New tricks: IEC enters new age in lithium and gold

Mining

Mining

Special Report: Previously focused on coal production, gold and critical minerals explorer Intra Energy Corporation has a new lease on life, gearing up for a jampacked month of exploration programs at its projects in WA and Canada.

Until four years ago, Intra Energy Corporation (ASX:IEC) was a coal miner in Africa with a 70% interest in the Tancoal mine, a dominant supplier to end users in Tanzania, Kenya, Rwanda and Uganda.

But as the world started its decarbonisation shift with critical minerals such as lithium, rare earths, graphite and nickel surging into focus for investors, so too did IEC.

The explorer appointed Ben Dunn as managing director in 2021 for the purpose of identifying base, precious and critical metals projects both in Australia and overseas and made its entry into Canada’s prolific James Bay region in May last year.

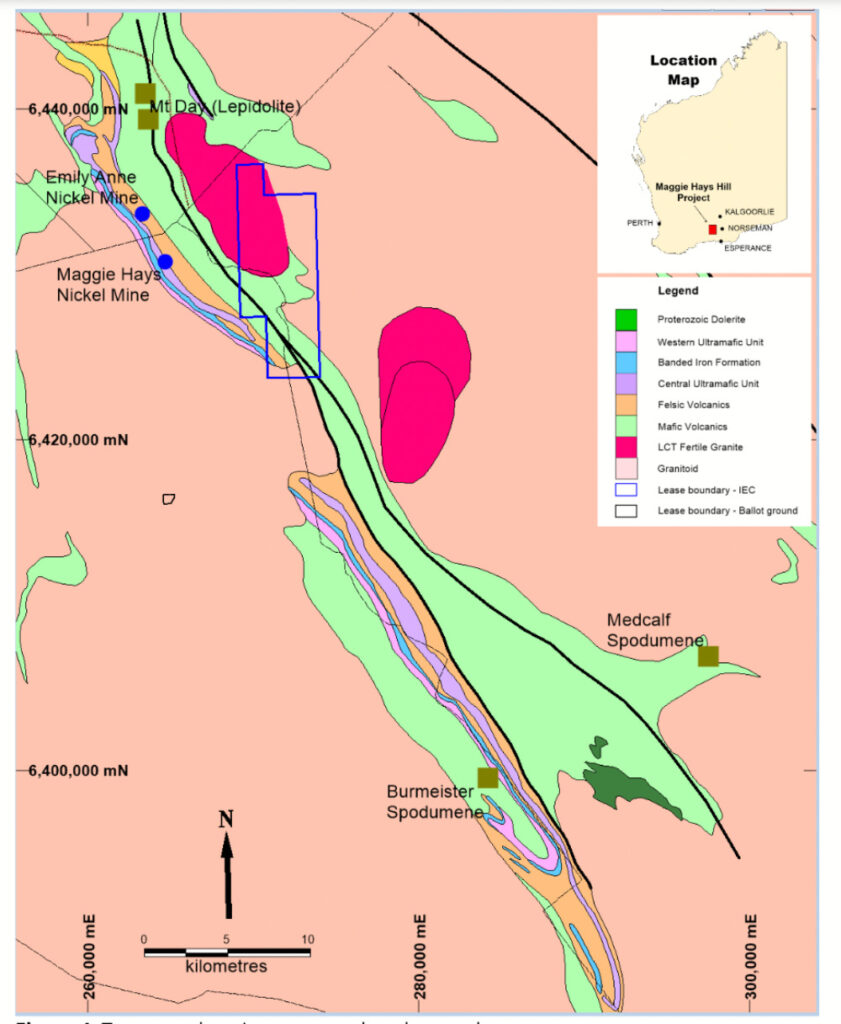

But closer to home, in WA’s Lake Johnston district, IEC also owns the newly acquired Maggie Hay Hills asset, which it bought from Global Uranium Enrichment, formally named Okapi Resources, at the beginning of 2024 when they were undergoing a transition of their own from gold explorer to a US-focused uranium company.

“They still had this Maggie Hay Hills project which they held for gold exploration but hadn’t really done much work on it and were trying to figure out what they were going to do with it,” Dunn says.

“We identified the project as something that might potentially have lithium and at that time TG Metals just made their Burmeister discovery in the area along with Rio Tinto (buying) into Charger Metals.

“We thought this was a great opportunity for us and while we really like our Canadian project, we knew that we needed to find something else because when you’re a small cap stock like us people need information all year round,” he says.

“WA is a fantastic mining jurisdiction; we already have people there and we thought this was our chance to increase our portfolio but still focus on battery metals.”

The project encompasses a 2.5km-long Southern pegmatite lithium target as well as a series of pegmatite dykes, all adjacent to an amphibolite ultramafic unit which can be traced for 7km across the tenement.

Soil sampling geochemistry conducted in 2021 identified lithium anomalism adjacent to the 2km pegmatite trend and for a further 2.5km north of the outcropping pegmatites.

Spodumene and lepidolite exist in the same mafic rock sequence to the north and south of the tenement, indicating that there are multiple LCT fertile granitoids in the area.

As well as lithium the project also boasts significant gold prospectivity with recent soil sampling results having defined a strong gold anomaly along a mineralised trend that extends 1km to the north.

“We didn’t buy the project for the gold, but we always suspected there was gold there because there had been historical, old-style artisanal workings done on it back in the day,” Dunn says.

“A previous explorer also drilled some holes and found gold, with some of the hits returning 2m at 11 or 12 g/t gold at 21m.

“We are very excited, we think that we’ve got two really substantive strong opportunities to generate shareholder value and we are going to drill them,” he says.

Gold prices have risen to all-time highs at a time when lithium prices have come off record levels, showing the optionality open with the twin commodity approach.

IEC has planned a 2000m reverse circulation drilling program, agreed terms with a drilling contractor and is in the process of finalising the contract.

Operations are expected to begin promptly following receipt of a final heritage survey report conducted with the Ngadju Aboriginal Corporation.

“For us, we know there is gold there because it’s already been found, it’s just a matter of determining the scale,” Dunn says.

“At the same time, we have some great opportunities to expand our portfolio and will continue to look for opportunities primarily in WA.”

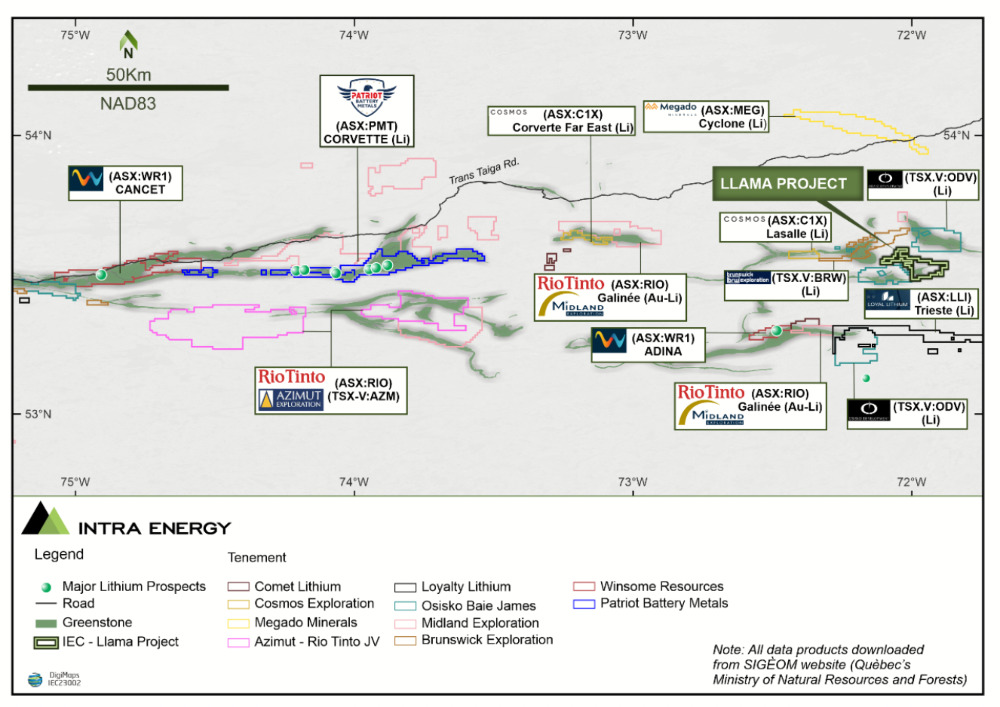

Meanwhile, IEC’s 69.2km2 Llama project, 40km from Winsome Resources’ (ASX:WR1) Adina asset and 120km from Patriot Battery Metals (ASX:PMT) Corvette property in Quebec, was identified as being prospective for lithium by the original vendors, DG Resource Management, the same company that vended PMT’s world class Corvette project.

Although exploration work didn’t immediately kick off due to Canada experiencing its most destructive wildfire season in 2023 – which saw more than 400 blazes raging across the country, half of them in Quebec – the company soon made up for lost time.

An initial first phase mapping program was carried out in October 2023 and successfully discovered multiple, large-scale pegmatites spread over several kilometres with thickness exceeding 200m.

“This project made a lot of sense to us,” IEC managing director Ben Dunn said.

“We were looking for a project to put into the company and the James Bay region was hot, it also came with a good partner in ‘Dahrouge Geological Consulting’ (DGC) who in our opinion are the right people to do the geological work for us.

“Our team have been a bit frustrated because we’ve got this licence which is a reasonable size with more than 120 mapped pegmatites and we haven’t been able to do any meaningful work on it because of the fires, plus in Canada you can only really work four to five months of the year,” he says.

“We’ve also identified a strong corridor right through the middle of it, a dyke swarm spread of about 5-6km.

“Our plans are to go back in late August, carry out two weeks of field work and identify drill-ready targets for testing in early 2025.”

Dunn says the plan is to conduct the usual assessments including mapping, rock chip sampling, and trenching in its pursuit of the main corridor.

He views that as the most fertile channel, which could potentially run from Loyal Lithium’s (ASX:LLI) ground in the south through the Llama project into tenements owned by Canadian company Brunswick.

“Both of those companies have had very successful exploration and drilling programs, proving spodumene in large amounts on their properties,” he says.

“We hope this round of exploration proves that we’re part of this trend and further identifies the pathfinder minerals that point towards where the lithium might be.

“It doesn’t guarantee it, but it’s a hell of a good indicator.”

This article was developed in collaboration with Intra Energy Corporation, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.