are essentially two businesses, Lawson, who led Firefly before moving across to Gascoyne after the November 2021 merger, does not shirk from questions about past issues stretching to before his time at Dalgaranga.

Developed alongside the construction of a 2.5Mtpa plant, he fingers the failings as one of geology centred on poor grade reconciliation at its Gilbeys pit, which saw Dalgaranga process ore far below the supposed 1.3g/t head grade of the main deposit.

“So that material was never there, the resource was overstated, which meant that the business case for that business, that first iteration of Gascoyne, was destined to fail with the failure to reconcile those head grades that everything had been based on,” he said.

“I’m not going to throw stones in this regard. But let’s just say to me that estimation wasn’t done correctly. And that’s pretty obvious when the result is actually the proof.”

Lawson says what the new Gascoyne has done is take a more diligent and rigorous approach to resource estimation, including peer review.

But what Lawson inherited was never going to survive a rising catalogue of cost pressures from labour to diesel and Covid, with approvals to mine Never Never taking too long to enable a smooth transition.

When the decision was taken to put the Dalgaranga plant on care and maintenance on November 8 last year, the company had spent the three months to September 30 operating at all in sustaining costs of $3135/oz, beyond even the record Aussie dollar gold price, against average realised prices of $2548/oz. Feed grades at the mill were just 0.81g/t. Something had to give.

Its shares currently trade at 12c, having climbed as high as 41c in August last year when Never Never first stepped on the scene.

After that false dawn, Lawson is hopeful the turnaround can begin.

“So the real turnaround story begins with the recapitalisation of the company earlier this year,” Lawson said.

“We raised $50 million at 10 cents and while I am cognisant of the past and I am cognisant of the baggage and the perceptions that carries, I’m about trying to create the future for shareholders, old and new.

“Obviously, there’s a fair few people underwater on the first iteration, but I think the deposit that we’ve found, the Never Never deposit, being that it’s now 300,000 ounces at 4.64(g/t), almost five times the grade of what was previously being mined.

“And it’s less than 600m from the plant that is already here, by virtue of that first iteration of Gascoyne.

“Those Gascoyne shareholders that have held on for so long are now in a better position than they ever were to (see a) return on that investment. Now, it’s easy for me to say, but what we’re doing is letting the drill bit do the talking.”

Lessons from the past

In putting the focus back on geology, Lawson is looking to lean on past experiences with Northern Star and Superior Gold, which bought the Plutonic mine off Northern Star when it was on what appeared to be its last legs in 2016.

“It’s the fourth time I’ve done it now where I’ve taken something that people said was dead and turned it around,” he said.

“I like taking new observations and asking people different questions, getting in front of the geos and saying, ‘You know what, if I gave you a million bucks, where would you drill a hole?’

“‘I don’t know anything about this region, but where would you want to drill a hole and then we’ll go test those targets.’

“I think accepted theories are one thing, but I’ve managed to come into a few of these operations now where the accepted outcome is not actually what happens.

“That’s the opportunity in itself, orebodies that were supposed to be refractory that had been mined past for 25 years and groupthink said don’t go and mine it and I mined it, and it recovered much better than what people had said.

“How many geos have driven past that orebody and not asked that question?”

That orebody became the Carribean Lode, which delivered 50,000oz at 88% recoveries. At GCY, Never Never will need to be an order of magnitude bigger, but has a similar origin story.

“For me coming into Gascoyne, a haul road was over this orebody, and there were people actively opposing drilling follow-up holes on holes that had grade in them along strike from the main deposit,” Lawson said.

“I simply supported the idea of drilling a 50m hole to see whether there was actually any truth to the rumour, and that opportunity becomes now a 300,000 ounce orebody in front of an operating plant.

“I love doing this. The motivation comes from having a crack, from coming into what is ostensibly a dead end situation and a difficult situation and taking geology and you know that group of people that have all that knowledge and combining it all and projecting that energy in one direction that it leads to a positive outcome.”

How big, how high grade?

The questions which will probably decide whether the turnaround will be a success is how big and how high grade can Never Never be?

High grade intercepts have continued to roll in for the deposit since the latest resource update in January, with a new one expected around July this year.

The quantum and grade of the resource — the underground component comes in at 7.2g/t — will be key to a decision to restart the Dalgaranga mill next year.

“We’ve stated pretty strongly from the outset that I want a more than five-year mine plan backed by reserves, so five years of reserves at high grade,” Lawson said.

“I’m not talking about one gram or marginal ore feed, I’m talking about taking that 4.64g/t resource and turning it into a +5, +6 gram resource closer to 700,000 ounces, if not closer to a million which I’ve stated in our exploration target.

“We really want to have a very solid mine plan with a good vision. Five to 10 years is ideally where I want to be and we want to be producing over 100,000 ounces a year.”

But in tabling the current resource Lawson said he didn’t want to “over call and under deliver”, a nod to the past which continues to dog the gold explorer.

“We’ve then set about with three drill rigs upon recapitalisation and have very rapidly extended that resource in pretty much every direction,” Lawson said of he 20,000m diamond (7,000m) and RC (13,000m) drill program under way ahead of underground drilling in November.

“As some of these announcements recently have shown, including one yesterday, we’re 110m below the resource and we’re still hitting 29m at 11g/t, which I’d say is a pretty high spec gold deposit.

“I’ve looked at a lot of these different things having worked for some of the bigger companies in the industry, and I’ve never seen drill hits like this on a consistent basis with this consistent sort of grade.”

To outline the scale of the resource Lawson has, comically, taken to using the wingspan of an Airbus A380 to outline its width.

“I’ve had a few people say to me, is it underneath the airstrip? And I said no, that’s not the intention. It’s purely the scale,” he said.

“The wingspan of an A380 is something like 79m and it is dwarfed by the scale of this deposit that we’ve outlined. And in less than 12 months, we’ve put that scale there.”

Sliding doors

Met test work is also looking promising.

“I haven’t released the information on that yet, I’m working on the announcement as we speak, that’s really favourable,” Lawson said.

“I’m going to be pretty excited to bring that to the market and the study that we’re doing around that is does this plant suit that material, the Never Never high grade material, which is a very simple chemistry.

“There’s no copper, lead, zinc, silver, there’s no appreciable arsenic … it is one of the cleanest orebodies I’ve ever seen. And when you match that against this very simple CIL-gravity circuit plant that we have here, it’s very well suited.”

That gravity circuit was never opened previously because the Gilbeys deposit did not contain much coarse gold.

As for the resource, the upcoming update is likely to be substantial, Lawson believes.

“I’m looking north of 500,000 ounces, again being conservative because I don’t want to under deliver, but it’s certainly going to be north of half a million ounces in a less than 18-month period,” he said. “I think that’s pretty substantial.

“I’d like to say that we’re on our path to 1Moz at this stage and towards the level of that exploration target.

“And I think the drill hits that we’re getting and the continuity we’re seeing, this ore body is already more continuous and higher grade and larger than some of the mid-cap peers that we have in the region are currently mining.”

A rebrand and retirement of the haunted Gascoyne name is also likely on the way.

“The priority was to actually get the facts straight, to actually make a discovery to change the future of the company,” Lawson said.

“And if I could do that, you earn the right to be able to give it your own brand and get a flag and a banner that the staff who’ve helped to change that future can follow and wear proudly on their shirts and the vehicles.

“To me this is the next stage in the evolution. So yes, rebranding is something I’m focused on now. And I want to roll it out with the new resource update that’s coming out mid-year.”

Gascoyne Resources (ASX:GCY) share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.