New Chile lithium asset adds to Pan Asia Metals Thai lithium asset

A pre-feasibility study is currently underway at the Reung Kiet lithium project. Image: via Getty Images.

- Test work flagged lithium recoveries up to 87% and Li2O concentrate grades up to 3.6%

- PAM is targeting downstream refining on the doorstep of Thailand’s biggest vehicle producers

- A pre-feasibility study is currently underway at the project

- Fieldwork has also begun at its prospective lithium assets in Chile

- Lithium company with multiple avenues to success

Coinciding with Pan Asia Metals reporting ‘very successful’ metallurgical test work results from its RK prospect at its Reung Kiet lithium project in Thailand, where a Pre-Feasibilty Study (PFS) is currently underway, Pan Asia Metals (ASX:PAM) has announced it’s exploration is already underway at its lithium clay project in Chile, through the collection of 30 surface and trenching samples.

Combined with the JVs it has in South East Asia with battery manufactures, the company is well advanced towards becoming a supplier of lithium and other battery metals.

Pan Asia Metals has advanced lithium assets in Thailand, and also in Chile. PAM is the only battery metals company in South-East Asia and the only lithium explorer in South-East Asia with advanced lithium projects.

The flotation of lithium mica concentrates from high grade feed has materially improved recoveries, highlighting the project’s potential to produce a 3.0% Li2O concentrate with 87% Li recoveries, or a higher 3.6% Li2O concentrate with 77% Li recoveries.

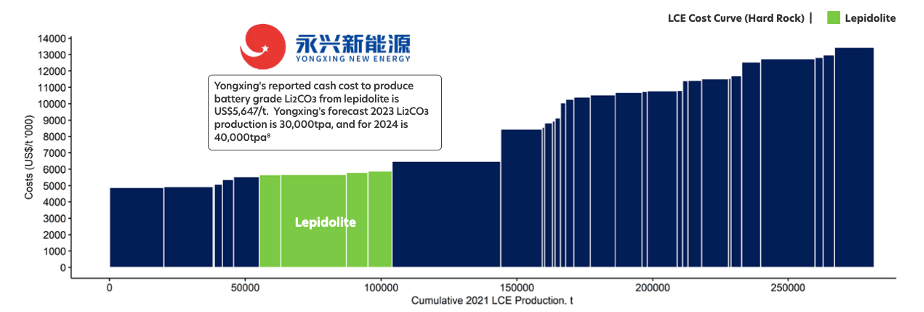

With the high Li2O feed grades and Li recoveries achieved, PAM has the potential to be as competitive as the best lepidolite based LCE processors in China.

These companies, highlighted in green below, are right down the bottom of the cost curve:

Wood MacKenzie places ‘established’ lepidolite sourced Li2CO3 production in the bottom third of the hard rock LCE cost curve. Chart based on Wood Mackenzie data located in Tianqi Lithium Corporation’s IPO Prospectus, June, 2022.

“This is an incredibly pleasing result. Our previously reported ore sorting results in November, 2022, demonstrated an increase in the modelled ore feed grade from 0.50% Li2O to 0.92% Li2O – positioning PAM with one of the highest grade lepidolite feed grades in the global peer group,” Pan Asia Metals’ (ASX:PAM) MD Paul Lock said.

“The modelled volume of concentrate feed is reduced by over 60%, with the reject material below the current mineral resource cut-off grade of 0.25% Li2O.

“This means PAM will be processing a materially higher grade ore than that reflected in the RK mineral resource, which equates to a considerable reduction in capital and operating costs on a per tonne LCE basis.

“This means PAM will require less beneficiation capacity (lower capex) and PAM will be processing less product (lower opex).”

“PAM’s Modelled Mining Scenario introduces 20% dilution and still achieves a 3.0% Li2O con with 78% Li recoveries, which is a great outcome,” he said.

Lepidolite: low cost, low emission lithium source with credits

Lepidolite has been demonstrated to have a lower carbon emission intensity than other lithium sources, PAM says.

Lithium carbonate and lithium hydroxide projects using lepidolite as their plant feedstock also have the potential to be placed near the bottom of the cost curve.

Notably, lepidolite comes with a suite of by-products, which can include tin, tantalum, quartz and feldspar in the concentration phase, and caesium, rubidium, potassium, silica and gypsum in the lithium conversion phase.

From production to downstream refining

RK is one of PAM’s key assets in Thailand, the largest vehicle producer in the region.

With Asia accounting for more than half of the global annual vehicle production, PAM is uniquely positioned to capitalize on the soaring demand for battery minerals in the region.

The company is pushing to become not only a lithium miner in Thailand but is working downstream into lithium refinement.

Last month, PAM announced a non-binding MOU with IRPC Public Company Limited (IRPC), one of the integrated petrochemical and refinery flagships of PTT Public Company Limited (PTT), Thailand’s national energy company, for a joint assessment for several linked components of the lithium-ion battery supply chain in Thailand, up until Cathode Active Material production (CAM).

In May, the company signed a deal with Vietnamese energy solutions provider VinES – which is a be a wholly-owned subsidiary of Vietnam’s largest privately owned entity Vingroup – to evaluate the construction of a standalone lithium conversion facility in an industrial zone close to VinES’s battery plant.

The evaluation will consider an initial 20,000-25,000 tonne per annum capacity to produce LCE and lithium hydroxide, supported by PAM’s lithium projects in the region.

MRE upgrade and PFS in the works

PAM’s objective going forward is to increase and upgrade the existing 10.4Mt mineral resource at RK, which will then be used as part of a PFS, a detailed look at the economics of building a project.

Additional test-work is planned which may result in better recoveries and a higher concentrate grades.

Metallurgical samples are also being prepared from drillhole samples derived from the Bang I Tum prospect.

The company also has its eye on other jurisdictions, entering into binding MOUs to acquire highly prospective lithium brine and clay projects in northern Chile in July.

The Tama-Atacama lithium project comprises six key project areas covering an area of approximately 1400km2 and based on well-established geology and work completed to date, has demonstrated potential for brine and clay deposits hosted in the Pampa del Tamarugal basin in the northern part of the Atacama Desert.

Already underway in Chile

In an announcement released to the ASX this morning the company announced fieldwork has already begun with the collection of 30 surface and trenching samples. A prospective white clay layer has been identified throughout the concession area and a 9kg sample collected for preliminary metallurgical test-work.

Discussions are underway with drilling contractors and the company is aiming for a September start. The lithium in clay target zone will be tested by broad spaced RC/aircore drilling to about 40m depth. This would only require about 15 holes as a first pass. PAM is in discussions with drilling contractors and expects to commence drilling in September, and with drilling success PAM is aiming to generate an inaugural Mineral Resource later this year.

Multiple avenues to success

PAM seems to be ticking all the boxes. It has a JORC resource at its Reung Kiet project in Thailand. Recoveries appear to increase the grade and volume. It is looking to introduce a Maiden Resource over a project nearby at BT Lithium Prospect. It has JVs locked in with battery and chemical manufacturers in South East Asia, and now it may only be months away from yet another Mineral Resource, this time in Chile.

This article was developed in collaboration with Pan Asia Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.