New ASX nickel IPO Lunnon Metals up 42% on debut and ready to explore Kambalda

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Australia’s newest listed nickel explorer Lunnon Metals (ASX: LM8) closed at a significant premium to its issue price to underline the continued investor appetite for resources IPOs.

Lunnon raised $15 million at 30c a share to fund a major diamond and reverse circulation drilling initiative at the long-shut Foster and Jan nickel mines in Kambalda.

After climbing more than 50% in early trade on Wednesday, Lunnon retraced to 42.5 cents at the close for a ~42% gain.

The mines have been locked up for years within the tenure of South African gold giant Gold Fields’ big St Ives gold mine since it bought that project from Western Mining Corporation in 2001.

They contain a current JORC 2012 resource of 39,000t of nickel metal at a typical high Kambalda grade of 3.2%.

That was cultivated painstakingly via the logging and sampling of old core during the downturn by Lunnon’s private predecessor ACH Nickel, a company backed by famed Kambalda mining entrepreneur and Lunnon non-exec director Ian Junk, which secured a 51 per cent stake in Foster and Jan alongside Gold Fields.

It has come to market at a more positive time for nickel, with Gold Fields backing the concept by converting its stake in the Foster and Jan mines into a 31% cornerstone stake in Lunnon on listing.

Lunnon has some gold prospectivity as well, with the former nickel mine and now nearby specimen-rich gold mine Beta Hunt an example of the double-sided nature of the region’s orebodies.

Lunnon Metals share price today:

Nickel Sulphides in short supply

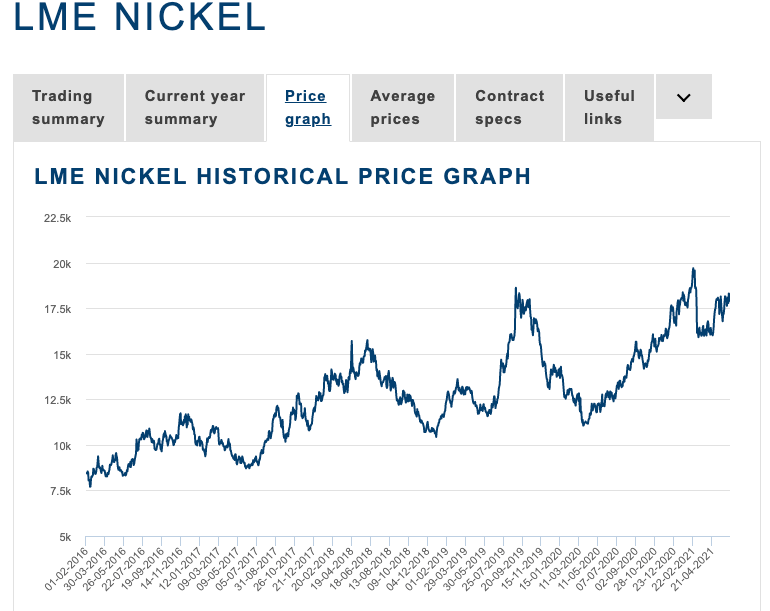

The price of nickel boomed in the mid-2000s commodities supercycle but dropped as low as $US7600/t in early 2016, a price at which all but a handful of miners were losing money.

It has rebounded significantly since then, with growing enthusiasm about the commodity’s value as a major product in the lithium-ion batteries that underpin electric vehicles.

Speaking at the Energy and Mines Australia Virtual Summit on Wednesday BloombergNEF metals and mining analyst Allan Restauro said EVs were expected to account for 50 per cent of the passenger vehicle market by 2035.

“Globally around 3.1 million passenger electric vehicles were sold in 2020. This represented around 4% of all passenger vehicles sold last year,” he said.

“Annual sales of internal combustion engine vehicles likely peaked in 2017 and also are unlikely to recover to such levels in the coming years.”

Lithium-ion battery demand is expected by BloombergNEF to hit 2700GWh in the coming years and 4500GWh annually by the mid-2030s.

That will mean demand for nickel sulphate will rise from less than 200,000t in 2020 to 1.5mt in 2030.

“Specifically for nickel sulphate, the nickel market continues to be one of the most challenging to achieve balance for batteries,” Restauro said.

“While resource supply is an issue, looking at nickel sulphate it may encounter supply challenges by 2024.”

Nickel sulphides like those found in Kambalda – a locale that has produced 1.6Mt of the metal since its discovery by Western Mining Corporation driller Jack Lunnon in 1966 – are the best and cleanest form of nickel for batteries.

In the absence of new supplies of nickel sulphides, Restauro said, battery makers would need to turn to more expensive, carbon intensive laterite producers in countries like Indonesia to source supply.

Lunnon IPO comes at the right time.

Lunnon managing director Ed Ainscough, who worked for WMC at its Kambalda gold business in the 1990s, told Stockhead earlier this month the time was right to renew interest in the Foster and Jan nickel mines.

“My view is that if we continue to find more resources at Foster/Jan, because it is in Kambalda and the resource grade is 3.2 per cent, typically if we find new mineralisation it will be pretty good grade,” he said.

“The backdrop clearly is that people believe the electric vehicle thematic and with the net zero target that countries and corporates are setting now … it will require a lot more nickel and copper in the future, which should be good for the nickel price.

“Generally, I think everyone agrees it should be higher, but we’re determined to make sure we’re not reliant on the nickel price.”

Lunnon is the latest battery or battery-adjacent metal to rise sharply on listing.

Lithium explorers Lithium Energy (ASX: LEL) and Global Lithium (ASX: GL1) both enjoyed strong debuts recently, with a number of other resources floats sitting in the ASX’s increasingly clogged pipeline.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.