Of name and nature – new gold IPO to add to Mount Monger regional heat

Pic: John W Banagan / Stone via Getty Images

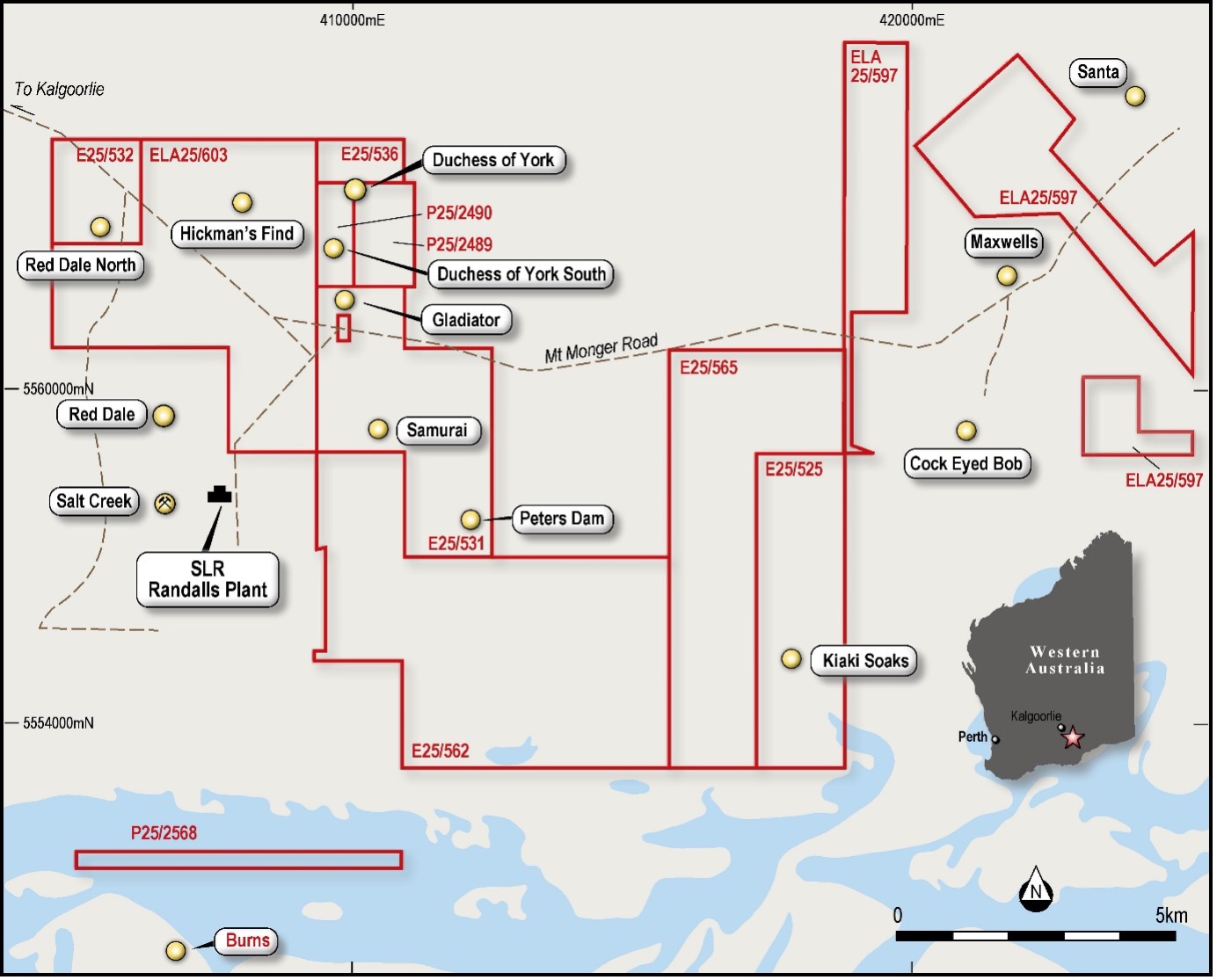

While prolific, the Mount Monger region, around 70km south east of Kalgoorlie in WA’s gold heartland, has until recently flown a little under the radar in terms of investor awareness.

Yes, the region has a long history of gold mining – with millions of ounces and more than a hundred years of output to show for it.

Yes, it is home to Silver Lake Resources’ (ASX:SLR) prolific Mount Monger projects and Randalls mill – a combined mining operation of great substance and profile.

But sometimes, even when all the fundamentals make sense, it takes more of a sudden spark to reignite intense interest in an area in the hearts and minds of onlookers.

When Lefroy Exploration (ASX:LEX) made its big hit at the Burns discovery in the Mount Monger region in February, it well and truly lit the tinderbox.

Lefroy’s discovery was not only significant for the explorer itself but demonstrated that for all its history the Mount Monger region had plenty more mineralised secrets left to be uncovered.

A new gold IPO helmed by an experienced exploration team and named for the region running hot will soon list, looking to further tap an area where gold potential outweighs the modern exploration work carried out to date.

The aptly-named Mt Monger Resources will soon list via an IPO, and focus on a series of contiguous tenements spanning 122km2 in its namesake region.

The company’s flagship exploration asset – the Mt Monger project – sits adjacent to Silver Lake’s operations and mill and just 5km from Burns.

It’s close to the regional noise but an untapped project with vast potential to sing its own tune, according to managing director Lachlan Reynolds.

“What we have there is a package of ground that contains a number of historical prospect areas which have been tested with either surface geochemistry or shallow RAB or aircore drilling, where work has generated some really interesting gold anomalies, but has never followed up,” he said.

“We now know that in areas like these there can be substantial deposits indicated by relatively modest near-surface gold mineralisation anomalies.

“What that leaves us with is a good selection of targets where we know there are mineralised structures to be followed up, but also a number of other prospect areas which are deserving of some more detailed exploration activity.”

A common story in prospective parts of the world like Mount Monger, the tenements on which the project sits have not been consolidated for several years.

Bringing them together in one package allows the company the opportunity to explore with purpose and with scope that enhances future development potential.

“This land hasn’t been fully consolidated since it was first worked in the late 1980s and early 1990s, so it’s the first time in many years that it’s been held as a coherent package,” Reynolds said.

“That gives us an opportunity to undertake a more systematic and comprehensive exploration program using more modern methods and ideas around the exploration potential than have been used in the past.”

It’s an approach with proven results down the road, courtesy of the work done by Lefroy in uncovering Burns earlier in the year.

“One of the major things we can take from Burns is yet another confirmation of the prospectivity of the entire Mount Monger region,” Reynolds said.

“In terms of the actual work itself, nothing special has been done other than going back and retesting targets that had indications of significant mineralisation, and they’ve been very successful in coming up with a potential new style of mineralisation.

“It just proves there are opportunities out there which have never been properly tested.”

That testing is high on the agenda for Mt Monger post-listing, with the intention to get boots on the ground and have the rigs turning as a priority.

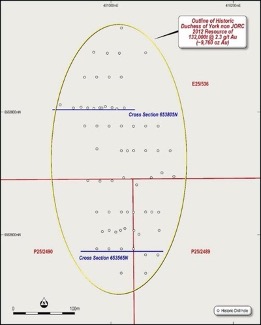

First up will be the Duchess of York prospect, where shallow historical drilling by WMC has detected mineralisation and a non-JORC compliant resource of 132,000t at 2.3 grams per tonne gold was reported by previous owner Hampton Hill Mining in its 2002 annual report.

Some deeper drilling was undertaken in the early 2000s, and mineralisation remains open at depth and along strike. Mt Monger is searching for an orebody similar in style to that of Silver Lake’s nearby Salt Creek deposit at Duchess of York.

“We’re keen to get out and test that prospect, confirm the presence of gold and the kind of historical grades seen at that prospect, and also potentially extend the known zone of mineralisation,” Reynolds said.

“Beyond that, we’ll be looking at a number of other prospect areas. There’s no shortage of targets for us to follow up.”

A story in two parts

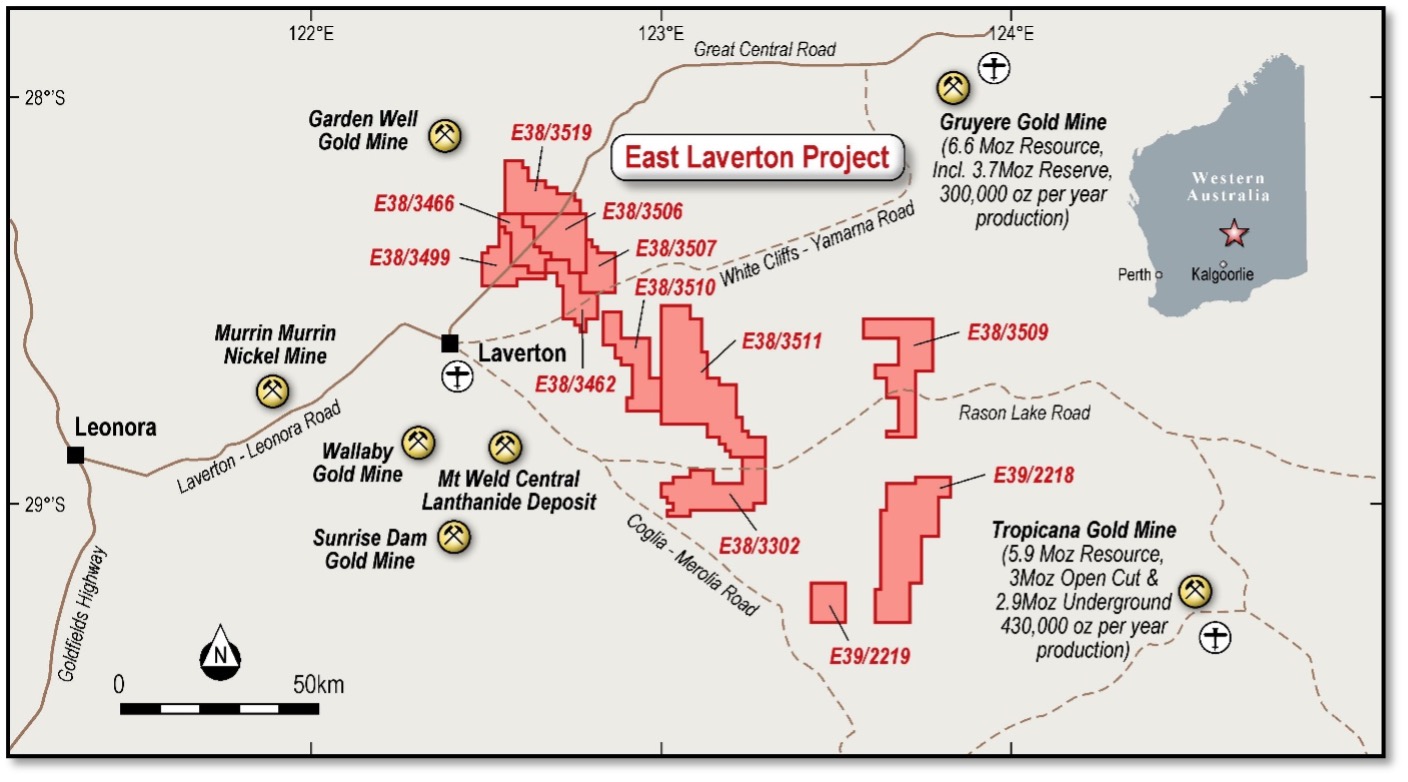

While Mt Monger Resources may be named for the Mount Monger region, the company will also list with an earlier-stage gold exploration project at East Laverton near some serious gold mines.

A land package spanning 3063km2, the East Laverton gold-& rare earths project is one the company believes could have multi-million-ounce potential in the style of AngloGold Ashanti and Independence Group’s Tropicana gold mine, and Gold Road & Gold Fields’ Gruyere gold mine.

The region has form in this regard – the 5.9-million-ounce Tropicana is one example, Gold Road’s 6.6Moz Gruyere mine is another. Also worth mentioning is Lynas Corporation’s Mt Weld rare earths project – among the most significant projects of its kind in the world.

Here’s some regional context.

Despite the presence of giants, the land package at East Laverton is relatively unexplored. Previous work carried out in search of uranium and diamonds has highlighted gneissic rocks similar to those which host Tropicana.

“What East Laverton offers us is a large ground-holding of poorly-explored areas adjacent to some very large gold discoveries made in recent times, not to mention the existing gold operations around Laverton itself,” Reynolds said.

“We have acquired tenements that need some earlier stage work but have big potential to turn up something unusual which may have been overlooked by previous reconnaissance work that’s been done.

“In several areas we know we have good-looking targets for early-stage work.”

Among these are the Seahorse and South Seahorse anomalies – the former an undrilled 3km anomaly where samples of around 42 parts per billion gold have previously been recorded.

The latter – itself 1.5km long – has been subject to some drilling by IGO, having previously returned three gold in soil anomalies of up to 46ppb gold.

IGO’s work was shallow and identified para-amphibolite and meta-sediment, including a likely recrystallised banded iron formation, which Mt Monger said suggested the potential for further rafts of greenstone sequences in the area.

An initial drill program will test this theory.

The project’s Point Kidman area contains some historical rare earth anomalies, which Reynolds said the company was keen to follow up to assess development potential.

With an anticipated listing date in June and plenty of news flow expected from the start, Mt Monger will be one to watch into the second half of the year and beyond.

This article was developed in collaboration with Mt Monger Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.