New discovery in Tasmania has Venture Minerals positioned well for tin bull market

Pic: Natalia Zhukova/iStock via Getty Images.

As tin prices soar to near record levels during a global crunch on supplies, Venture Minerals has made a well-timed discovery near its Mount Lindsay Tin-Tungsten project in Tasmania.

Conducting its first exploration drilling at Mount Lindsay in eight years, Venture Minerals (ASX:VMS) has found a substantial skarn system right next to the world class Renison tin mine, which has produced over 230,000t of tin since the 1890s.

New drilling from Venture adjacent to its 80,000t of tin Mount Lindsay deposit has hit a 150m alteration zone, containing 16m of magnetite and sulphide rich skarn with the potential to host tin mineralisation within the extension of the Renison sequence.

The diamond drilling program was designed to test extensions of Renison, specifically targeting a coincident electromagnetic and surface geochemical anomaly, favourably located on highly prospective carbonate units that typically dominate the Renison mine sequence.

Venture will get downhole EM started straight away with assay results pending. If today’s market reaction – a ~7% gain – is anything to go by, shareholders will be waiting for those with bated breath.

The company’s managing director Andrew Radonjic toasted the “immediate success” from the new drilling program.

“Immediate success from the first exploration drilling at Mount Lindsay since 2013, has seen the discovery of a substantial skarn system immediately along strike from one of the world’s most significant and high-grade tin mines (Renison Bell Mine) and adjacent to Venture’s Mount Lindsay Tin Deposit located within Australia’s premier tin district,” he said.

Tin market in perfect storm

It comes at a time of unprecedented tightness for the metal, which is known as the “spice metal” because a little bit of tin is in virtually everything.

It is heavily exposed to the booming semiconductor and electronics sectors with around half of all tin production going into solder to join electronic circuit boards.

Covid-free Tasmania is re-emerging as a major tin province at the same time as coronavirus restrictions have stalled supply in large producing nations like Indonesia and Myanmar.

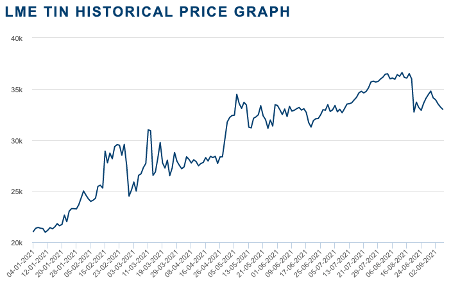

These supply shocks and healthy demand growth have seen tin prices rise from ~US$21,000/t at the start of the year to US$33,000/t on the LME today.

Tasmanian operators will also benefit from enhanced ESG metrics, with virtually all of the state’s power supply coming from renewable sources and particularly hydropower.

Venture’s Mount Lindsay project is located just 12km from Renison and is already regarded as a critical minerals project by the Australian Government, containing 81,000t of tin and 3.2 million metric tonne units of tungsten oxide.

It is poised to be a beneficiary of the shift to EVs and the battery revolution, with the International Tin Association predicting a surge in demand driven by the lithium-ion battery market of up to 60,000tpa by 2030.

World consumption for all tin was just 328,000t in 2020.

“The discovery of a potential new tin-bearing skarn system so close to the company’s flagship tin deposit delivers Venture an excellent opportunity to add to the already significant resource base at Mount Lindsay,” Radonjic said.

“Consumers and investors are becoming extremely focused on ESG-compliant sourcing of tin, Mount Lindsay is well positioned to meet this demand, being in a ESG compliant jurisdiction, with access to renewable hydropower, combined with the company’s commitment to minimizing its carbon footprint, through planned underground mining and processing strategies.”

Underground scoping study ongoing at Mount Lindsay

Improved market conditions for tin and tungsten encouraged Venture to kick off an underground scoping study at Mount Lindsay, with prices for both metals up 150% and 80% respectively since 2016.

The Mount Lindsay resource was last updated in October 2012 and Venture has a number of prospective targets around its tenement holding in northwest Tasmania.

They include the Big Wilson target to the north-east of Mount Lindsay, where Venture hit 17.4m at 2% tin and Webbs Creek, where historic drilling returned 8.5m at 0.4% tin and 0.2% tungsten.

This article was developed in collaboration with Venture Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.