Nickel is now a contrarian play. Does that make it a… smart move?

Pic: Getty Images

- Despite short term headwinds, Sprott analyst Steve Schoffstall has suggested the time could be right for a contrarian bet on nickel miners

- Surpluses will peter out by the end of the decade as demand from EVs and other clean energy applications rises

- Other analysts are not so sure the long term demand uptick from the energy transition will lead to a price breakout for base metals

It was only a matter of time before these contrarian investors came rushing to the defence of the nickel market.

The stainless steel ingredient cum battery metal was the pits of the mining sector in January as a flood of mine closures and production curbs hit the market after a year that saw a halving in prices.

Typically that’s a sign of a floor and rebound. But many in the market — including world’s biggest miner BHP (ASX:BHP) — have noted a structural rather than cyclical shift.

The reason is an explosion of supply from Indonesia.

A decade ago the South-East Asian nation was producing around 2-3% of the world’s nickel tonnes.

But in response to an export ban that forced Chinese stainless steel producers to establish local refineries utilising the country’s abundant lateritic nickel deposits, it now boasts a market share of around 50%.

That could rise to as much as 70%, with technological advancements enabling Indonesian-based producers to churn out ‘class 1 nickel’ for batteries from factories previously assumed to only be suited for use in lower quality stainless steel.

But the trick is to enter at the bottom, not the top, and contrarian nickel loving voices are starting to emerge.

Sprott’s Steve Schoffstall appears to now be one of those voices, saying the long-term demand story from EV production growth means “despite the current supply glut, we believe nickel’s long-term fundamentals are strong”.

“In our view, nickel miners are poised to offer investment attractive opportunities to investors,” Schoffstall said in a note last week.

“Although nickel prices declined in 2023 on the back of softer Chinese EV sales and a flood of supply from Indonesia, the metal has been rebounding thus far in 2024 and benefiting the prospects of mining companies.

“The rise in nickel prices seems to be a combination of investor sentiment, potential supply constraints, and the underlying long-term demand for nickel in the clean energy transition.”

Rising tide

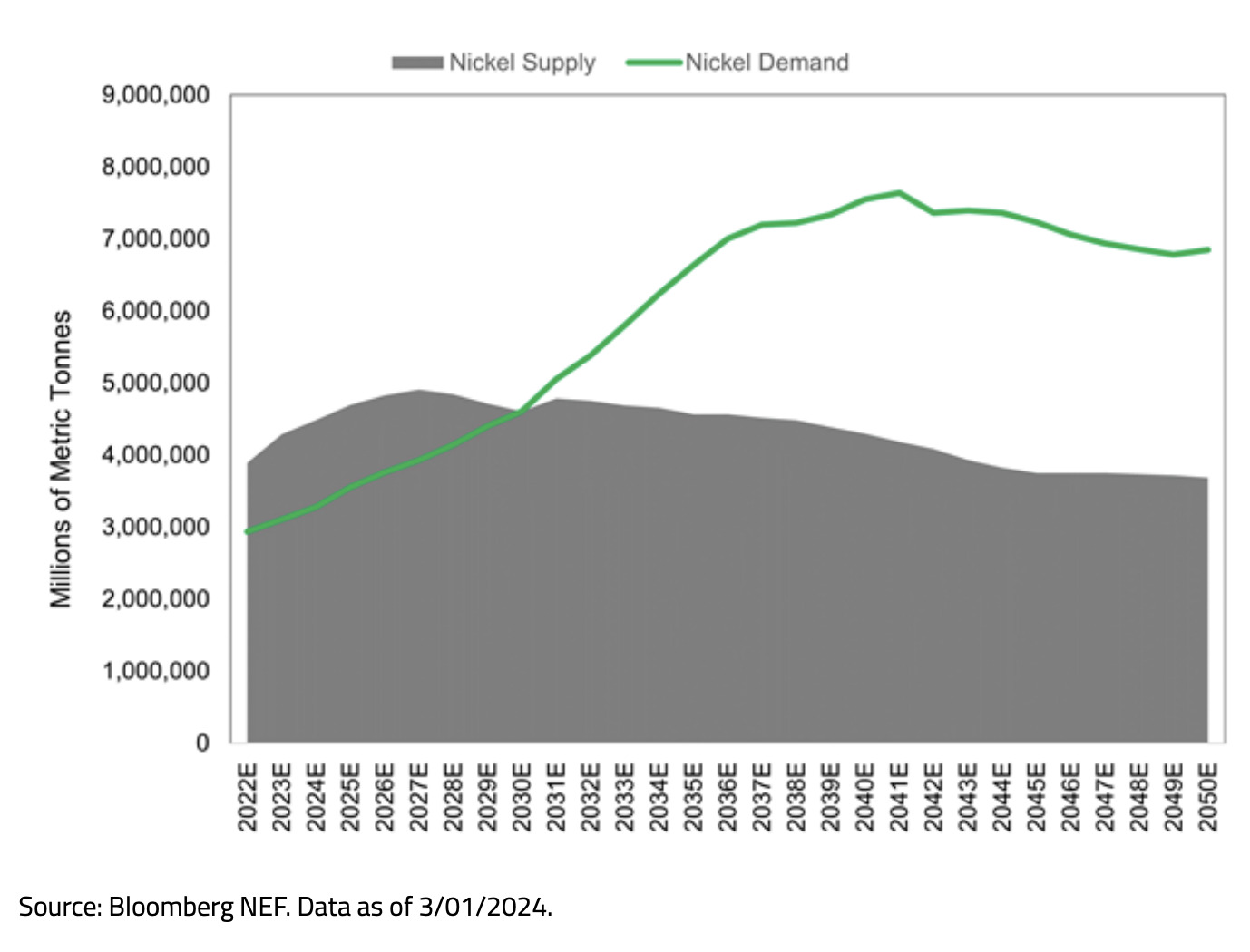

Based on BloombergNEF numbers, this Sprott graph shows we’re still looking at nickel surpluses up to the last years of the decade — roughly in line with BHP comments that an oversupply of nickel metal is likely to be seen until early in the 2030s.

But patient investors could benefit from a sharp rise in nickel demand as EV penetration goes mainstream in league with ICE sale bans and the pointy end of government initiatives to hit 2050 net zero targets.

Schoffstall says nickel will see increasing demand from lithium ion batteries used in EVs, but also from other clean energy technologies like energy storage, hydrogen production, geothermal energy, wind turbines and nuclear power plants, where the anti-corrosive properties of nickel alloys are in demand.

Around one third of class 1 nickel demand is coming from EV batteries currently, rising to over 50% by 2027, Schoffstall said.

“Stricter emission mandates are also helping to boost the nickel industry, particularly in the U.S., where the Environmental Protection Agency is imposing mandates that could require nearly two-thirds of new cars and light trucks sold to be EVs by 2032,” he said.

“As with copper and other commodities, we believe moves by global central banks to reduce interest rates will also support the nickel market, given that lower rates generally lessen the cost of carrying inventories, and thus provide support for nickel prices.”

Waste your money?

But is it worth splashing your money right now?

Nickel stocks have had a rough ride, the latest bear signal the shuttering of First Quantum and Posco’s Ravensthorpe Nickel Mine for the third time in only 15 years.

And while prices have lifted to a touch under US$19,000/t — from lows of under US$16,000/t — in the past couple months, one of the big catalysts for that shift could be drying up.

Indonesian orebodies and plants had been locked up in approval mayhem around the country’s national election in February.

That backlog looks to be clearing, as noted by Nickel Industries (ASX:NIC) MD Justin Werner on the Indonickel producer’s recently quarterly call.

We are seeing increased corporate and government interest in supporting new nickel operations.

Australia’s Federal Government has given major project status to Alliance Nickel’s (ASX:AXN) NiWest project in the Northern Goldfields after placing nickel on its critical minerals list.

That one has the backing of US-Euro automaker Stellantis and Korea’s Samsung.

Japan’s Sumitomo and Mitsubishi meanwhile have committed to undertake a $98.5m DFS on the long-stalled Kalgoorlie Nickel Project, owned by Ardea Resources (ASX:ARL) and proposed in one form or another since the 1990s.

That could see the Japanese trading giants pick up an eventual 50% stake in the development to support their domestic battery production.

At the same time, some naysayers say a run in base metals, which has also included a charge in copper prices to almost US$10,000/t, has been overdone.

Macquarie analysts Friday said FOMO was driving much of the enthusiasm in base metal prices and rising long positions.

Macquarie’s scribes expressed skepticism in long term demand bull scenarios, saying higher prices tended to lead to rebalancing from market participants.

“The longer the duration of improving global growth, the greater the potential for markets to get tighten and prices to push higher,” Macquarie’s analysts said.

“Even so, we remain sceptical of some more dramatic structural deficit narratives – high prices enable markets to rebalance, both by incentivising supply growth and demand destruction.”

They say global growth indicators are not supporting current base metal prices, with inventories not as tight as prices would have you believe.

At the same time ANZ’s commodity strategists Daniel Hynes and Soni Kumari said in a note that while global growth was not exceptional, consumption patterns indicated global growth was directed towards areas supporting higher commodity demand.

“We think the composition of economic growth is favouring commodity demand, particularly the acceleration in manufacturing and the energy transition,” they wrote.

“Robust external demand is likely to support key commodity exports.”

It came after Chinese imports of major commodities lifted across the board in April, a month which saw almost every metal run higher.

READ: Up, Up, Down, Down: Everyone’s a winner in an astounding April for major metals

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.