Nickel price at year-high as China seeks extra supply

Pic: Schroptschop / E+ via Getty Images

- Price of nickel metal has advanced 48 per cent since March low

- ‘China’s nickel ore imports were down in year-on-year terms primarily because imports from Indonesia have dried up’

- Nickel is used in the production of stainless steel, and has uses in EV batteries

Nickel prices have taken off as China struggles to source enough of the base metal from its traditional supplier of Indonesia presenting an opportunity for Australian nickel producers.

The price of nickel has gained 48 per cent since its March low of $US11,055 per tonne, and was trading at $US16,373 per tonne ($22,100/t) on Friday, according to London Metal Exchange data.

“We expect nickel prices to remain strong in 2020, and only start receding when China’s demand begins easing some time next year,” said Commonwealth Bank of Australia analyst Vivek Dhar in a report.

The nickel market is expected to go into deficit this year on stronger-than-expected demand from China’s steel industry which uses nickel in its production of stainless steel, said Dhar.

Price of nickel at one-year high

Nickel prices surpassed $US16,000 per tonne last week for the first time since November 2019, and their recent peak was at $US18,620 per tonne in September last year.

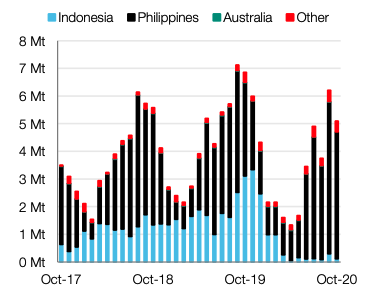

China has drawn more nickel supply from the Philippines as its supply of the metal from Indonesia has dwindled.

“China’s nickel ore imports were down in year-on-year terms primarily because imports from Indonesia have dried up,” said Dhar.

Indonesia brought in a ban on nickel exports in January 2020, in order to foster homegrown downstream processing of nickel ore into metal, and a similar ban was in place for three years between 2014 and 2017.

Shipments of nickel from the Philippines to China were up 36 per cent year on year in October, while its supply from Indonesia dipped 26 per cent on year last month, according to Chinese import data.

Philippine nickel production was affected recently by two typhoons, Quinta and Morafi.

EV sector is another rising driver for nickel demand

Nickel is also an in-demand metal for the EV market, and demand in this sector has continued to ramp up this year.

Elon Musk announced in September at Tesla’s Battery Day event that nickel would be the company’s metal of choice for its batteries.

At the time Musk said he had conversations with nickel miners in which he asked them to increase their output for the EV industry.

Tesla has been targeting cost reductions in its EV battery production process, and views nickel as a better option than cobalt.

Another nickel market participant, Japanese trading company Sumitomo, has also forecast higher nickel prices near term.

“The value of nickel will not stay the same, but will rise further,” Sumitomo’s chief financial officer, Masaru Shiomi, told Nikkei Asia.

The Japanese company operates a nickel mine in the African country of Madagascar.

China’s aggressive push for EVs is increasing demand for nickel, and other base metals such as copper, used in EV production.

Caspin Resources targeting exploration near Julimar discovery

Some ASX nickel companies are stepping up their exploration activity and projects; among these is Caspin Resources.

Caspin Resources (ASX:CPN) has started exploration work at its Yarawindah Brook project in WA’s New Norcia nickel province after it raised $8m in an IPO.

“We have hit the ground running and have already completed our first exploration program in the form of an airborne electromagnetic survey,” chief executive, Greg Miles, said.

The survey is targeting sulphides bearing nickel, copper and platinum group metals in previously unexplored areas of the New Norcia nickel province.

Caspin Resources’ tenement is 40km north of Chalice Gold Mines’ (ASX:CHN) Julimar nickel-copper-pge discovery.

Hannans acquires two WA nickel tenements

Nickel explorer Hannans Limited (ASX:HNR) has picked up two nickel projects in WA.

The first is its purchase of a 90 per cent interest in an exploration licence prospective for gold and nickel between Southern Cross and Bullfinch for $100,000.

The licence is expected to be granted in early 2021, and Hannans is to start a review of historic data for the area to produce some exploration targets.

The area covers the Forrestania greenstone belt hosting nickel sulphide mines to the south in Spotted Quoll and Flying Fox, and nickel mineralisation to the north in Trough Well.

The company said a minimal amount of exploration activity has been carried out in the Southern Cross area for nickel sulphides.

The second project acquisition for Hannans is a 70 per cent interest in an exploration tenement 45km southwest of the Nova nickel-copper mine in WA’s Fraser Range.

A ground electromagnetic survey of the tenement has been organised for early 2021.

The tenement is near to IGO Limited’s (ASX:IGO) Nova-Bollinger mine, and Hannans can earn its interest in the tenement through $1m of exploration expenditure.

Share prices for Caspin Resources (ASX:CPN), Hannans Limited (ASX:HNR)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.